When setting aside hard-earned money, simply saving isn’t enough; where you save matters just as much. A Savings Account isn’t a one-size-fits-all solution. With a plethora of offerings in today’s banking landscape, aligning your choice with your financial goals can play a pivotal role in growing that nest egg. While some accounts cater to basic banking needs, others come with perks tailored for specific financial milestones. ... Xem chi tiết

Investment

Green Bonds – Introduction, Benefits and Issue – Investment Guide

Green Bonds: The current market for the investors have been for investing in the bonds, the bonds have been much reliable source and the bond issuance company has also got good credit rating which would increase the trust amongst the investors. The green bonds market has not been so popular in India but was globally accepted in the year 2007, but lately accepted in India. This article will brief you about the meaning of Green ... Xem chi tiết

Checklist for Effective Financial Planning, Why Financial Planning?

Checklist for Effective Financial Planning, Why Financial Planning?, This article is based upon the financial planning needs of the business or individual which need to be implemented for effective existence of the same. Financial planning helps the individual to allocate the funds in the best possible manner and to reduce the need of the working capital so as to earn the more amount of the interest amount. Now you can scroll ... Xem chi tiết

Callable and non callable Fixed deposits: Benefits, Limitations

Know about Callable and non callable fixed deposits. What are Callable and Non-callable Bank Fixed Deposits (FDs)?. A very few months ago Reserve Bank of India has introduced non-callable fixed deposits in India. To avoid the serious problem arising in asset and liability management of banks RBI has launched this type of instrument. Fixed deposit means an amount being deposited in a bank carrying certain percentage of ... Xem chi tiết

Invest in Child Insurance Policy – Why?, Benefits for Investment

Invest in Child Insurance Policy: As a responsible parent, the primary duty of everyone having kids is to protect the future of their child, and to arrange for the future financial requirements of children. And a good way to start this is to invest in a child insurance plan. A child insurance plan not only provides the security that you would want for your child, it gives you the benefits of investments as well. Here are ... Xem chi tiết

What are blue chip Companies & Should you invest there?

Blue chip companies: The term blue chip has been coined from the family card game ‘poker’ in which blue colored chips carry the highest value. Similarly, blue chip companies are those that are strong, widely recognized and well established with a history of sound financial performance. They have the high market value like the blue coins in the poker game. They are often the market leaders in respective industries. They are ... Xem chi tiết

EPFO Mobile App, Check EPF Balance by Missed Call by SMS 2023

EPF Balance 2023: EPFO Mobile App, Check EPF Balance by Missed Call, EPF Balance by SMS. New way Check EPF Balance by EPFO Mobile App, Check EPF (Employee Provident Fund) balance by SMS, Check Your EPF Balance by Using EPFO Mobile App, epf missed call no. EPF Toll free Number for Balance Checking. Check epf balance enquiry sms Number From Below. Check Very Simple Procedure for know your EPF Balance, You can also Check EPF ... Xem chi tiết

What is Market volatility? How to protect your investment from it

Market volatility: Market volatility is the frequency with which the market price of a stock fluctuates in the stock market. The more ups and downs in the price of a security the more volatile is the security. The more a market swings the more volatile it is. These severe ups and downs make the market very fragile for the investors In this post we discuss few ways with which one can protect from the market volatility. SIP is ... Xem chi tiết

Seekho aur Kamao yojana – Lear and earn scheme (All Details)

Seekho aur Kamao yojana – Lear and earn scheme: In the year 2013, just an year before the elections that elevated Mr Modi as prime minister, the then government run by UPA-II has launched many projects, schemes in a usual election mode if not in a hasty way. One of such schemes is “Seekho aur Kamao” which means “Learn and earn”. This scheme was designed to provide skill develop opportunities to the youth belonging to the ... Xem chi tiết

Businesses to start with low investment in metro cities 2023

Businesses to start with low investment in metro cities. India is going through an age of transformation backed by the startup revolution filling bundles of entrepreneurial spirit in young minds. A good idea will worth only when it is implemented at the correct time at correct place. Metro cities like Bangalore, Chennai, Delhi, Hyderabad, and Mumbai offer lots of business opportunities for aspiring entrepreneurs. Among these, ... Xem chi tiết

What is FDI, Advantages of FDI and Disadvantages of FDI 2023

What is FDI, Advantages of FDI and Disadvantages of FDI: All you want to know about Foreign Direct Investment. My this article is about the Foreign direct investment which is been increasing day by day, as the foreign market players are given encouragement to start up their business in India, destroying the current market players of India. There are advantages and disadvantages for foreign direct investment. FDI has been ... Xem chi tiết

Pradhan Mantri Awas Yojana: Features, Interest Rate, Subsidy, EMI

Pradhan Mantri Awas Yojana: Find out PMAY Features, Interest Rate, Subsidy, EMI. Housing for All Scheme, Having an own house is a dream of every Indian. But the day to day increasing cost of all the accessories which are necessary to build a house is making it very difficult in these days. India houses millions of people who do not have their own house. In order to provide these with an own house Prime Minister of India Shri ... Xem chi tiết

Union Budget 2020 – Union Budget 2020 Direct Taxes Highlights

Union Budget 2020 – Union Budget 2020 Direct Taxes Highlights. Finance Minister – Smt. Nirmala Sitharaman, on 1st February 2020 presented Budget for 2020-2021 with an aim at energizing the Indian economy through a combination of short-term, medium-term, and long term measures. Income tax rates for Individual Nil for income up to Rs. 2,50,000 lakhs5% for income between Rs .2,50,001–Rs.5,00,000 lakhs10% for income between Rs ... Xem chi tiết

Best SIP Mutual Funds to Invest in 2020 – Investment in India

Best SIP Mutual Funds to Invest in 2020 : The investment in the mutual funds have proved to be the best in the market as the common man is not involved, where to invest the same. Mutual funds are such instruments which have guaranteed minimum return since long time. But to select the best mutual fund, which would provide the best returns is very difficult. So here are some of the mutual funds which have extremely well ... Xem chi tiết

Franklin Templeton Prima Fund (FIPF) – All you need to know about

Franklin Templeton Prima Fund (FIPF). This article basically about the fund which is managed by the Franklin Templeton group. I have explained here the details of one specific plan called “Franklin Templeton Prima Fund” which is in big debate for its returns. Here is all you want to know about the plan and take decision whether it is beneficial for you to invest in the scheme or not. Now check more details regarding “Franklin ... Xem chi tiết

Complete details about – China’s black Monday – A Detailed Analysis

Complete details about – China’s black Monday, Hundreds of billions wiped off as a result of the China’s massive stock market crash occurred on Monday 24th August. After US China is the second largest economy in the world contributing 13% of the world’s economy. This day was described as a black Monday by the media which caused the Chinese shanghai index into a down trend by 8.5%. This is the Shanghai worst single-day fall in ... Xem chi tiết

Employee Investment Guidelines for FY 2019-2020 (How to Save Tax)

SectionParticularsDeduction allowable80CInsurance Premium Total deduction under section 80C for various investments can’t exceed 1,50,000/- Only premium paid and services tax are allowed as deduction and late payment charges will not qualify for Tax benefit on premium payment will be restricted to maximum of Policy issued before 1st April,2012 – 20% of the actual capital sum assured Policy issued on or after 1st April,2012 – ... Xem chi tiết

EPF Partial Withdrawal Rules, PF Withdrawal Status, Form, Rules

PF members are allowed to fully or partially withdraw balance from their account. EPF Partial Withdrawal Rules, EPF Advance, Partial Withdrawal Rules Check EPF Partial Withdrawal Rules , EPF is safety net for middle class. The EPFO has also launched the UAN (Universal Account Number) which has enabled subscribers to merge multiple PF accounts as well as make withdrawals from their account without the attestation of their ... Xem chi tiết

Incorporation of Joint Venture Company in India (Registration)

Incorporation of Joint Venture Company in India, Procedure for Formation of Joint Venture Company in India. Joint Venture in India by Foreign Companies, Another option available for foreign entity to invest in India is to set up a joint venture company, which means collaboration with an Indian company and contributing in terms of capital, infrastructure, knowledge, technology, etc. It may involve an entirely new business, or ... Xem chi tiết

Equity Investing during Pandemic times, Its time for Equities

Its time for Equities and only Equities: The Indian economy looks promising again which is reflected through the India’s manufacturing sector activity which climbed to a near eight-year high in January 2020. It is mainly driven by a sharp rise in new business orders amid a rebound in demand conditions that led to a rise in production and hiring activity. Well the slowdown feathers are shedding down and hence the time has come ... Xem chi tiết

Sukanya Samriddhi Account Rules 2020, Sukanya Yojana 2020

Sukanya Samriddhi Account Rules 2020: Sukanya Samriddhi Account is Government of India backed savings scheme targeted at the parents of girl child. It is a Girl Child Prosperity Account. The Sukanya Samriddhi Yojana was launched as a part of the Beti Bachao, Beti Padhao campaign by the Modi government on 22 January 2015 after seeking the subjugating conditions of the girl children in the country. The scheme encourages parents ... Xem chi tiết

India Equity Investment – A Perspective & Expectations from Modi 2.0

We expect India equity market to continue to climb wall of worries of US-China Trade issues to domestic slow-down fears. With major uncertainty out from an election verdict of a stable & decisive govt, the market is expected to rally on hopes of reforms to accelerate growth. Though, long term structural issues will take time – whether it pertains to public sector bank mergers to privatisation initiatives. Cement volumes ... Xem chi tiết

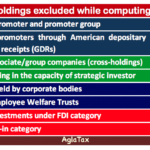

What is Investible Weight Factors (IWF)? with Example & signifies?

Investible Weight Factors (IWFs): Investible weight factor is the unit that shows how much portion of a company’s total shares is available to the investors for trading freely on the stock exchange. It is mainly used in computing the market capitalization of a company under free float methodology. While computing IWF, stocks held by the entities having strategic interest in a company are eliminated from the total number of ... Xem chi tiết

Pradhan Mantri Krishi Sinchai Yojana, all you need to know about PMKSY

Pradhan Mantri Krishi Sinchai Yojana (PMKSY): Have ever pondered yourself on a question “which sector in India is generating most employment?” Few may wonder to know that it is the agriculture sector that generates more employment opportunities by contributing to the country’s workforce by more than 50%. Agriculture is considered to be the backbone of Indian economy. People’s president APJ Abdul Kalam in his vision 2020 has ... Xem chi tiết

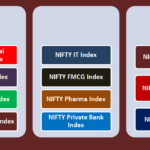

NIFTY Sectoral indices & How are they calculates?, Selection criteria

What is NIFTY Sectoral index?: Index that is constructed by the stocks that are selected and grouped together on the basis of the industry the companies belong to is a Sectoral index. NIFTY sectoral index is calculated by grouping the stocks listed on National Stock Exchange (NSE). These are computed based on free-float market capitalization method in which the market value of the share is multiplied by the number of shares ... Xem chi tiết

National Apprenticeship Promotion Scheme: Objectives, Eligibility

National Apprenticeship Promotion Scheme: One of the biggest problems our country has been facing is the growing unemployment along with the growing graduates every year. Unfortunately, mere college education is not giving them the skills required to enter the job market. And there have been many programmes that the government of the day initiated to train the youth to make them ready for the industry. “National Apprenticeship ... Xem chi tiết

State Bank of India Fleet Finance Scheme, SBI Fleet Finance Scheme

State Bank of India Fleet Finance Scheme: State bank of India has been providing various loan services specially designed for Small and Medium Enterprises (SME). One of such products offered by India’s largest bank is SBI Fleet Finance Scheme, which is aimed at providing loan for transport operators owing fleet of commercial vehicles like trucks, trailers, tankers and buses. check more details for SBI Fleet Finance Scheme from ... Xem chi tiết

Nai Udaan scheme – Free coaching to minorities 2020 (All Details)

Nai Udaan scheme – Free coaching to minorities 2020: There have been many schemes implemented by the government of India for the improving the lives of the minority communities. One of such schemes is a ‘free coaching scheme for minority students’ which essentially focuses on providing free coaching services to the students belonging to the recognized minority communities. This scheme is run by ministry of minority affairs, ... Xem chi tiết

Reasons for Fluctuations in Gross Profit Ratio, Fluctuations GP Ratio

Reasons for Fluctuations in Gross Profit Ratio, Fluctuations GP Ratio: In the preparation and finalization of Financial Statements, GP analysis plays a very important role. Here, we will analyze the reasons for fluctuations and how to observe them. Before we proceed further, let us understand the basic meaning of the term. now check more details for “Reasons for Fluctuations in Gross Profit Ratio” from below… Gross profit ... Xem chi tiết

KVP, PPF, NSC Which is best? Comparison Chart with interest rates

KVP, PPF, NSC Which is best? Comparison Chart. Check Comparison Chart – KVP, NSC and PPF. Check Compression between KYP, NSC and PPF. There are so many options available for investment. Don’t get confused though. This article will spill out the options, their benefits and drawbacks. So read more on KVP, PPF, NSC Which is best? from below… The Below mentioned points have been explained in detail below: KVP (kisan Vikas ... Xem chi tiết

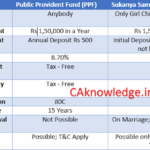

Sukanya Samridhi Yojana vs PPF – Eligibility, Maturity, Interest

Sukanya Samridhi Yojana vs PPF. Here we provide Difference Between Sukanya Samridhi Yojana vs PPF. find our complete information regarding Sukanya Samridhi Yojana vs PPF. Find full details of Sukanya Samridhi Yojana and PPF (Public Provident Fund) Account like Eligibility, Location of opening the account etc. now you can scroll down below and check difference between Sukanya Samridhi Yojana vs PPF. Sukanya Samriddhi yojana ... Xem chi tiết

Vidyanjali – A School Volunteer Programme: What is?, Eligibility

Vidyanjali: Being the 2nd most populated country, India is also the home for more number of school going children. And the school dropouts due to lack of financial resources has been increasing at an alarming rate. And the government schools are continuously failing to retain the students either because the students switch over to private & corporate schools or the children are forced to work to support their family. ... Xem chi tiết

Major initiatives of Ease of doing businesses in India – Detailed

Major initiatives of Ease of doing businesses in India. Find Complete details for Ease of doing business in India. My this article is about the automation which has been acquired by the new government and the new initiative for the better India. This initiative has been highly been encouraged as our PM is also fond of all the processes to be automated and the process from obtaining the license to the liquidation of the same ... Xem chi tiết

Masala Bonds – Meaning and Background (All you need to know)

Masala Bonds : Meaning of Masala Bonds and Background of Masala Bonds.Masala bond was the first Indian bond to get listed in London Stock Exchange. IFC named it Masala bonds to give a local flavour by calling to mind Indian culture. In this article you can find complete details about Masala Bonds like – Meaning of Masala Bonds, Background of Masala Bonds etc. Recently we also provide details about “Masala Bonds – Quick Facts, ... Xem chi tiết

Sukanya Samriddhi Yojana in Hindi: सुकन्या समृद्धि योजना इन हिंदी

Sukanya Samriddhi Yojana in Hindi: हम जानते है की हमारे देश में बेटियों के क्या हालात है| बेटियों के हालात में सुधार लाने के लिए Sukanya Samriddhi Yojana को प्रस्तुत किया था| Sukanya Samriddhi Scheme Details में जानकारी आपको इस आर्टिकल में प्राप्त होगी| Sukanya Samriddhi Account के बारे में और अधिक जानकारी प्राप्त करे और Sukanya Samriddhi Yojana Calculator से बेटियों को कितनी अमाउंट प्राप्त होगी उस बारे में जाने| इस अकाउंट में ... Xem chi tiết

Masala Bonds – Quick Facts, Positive Side & Apprehensions

Masala Bonds: find complete details about Masala Bonds like – Difference between ECB and Masala Bonds, Quick Facts about Masala Bonds, Positive side of Masala Bonds, Apprehensions about Masala Bonds etc. Now check more details about “Masala Bonds – Quick Facts, Positive Side & Apprehensions” from below….. ECBs refer to commercial loans in the form of bank loans, securitized instruments, buyers’ credit, suppliers’ credit ... Xem chi tiết

23 most common Investments and how they are taxed? – Detailed

23 most common Investments and how they are taxed?:Most forms of tax saving investments options work under the parameters of section 80C of the Income Tax Act. Here are the best investment options and plans in India for 2020 with safe investments & higher returns with Tax information. Interest earned in saving bank account up to Rs 10,000 is exempted from tax u/s 80TTA. Any interest more than Rs 10,000 is added to your ... Xem chi tiết

Deen Dayal SPARSH: What is SPARSH?, Objective, Eligibility

Deen Dayal SPARSH (Scholarship for Promotion of Aptitude & Research in Stamps as a Hobby): Do you know what philately is? Not many have heard the term philately which means collection, appreciation and research activities on postal stamps. Are you one among those few in school who show extreme interest in collection and study of postal stamps? Then you must know about a new scheme called Deen Dayal SPARSH (Scholarship for ... Xem chi tiết

Tax Free Bonds – Purpose, Benefits, Interest, Eligibility, Risk

Tax free bonds are highly popular investment option among investors due to the taxation benefit that they offer. Know more about Tax Free Bonds in India. 1.How to Invest in Tax Free Bonds? 2. Who can Invest? 3. Comparison with Tax Saving Bonds. These bonds, generally issued by Government backed entities, are exempt from taxation on the interest income received from such instruments under the Income Tax Act, 1961. The income by ... Xem chi tiết

Bình luận mới nhất