My this article talks about the foreign institutional investors which are taking a large share of market in the current market scenario. Maximum number of readers do not know the meaning of the term Foreign Institutional Investor. The term means the entities or companies or any institution which are registered outside India and they want to make investments in India or make proposals for making investments in India. They make ... Xem chi tiết

Investment

Pradhan Mantri Suraksha Bima Yojana, PMSBY Yojana Details 2022

Pradhan Mantri Suraksha Bima Yojana, PMSBY Yojana Details 2022. The scheme will be a one-year cover, renewable from year to year, Accident Insurance Scheme offering accidental death and disability cover for death or disability on account of an accident. The scheme would be offered/administered through Public Sector General Insurance Companies (PSGICs) and other General Insurance companies willing to offer the product on ... Xem chi tiết

Startup Companies in India, Ways to improve your Startup In India

Startup Companies in India – Ways to improve your Startup reputation in India, Overview of the Startup Companies in India, This article is about the recent trends seen in the markets of the India which is about the youngsters starting up their company and doing some innovative which others are not able to do. This period of India is considered to be the age of startups in which a huge amount of startups have been registered ... Xem chi tiết

Pradhan Mantri Suraksha Bandhan Yojana 2022 – All Detailed

Pradhan Mantri Suraksha Bandhan Yojana: Keeping in view the ensuing Raksha Bandhan Festival in mind specially designed Schemes “Suraksha Bandhan” are launched. However, these products have relevance for other festivals, social occasions and family celebrations also. These schemes are as below: Jeevan Suraksha Gift Cheque- Rs.351/-Suraksha Deposit SchemeRs. 201/-Jeevan Suraksha Deposit Scheme Rs. 5001/-India being a nation of ... Xem chi tiết

Pradhan Mantri Jan Dhan Yojana 2022: Eligibility, Documents

Pradhan Mantri Jan Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance and Pension in an affordable manner. After being elected as the Prime Minister of the world’s one of the fastest growing countries Honourable Shri Narendra Modi has launched many schemes to improve the quality of living of the ... Xem chi tiết

How to get loan against PPF: Eligibility, Amount of loan, ROI

How to get loan against PPF – Public Provident fund is not just a good social security scheme but it also provides many other benefits in the form of deduction while computing the total taxable income and earns a good amount of interest at no risk. Apart from these benefits it also provides a facility to avail a loan against it. in this article, we provide complete details for How to get a loan against PPF like – Eligibility ... Xem chi tiết

Post Office Saving Account: Benefits & Rate of Interest 2022

Post Office Saving Account – Benefits and Rate of Interest. Check Rate of Interest of “Post Office Saving Account“. In this article we provide complete details for Post Office Saving Account Scheme like – Benefits of Post Office Saving Account, Rate of Interest in Post Office Saving Account Scheme. Account can be opened by cash onlyMinimum balance to be maintained in a non-Cheque facility account is INR 50/-Cheque facility ... Xem chi tiết

What should you choose for your startup – LLP or Pvt Ltd ?

What should you choose for your startup – LLP or Pvt Ltd Company ?. Nowadays the trend of registering a startup and making operational is very high. Youngsters and Teenagers are increasingly participating in the scheme of the Government of India, called “Startup India”, but it is very much crucial for the person to select which kind of institution it should select, should he select Company form or Proprietorship concern or ... Xem chi tiết

What is FDI, Benefits & Importance of Foreign direct investment

What is FDI and its Benefits. In this article you can find everything you want to know about FDI like – Meaning if FDI, Fdi In India, Importance of FDI, Creates employment, Brings the expertise, Access to funds across the globe. Recently we provide complete details for FDI – Reporting under FDI Scheme on the e-Biz platform. Now you can scroll down below and check complete details for “What is FDI and its Benefits” If you like ... Xem chi tiết

Formation of Foreign Institutional Investor by Foreign Entity

Foreign Institutional Investor, Incorporation of Foreign Institutional Investor in India. A Foreign Institutional Investor (FII) means an entity established outside India and which proposes to make investment in India in securities. Foreign entities, willing to invest in India as FIIs, should first register themselves with the Securities and Exchange Board of India (SEBI). A wide range of foreign entities are allowed to ... Xem chi tiết

EPF Universal account number: What is UAN?, How to get UAN No

EPF Universal account number: What is UAN?, Advantages, How to get UAN Number?, All About on Universal Account Number (UAN) for Provident Fund Before Introduction of UAN every PF member used to spend a lot of time to comply the administrative procedures and rules to transfer his PF from old employer to new employer in the times of switching over to new jobs from existing one. But with introduction of UAN Government (In fact ... Xem chi tiết

Startup India: Standup India 2022: All you need to Know About

Startup India – Standup India 2022: Complete Details, India being called as the worlds one of the fastest-growing economies is going through a perfect time for transforming the ideas of potential entrepreneurs into successful business ventures. Having an abundant market to reach India has the fastest emerging startup ecosystem in the world. To boost the idea of the setting new startups and creating immense employment ... Xem chi tiết

Employee Pension Scheme: Basic Details, Eligibility, Features

EPS Scheme: Employee Pension Scheme: After providing basic details for Employee Provident Fund, Here we are providing complete details for Employee Pension Scheme. In this article you can find everything you want to know about Employee Pension Scheme like – Details for Employee’s Pension Scheme 1995, Rules for Eligible employees, No contribution on above 15000 – for new members, Pensionable salary for pension calculation, Main ... Xem chi tiết

New Deduction 80C Sukanya Samriddhi Savings Account 2022

New Deduction 80C Sukanya Samriddhi Savings Account, Scheme is meant for long-term savings for Girl Children to meet out their Education and Marriage expenses. Sukanya Samriddhi Savings Account (Sukanya Samridhi Yojna) launched by Govt recently has received very good response as PM Mr. Narendra Modi gave personal attention to this scheme as a part of ‘Beti Bachao Beti Padhao’ campaign. Now you can scroll down below n check ... Xem chi tiết

Kisan Vikas Patras: Introduction, Benefits, Interest Rates, Types

Kisan Vikas Patras: Introduction, Benefits, Interest Rates, Various Types. Kisan Vikas Patra is a saving scheme that was announced by the Government of India. Under this scheme it doubles the money invested in eight years and seven months. There are many such post office schemes in which good returns are being received by the customers. KVP is also a popular post office office. It is giving 7.7 percent interest in the present. ... Xem chi tiết

Investment into India by Non Resident Indians on Non Repatriation Basis

Investment into India by Non Resident Indians on Non Repatriation Basis: Significant amendments have been legislated over the past couple of years under the exchange control regulations and FDI Policy for amending the definition of NRIs and for clarifying that investments made by NRIs on non-repatriation basis shall be treated at par with domestic investments. The purpose of this article is to summarise the amendments and ... Xem chi tiết

GDP of India 2022 with comparison of other countries, How to Calculate

GDP of India: India becomes the 6th largest economy in the world, climbing two places to overtake Britain and France. GDP, i.e., the Gross Domestic Product – means the total sum of goods and services in the country, which can be counted in money, which is a special period mainly for one year. This is an important micro economic scale which is a symbol of the economy and efficiency (effect). This is because GDP is associated ... Xem chi tiết

Axis Bank Sukanya Samriddhi Account 2023: How to Open Account

Axis Bank Sukanya Samriddhi Account 2023: Axis Bank is the third largest private sector bank in India. Sukanya Samriddhi Account is a Government of India backed saving scheme targeted at the parents of girl children. The scheme encourages parents to build a fund for the future education and marriage expenses for their female child. The bank offers financial services to customers from large and mid-sized corporates, MSME, ... Xem chi tiết

Invest through direct shares or equity mutual funds? 2023

Invest through direct shares or equity mutual funds? Know what is the benefit deal for you. Usually, you can start investing in mutual funds from Rs 500. But there are also some companies that offer the facility to start investing from Rs 100. ‘Profit is the reward of risk’. This statement of Prof. Holley fits the business world to the investment market. Talking about investing in the stock market, if you are knowledgeable ... Xem chi tiết

Full service brokers Versus Discount brokers Which one to choose?

Full service brokers Versus Discount brokers: While making any buy or sell decisions in the stock market, one thing that we all worry about is brokerage costs. Any transaction in the stock market involves brokerage costs as brokers are the ones who act as the bridge between the retail investors and the stock market. Currently, there are 2 types of brokerage models in India that are distinctly different in terms of the services ... Xem chi tiết

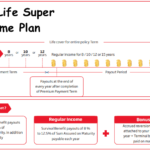

HDFC Life Super Income Plan: Plan, Eligibility, Tax Benefits 2023

HDFC Life Super Income Plan is a participating plan that offers guaranteed income for a period of 8 to 15 years. It also offers an opportunity to participate in the profits of participating fund of the company by way of bonuses. The plan is ideal for individuals who need regular income at their disposal so that they don’t have to worry about future expenses and fulfil their financial goals uninterrupted. Min- Max Entry Age ... Xem chi tiết

What should be taken: Life Insurance or PPF ?? (with all details)

Life Insurance or PPF 2023: this article talks about the Similarities, Benefits, Differences in the Money to be given or invested for Life Insurance and PPF. This topic has been very much hit in the individuals that what should be taken and which would give high returns with additional benefits. So I had written this article for those who are confusion for what to do. After reading the full article, you would be crystal clear ... Xem chi tiết

Sagar mala programme of India: National Perspective Plan

Sagar mala programme: Lying in the middle of Indian Ocean, India is endowed with rich maritime advantages such as 7500 km coastline covering 13 states and union territories which is at a strategic location of many international trade routes such as Malacca strait etc. It is reported that maritime logistics has been a very important component of Indian economy accounting for 90% of Export & Import trade by volume & 72% ... Xem chi tiết

National Pension Scheme: Eligibility Contribution Maturity

National Pension Scheme: Eligibility, Contribution, Tax Benefit, Maturity. Everything you want to know about National Pension Scheme. Here we are providing complete details for National Pension Scheme. Find full details for National Pension Scheme like About this Scheme, Eligibility Minimum contribution, etc. After Providing Complete details for Sukanya Samridhi Yojana now we provide National Pension Scheme The Government of ... Xem chi tiết

Pradhan Mantri Jeevan Jyoti Bima Yojana: Eligibility, Period

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a term insurance plan. If a person dies after investing in Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), then his family gets Rs 2 lakh. – PMJJBY is an Insurance Scheme offering life insurance cover for death due to any reason. It is a one year cover, renewable from year to year. Dena bank has tie-up with LIC for this scheme. The scheme will be a one year cover Term Life ... Xem chi tiết

Bharat Mala Project: Objectives, Coverage, Components, Funding

Bharat Mala Project: Government of India headed by Prime Minister Narendra Modi has launched many initiatives to boost the infrastructure development in the country which is an inevitable sector on which the industrial growth of any economy is premised. China is what it is today because of its multi faceted leap taken to modernize the infrastructure in the industrial cities such as Shenzhen etc. “American roads are not good ... Xem chi tiết

Pradhan Mantri Ujjwala Yojana: Eligibility, Application Form

Pradhan Mantri Ujjwala Yojana – Procedure for Applying Pradhan Mantri Ujjwala Yojana . In rural India still there is a larger section of the household using conventional sources of fuel for cooking. Some of them are dried cow dung and firewood. Due to the smoke generated during the cooking the health of the people in these areas is damaged very rapidly. There has been a survey saying “more than 5 lakhs people die each year” as ... Xem chi tiết

Best Investments Plans In India: PPF, LIC, Mutual Funds 2023

Best Investment Plans 2023, Best Investments Plans In India – PPF, LIC, Mutual Funds, Term Deposit with Banks 2023, Check Top Investment Plans in India For 2023. We all wish to go for investments which give us safe returns, are less risky, have our desired maturity periods & it will be a cherry on the cake if these investments also get us deductions from tax liability. Here we discuss many Investment Plans available in ... Xem chi tiết

Seed Funding Assistance, SEED Capital, Importance – Detailed

Seed Funding Assistance: Now a days there are many people coming with innovative business ideas that are having the viability of turning them into a successful business. But the only thing that stands as an obstacle to them is scarcity of funds. Seed funding is a boon to these people who are extremely desirous to establish their own startup. Here I’m going to discuss a few lines about seed capital assistance. If you like this ... Xem chi tiết

Moats and Floats: Investment lessons from Warren Buffet’s letters

Moats and Floats – Investment lessons from Warren Buffet’s letters. Moats: For those who are familiar with the letters that Billionaire investor writes to his company’s shareholders, the concept of moat is known as the competitive advantage enjoyed by a business entity over its rivals in the same industry. For example, if CoCo Cola has certain competitive advantages over its rival PepsiCo then these advantages can be termed as ... Xem chi tiết

Reverse Mortgage: Features, Meaning, Eligibility, Taxation

Reverse Mortgage : Soon after retirement one may have to think about the available resources to lead his rest of the life. Those having good amount of retirement benefits and a financial supporter don’t need to worry too much at this point of their time. There are many plans offered by various banking institutions to fund the needs of this kind. One of those plans is reverse mortgage. Living in a house owned by you rather in a ... Xem chi tiết

Real Boost Top 3 Cities to Invest In Real Estate Sector 2023

Real Boost, Top 3 Cities to Invest In Real Estate Sector, The only sector which would have no risk in it and would yield you enough amount of return from it would be the Real Estate Sector subject to you choose the right place or location and the right time period. So here we are with the detailed analysis of the cities where you can get the best returns if invested at the right time. These sector has been growing very fast ... Xem chi tiết

Commercial Papers: Meaning Objective Features Maturity

Commercial Papers (CP) is an unsecured money market instrument issued in the form of a promissory note. Commercial Paper was introduced in India in 1990. CP can be issued in denominations of Rs.5 lakh or multiples thereof. Commercial Papers: What is Commercial Paper in India?, Here we are providing complete details regarding Commercial Papers. Recently we provide Senior citizens savings scheme – Complete features and Section ... Xem chi tiết

Best Short Term Investment options in India 2023

Best Short Term Investment options in India. Investment options are always constrained by your investment horizon, what investment instrument you chose is highly related to your investment horizon, today we are going to discuss few investment options for the short term. Now check more details about “Best Short Term Investment options in India” from below… Before we go ahead it is very important to define short term, for some ... Xem chi tiết

Register with Amazon as seller 2023: Guide, Fee, GST Number

Register with Amazon as seller. Procedure for sell on amazon in India. Now a days you can hardly find a man using no smartphone in urban and semi urban areas. With day to day sophistication of mobile technologies smart phone seems to have become a necessity among the public. There has been lot of change in the internet technologies over the time. Now internet is available to most of the people unlike in 90s. check more details ... Xem chi tiết

India’s Top 10 Safe Investment Plans, Top Investment Plans 2023

India’s Top 10 Safe Investment Plans 2023. Investment in India, Here we are providing complete details for the Top 10 Investment Plans in India. Find List of 10 Safe Investments in India. List of Best Investment Plans in India. Top 10 Best Tax Saving Investment Options in India for 2021. In this article, you can find all details regarding India’s Top 10 Safe Investment Plans. Now you can scroll down below and check complete ... Xem chi tiết

What is Systematic Withdrawal Plan (SWP): In Detailed

Systematic Withdrawal Plan (SWP): Systematic Withdrawal Plan allows an investor to withdraw a fixed/a pre-determined amount from his existing investments in mutual funds at a pre-decided interval (Varying from monthly, quarterly, semi-annually or annually). In a sense, SWP is a mechanism similar to SIP, but the only difference is SWP gives the investor an option to withdraw a portion of his investment. SWPs are relatively ... Xem chi tiết

Venture capital finance: Features, Advantages, Disadvantage 2023

Venture capital finance In India, They’re known for backing high-growth companies . in the early stages, and many of the best-known entrepreneurial success stories owe their growth to financing from venture capitalists. Day by day India is becoming a favorite destination for startups. Many surveys have indicated reportedly that India is the second most fast growing place for new, young and talented startups where approximately ... Xem chi tiết

How to Start your own Retail Jewellery Business, Important Points

How to Start your own Retail Jewellery Business, This article is about starting your business in the field of Jewellery which is regarded as the most prominent sector of India. In today’s world the entrepreneurship has become very popular and the startups are also given boost by the government so that they can come up with various initiatives and innovations. The concept of starting a business is very much popular where the ... Xem chi tiết

Bình luận mới nhất