India Post Payments Bank Balance Enquiry No 2023 by Missed Call. To add to your convenience of banking with India Post Payments Bank (IPPB), you can get your account information without any hassles, through the facility of missed call banking. Register your mobile number for IPPB’s missed call banking service and start availing the benefits. Check more details about how to check India Post Payments Bank balance by a missed ... Xem chi tiết

How to Link HDFC Credit Card to Aadhaar Card – Step by Step guide

How to Link HDFC Credit Card to Aadhaar Card: As per the new govt rules, it is important to link credit card to the Aadhaar Card, If you have a HDFC Bank credit card. if you fail to link your 12-digit Aadhaar number to it by the revised date. If you have already linked Aadhaar number to your HDFC savings account, then there is no need to worry. But if you have not linked Aadhaar to HDFC credit card offered by a bank wherein ... Xem chi tiết

Suryoday Bank FD Rates, Suryoday Fixed Deposit Rates 2023

Suryoday Bank FD Rates: Suryoday Small Finance Bank’s Regular Fixed Deposit ensures that your earnings grow steadily and effortlessly. Its key features like attractive interest rates, multiple interest payout options, and zero penalty on premature closure make it the ideal investment for your hard-earned money. The Suryoday Bank offers a wide range of Fixed Deposits (FDs) that offer a good rate of return and come with various ... Xem chi tiết

ICICI FD Rates 2023, ICICI Bank Fixed Deposit Rates 2023

ICICI FD Rates 2023: ICICI Bank’s Regular Fixed Deposit ensures that your earnings grow steadily and effortlessly. Its key features like attractive interest rates, multiple interest payout options, and zero penalties on premature closure make it the ideal investment for your hard-earned money. The ICICI offers a wide range of Fixed Deposits (FDs) that offer a good rate of return and come with various other benefits. Some of ... Xem chi tiết

ICICI RD Interest Rates 2023, ICICI Recurring Deposit Rates

ICICI RD Interest Rates 2023: Invest fixed sum of amount on monthly basis in ICICI Recurring Deposit and get attractive interest rates. Build up your savings through regular monthly deposits of a fixed sum over a period of time with ICICI RD. This is a great option for those who have fewer earnings as the monthly deposit amount is very less in ICICI Account. ICICI Bank Recurring Deposit (RD) is an ideal way to invest small ... Xem chi tiết

National Savings Certificate (NSC): Types, Interest Rates 2023

National Savings Certificates, popularly known as NSC, were heavily promoted by the Indian government in 1950s after India’s independence, to procure funds for nation building. These instruments became much popular among those who wanted to make use of the opportunity to make their investments for a slightly longer time period and then gain the interest rates. A single holder type certificate can be purchased by, an adult for ... Xem chi tiết

Types of Mutual Funds or Classification of Mutual Funds

Types of Mutual Funds or Classification of Mutual Funds. after providing what is mutual fund today we provide Types or Classifications of Mutual Fund. Mutual Funds are classified by two Basis one of them is “on the Basis of Objective” and Another is ” on the Basis of Flexibility” we are providing all details of classification of Mutual Funds. Recently we provide Latest income tax slab rates for A.Y 2022-23. You can also check ... Xem chi tiết

Equitas Bank Saving Account: Interest Rates, how to apply

Equitas Bank Saving Account: up to 7% Interest Rates. Elevate your Banking experience with Equitas. We at Equitas have gone that extra mile to ensure that our products suit your needs, are hassle-free, digital, and easily accessible. Why Choose Equitas Bank Savings Account? Through its network of branches in India and overseas, Equitas Bank provides a range of financial products including the Equitas Bank Savings Account. The ... Xem chi tiết

Gold Loan 2023: Feature, Eligibility, How to Apply, Interest

Gold loans are one of the most popular form of loan present in our country. We used to keep jewelries and other ornaments with us which are mostly made up of gold. These ornaments and jewelries have helped us a lot in our bad times. We have used them as an asset or collateral to fulfill the dreams or to tackle some financial problems. Gold loans are nothing new, as we are using gold as collateral for a very long time. Also ... Xem chi tiết

Functions of Money: Primary, Secondary and Contingent Functions

Functions of Money: With the advent of banking sector and emerging financial markets in the economy, one requires a precise understanding concerning money; what exactly would term money imply; any object (not necessarily rupee) that circulates widely as a means of payment or does it involve something more to it. Besides this, what is the connection between money, banks, and credit system? The term ‘Money’ was derived from the ... Xem chi tiết

National Digital Locker (DigiLocker): How to Upload & Share Documents?

National Digital Locker (DigiLocker): It will minimize the use of physical documents. It will provide authenticity of the edocuments and thereby eliminating usage of fake documents. It will provide secure access to Govt. issued documents. It will reduce the administrative overhead of Govt. departments and agencies and make it easy for the residents to receive services. You can find complete details for Digital Locker. Now you ... Xem chi tiết

SBI Prime Credit Card, Prime Benefits | Free Pizza Hut Voucher

SBI Prime Credit Card : SBI Card PRIME Contactless Credit Card powered by Visa payWave / MasterCard Contactless is a fast and convenient way to pay for every day purchases. It is a secure, contactless chip technology designed to help you spend less time at the cash register and give you the freedom to do the things that matter most to you. Step 1: Look for the Visa payWave/MasterCard Contactless mark and contactless logo at ... Xem chi tiết

Kerala Gramin Bank Balance Enquiry Number 2023 by missed call

Kerala Gramin Bank Balance Enquiry shows a summary of all the money that an account holder withdraws from the account. It helps track finances, check Kerala Gramin Bank account balance, saves from any fraudulent activity and understand the spending habits on a regular basis. Kerala Gramin Bank is considered to be one of the leading banks in India. If you are an Kerala Gramin Bank customer and your mobile number is registered ... Xem chi tiết

Link Aadhaar Card to HDFC Bank via Online, Offline, SMS, Net Banking

HDFC Bank Aadhaar Card Link process, How to link Aadhaar Card to HDFC Bank Account: Check Step by Step guide for linking Aadhaar Card to your HDFC Account Number. Check out our exclusive guide for Aadhaar Card Seeding with your HDFC Account Number. Information on Linking Aadhaar to your Bank account… As per the amendment in PMLA rules by the Government, all bank accounts should be linked with Aadhaar by 31st Dec; failing ... Xem chi tiết

Axis Bank FD Rates 2023, Axis Bank Fixed Deposit Rates 2023

Axis Bank FD Rates: Axis Bank Fixed Deposit ensures that your earnings grow steadily and effortlessly. Its key features like attractive interest rates, multiple interest payout options, and zero penalty on premature closure make it the ideal investment for your hard-earned money. The Axis Bank offers a wide range of Fixed Deposits (FDs) that offer a good rate of return and come with various other benefits. Some of the features ... Xem chi tiết

Fixed Deposit 2023: Features, Advantages, Disadvantages

My this article is about the features, advantages, disadvantages, meaning of fixed deposit account, interest rates at which it is available, what would be the benefits of it, how it is different from a savings account, the duration for which fixed deposit can be issued, eligibility to open a fixed deposit account. However, there may be different rules for opening deposit account in different banks. The whole explanation and ... Xem chi tiết

BOB RD Interest Rates 2023, Bank of Baroda Recurring Deposit

BOB RD Interest Rates 2023: Invest fixed sum of amount on monthly basis in Bank of Baroda Recurring Deposit and get attractive interest rates. Build up your savings through regular monthly deposits of a fixed sum over a period of time with BOB RD. This is a great option for those who have fewer earnings as the monthly deposit amount is very less in BOB Account. Bank of Baroda Recurring Deposit (RD) is an ideal way to invest ... Xem chi tiết

Mudra Bank Yojana: Interest Rate, Introduction, Funding, Benefit

Mudra Bank Yojana: Union Finance Minister Arun Jaitley said the MUDRA Bank was a step in the right direction for “funding the unfunded.” He had proposed the MUDRA Bank in his budget speech in February. Find out Mudra Bank Loan Eligibility, Interest Rates, the procedure to apply and how to get approved for a Mudra Bank Loan under Pradhan Mantri Mudra Yojana. Now you can scroll down below and Check Complete Details ... Xem chi tiết

Five types of mutual funds, know which is right for you before investing

There are five types of mutual funds, know which is right for you before investing. All of us save to meet our financial needs. While saving money can be used in emergency on one hand, it also saves you from the path of taking a loan. A man’s financial goals are retirement, children’s wedding, holidays, buying a house, buying a big car or starting his business. It takes money and time to complete them. If you give five to 10 ... Xem chi tiết

AU Bank Saving Account: up to 7.25% Interest Rates, how to apply

AU Bank Saving Account: up to 7.25% Interest Rates. Why Choose AU Bank Savings Account? Through its network of branches in India and overseas, AU Bank provides a range of financial products including the AU Bank Savings Account. The savings account has a variety of benefits and services. The most attractive features are that the savings account does not require a minimum balance and provides ATM/Debit card, net banking and ... Xem chi tiết

Devaluation of Currency: Meaning, Devaluation vs Depreciation

Devaluation of Currency details 2023: The reduction of a currency´s value in relation to other currencies or a decrease in the exchange value of a currency against gold or other currencies, brough. After Providing How the value of rupee is determined?, Here we are providing everything you can to know about Devaluation of Currency like – Meaning of Devaluation of Currency. Devaluation of currency : Devaluation of a currency ... Xem chi tiết

PhonePe Loan in 2023: How to get PhonePe Instant Loan 0%

PhonePe Loan: Phonepe is a payment application app in India that was launched by Flipkart in 2015. Phonepe is the most famous and successful online payment application in India. It has even surpassed the Google pay application, which was launched by Google for the same purpose. Phonepe is one of the most reliable and faster mediums to trade your money. It was launched, to make India cashless, and many are using the ... Xem chi tiết

Earning Per Share: Definition Calculation Basic EPS Diluted

Earning Per Share – Earnings of a company mean nothing but the net profit after taxes and minority interest and EPS means Earnings per share available to the equity share holders of the company for each share held after all other external stakeholders have been paid/accounted for. The portion of a company’s profit allocated to each outstanding share of common stock. Earnings per share serve as an indicator of a company’s ... Xem chi tiết

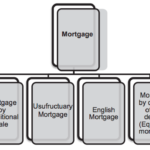

Mortgage: Introduction in detailed, Six Types of mortgages

Mortgage: It is defined in Transfer of Property Act as, transfer of interest in specific immovable property (land, benefits arising out of land, things attached and permanently fastened to earth) to secure an advanced loan, or an existing debt or a future debt or performance of an obligation. Once the amount due is paid to the lender, the interest in the property is restored back to the borrower. Lender gets right to recover ... Xem chi tiết

SBI Credit Card Payment by UPI App (Get Credit Limit Instantly)

SBI Credit Card Payment by UPI App (BHIM SBI Pay). UPI is a payment system that allows money transfer between any two accounts by using a smartphone. “SBI Pay” (UPI App of SBI) is a payment solution that allows account holders of Banks participating in UPI to send and receive money from their smart phones with a virtual payment address which is the identifier. No additional details are required to be used other than the ... Xem chi tiết

How to Avoid Annual Charges for Credit Card or Avoid Annual Fees

How to Avoid Annual Charges for Credit Card, Credit cards are becoming a necessity for everyone. List of Credit cards with No Annual Fees. check out list of all Free Credit Cards 2023. With the increasing in online shopping and availability of credit card swiping machine. Anyone can now use the credit card to purchase items and get cash backs and rewards on it. Credit card users like to avail such discounts and cash backs. ... Xem chi tiết

Kotak Bank Balance Enquiry Number 2023 by Missed Call SMS

Kotak Bank Balance Enquiry Number 2023 shows a summary of all the money that an account holder deposits or withdraws from the account. It helps track finances, check Kotak Bank account balance, save from any fraudulent activity, and understands the spending habits on a regular basis. Kotak Bank is considered to be one of the leading banks in India. Kotak Mahindra Bank is a private sector bank Situated in Mumbai, India. In ... Xem chi tiết

Link Aadhaar Card to Kotak Bank: Online, Offline, SMS 2022

Kotak Bank Aadhaar Card Link Process, Link Aadhaar Card to Kotak Bank via Online, Offline, SMS, Net Banking. How to link Aadhaar Card to Kotak Bank Account: Check Step by Step guide for linking Aadhaar Card to your Kotak Account Number. Check out our exclusive guide for Aadhaar Card Seeding with your Kotak Account Number. The Reserve Bank of India (RBI) has clarified that it is necessary to link the bank account with the ... Xem chi tiết

Fix Deposit Interest Rates 2023, FD Interest Rates of all banks

Fix Deposit Interest Rates 2023: Bank Fixed Deposit ensures that your earnings grow steadily and effortlessly. Its key features like attractive interest rates, multiple interest payout options, and zero penalty on premature closure make it the ideal investment for your hard-earned money. A fixed deposit is a financial instrument provided by banks or NBFCs which provides investors a higher rate of interest than a regular ... Xem chi tiết

BOI Home Loan 2022, Bank of india Home loan: Interest Rates

BOI Home Loan 2022: Bank of India was founded on 7th September, 1906 by a group of eminent businessmen from Mumbai. The Bank was under private ownership and control till July 1969 when it was nationalised along with 13 other banks. Bank of india offer BOI Star Home Loan. In this article we provide complete information regarding BOI Home Loan like – Eligibility for BOI Home Loan, BOI Home Loan Interest Rates, Documents Required ... Xem chi tiết

HDFC RD Interest Rates 2023, HDFC Recurring Deposit Rates

HDFC Recurring Deposit: Invest fixed sum of amount on monthly basis in HDFC Recurring Deposit and get attractive interest rates. Build up your savings through regular monthly deposits of a fixed sum over a period of time with HDFC RD. This is a great option for those who have fewer earnings as the monthly deposit amount is very less in HDFC Account. Recurring Deposit allows customers with an opportunity to build up their ... Xem chi tiết

Pradhan Mantri Matritva Vandana Yojana (PMMVY), How to apply?

Pradhan Mantri Matritva Vandana Yojana (PMMVY): India accounts for around 18% of the world’s total maternal deaths. Women in rural areas are suffering most post their delivery due to lack of financial resources for adequate nutrients in take. And the women working in un-organized sectors will have to be away from their work during the period of post delivery which makes them the life more difficult if no savings are available ... Xem chi tiết

How to choose a right mutual fund scheme in India (In Detailed)

How to choose a right mutual fund scheme, How to Choose Best Mutual Fund Plans, The right choice of mutual Funds, It’s often not possible for an investor to analyse a fund’s performance by applying theoretical jargons because of real life constraints, particularly shortage of time. Some basic homework, nevertheless, always helps to choose the right among many. now check more details for “How to choose a right mutual fund ... Xem chi tiết

SBI Saving Account: Features, Interest Rates, Types, How to Apply

SBI Saving Account: Why Choose SBI Savings Account? Through its network of branches in India and overseas, SBI provides a range of financial products including the SBI Savings Account. The savings account has a variety of benefits and services. The most attractive features are that the savings account does not require a minimum balance and provides ATM/Debit card, net banking and mobile banking facilities. State Bank of India ... Xem chi tiết

Core Banking Solution: Introduction Benefits of Core Banking

Core Banking solutions are banking applications on a platform enabling a phased, strategic approach that lets people improve operations, reduce costs, and prepare for growth. Implementing a modular, component-based enterprise solution ensures strong integration with your existing technologies. A leading provider of such a solution that many banks turn to as an ideal solution is BankPoint. An overall ... Xem chi tiết

RBL Credit Card Status, RBL Bank Credit Card Application Status

RBL Credit Card Status, Check RBL Credit Card Application Status Online. How to Apply and Check RBL Bank Credit Card Application Status Online 2023. Steps to Check RBL Bank Credit Card Status. Hello Friends In this article we provide complete details for how to check RBL Bank Credit Card via Online mode and how we can approve RBL Credit Credit Card. Now check out detailed guide for how to check RBL Bank Credit Card Status via ... Xem chi tiết

A Quick guide to credit card loans in India, Loan on Credit Card

A quick guide to credit card loans in India: Credit cards have become very popular given the wide variety of options they offer ranging from EMIs to cash withdrawals, Cash back to loans. In case of urgent requirements, one may have to face a lot of difficulties in securing the required finance. However, loans against credit cards are very good in the event of unforeseen financial emergency as the loan gets disbursed quickly ... Xem chi tiết

Bank of Maharashtra Balance Enquiry No by Missed Call 2023

Bank of Maharashtra Balance Enquiry Number shows a summary of all the money that an account holder withdraws from the account. It helps track finances, check Bank Of Maharashtra account balance, saves from any fraudulent activity and understands the spending habits regularly. Bank of Maharashtra is considered to be one of the leading banks in India. If you are a Bank Of Maharashtra customer and your mobile number is registered ... Xem chi tiết

How to link Aadhaar Card to PNB Bank Account by Online, Offline

PNB Bank Aadhaar Card link 2023, How to link Aadhaar Card to PNB Bank Account: Check Step by Step guide for linking Aadhaar Card to your Punjab National Bank Account Number. The Reserve Bank of India (RBI) has clarified that it is necessary to link the bank account with the Aadhaar. RBI has also said that the bank should implement this without waiting for any order. RBI’s cleaning has come because in some media reports it was ... Xem chi tiết

Bình luận mới nhất