8 Ways to Invest your Annual Bonus wisely, Annual Bonus – Make the best of It!, We are in that part of the year right now where either you must have received your Annual Bonus or you might be receiving it anytime soon! So, you should keep your plan ready to make the best out of it! These are the following ways in which you can invest them & make easy gains. Let us have a look on the same. You can invest in insurance ... Xem chi tiết

Investment

Best Long Term Investment Plans In India 2023: Full Guide

Best Long Term Investment Plans In India, Best Long Term Investment Options in India, here we are providing complete details regarding top long-term investment options in India in 2023. We all wish to make the most benefit from our savings but are often confused about where to invest in, so here we provide you details about various Long Term Investment Plans. When you started for investing your hard-earned money, you can find ... Xem chi tiết

Structured Settlement Investments an Overview – Advantages

Structured settlement investments an Overview. Structured settlements are usually associated with compensation to injured plaintiffs following a legal hearing. This article is very useful for those investors who want to Invest Money in Foreign. Now you can scroll down below and check complete details regarding “Structured Settlement Investments” Structured settlements are structured cash payments through anannuity system that ... Xem chi tiết

Difference Between FDI and FII? Meaning of FDI and FII 2023

What’s the Difference Between FDI and FII?. Both FDI and FII is related to investment in a foreign country. FDI or Foreign Direct Investment is an investment that a parent company makes in a foreign country. On the contrary, FII or Foreign Institutional Investor is an investment made by an investor in the markets of a foreign nation. Recently we also provide a complete guide for ADR and GDR. If you like this article then ... Xem chi tiết

How to Double your money wisely? (7 Ways), Ways to get Doubled

How to Double your money wisely ? (7 Ways): There are many people in the world, who want to make the money without any effort or hard work but by investing in the right way and the best optimum return based investment. They are people with a very sharp minds, and hence they would be very much smart in investing. Now the people also want that the amount invested should get doubled in short term and get them back, but investing ... Xem chi tiết

Don’t have credit history? Here’s how can you build it (Detailed)

Don’t have credit history? Here’s how can you build it: A good credit history is always a better credential when applied for a loan. A healthy credit score is always a must to have to secure positive results for the loan and credit card applications. If you have never had a formal credit history, it would for sure make a difference when you are out in the market for loans and credit cards. In this post, we discuss the best ... Xem chi tiết

What is Government Security?: Meaning, Objectives, All Terms

A government security is a bond issued by a government authority with a promise of repayment upon maturity. Everything you want to know about Govt Security. Treasury bonds, Cash Management Bills, Dated Government Securities, Fixed Rate Bonds, Floating Rate Bonds, Zero Coupon Bonds, Capital Indexed Bonds. Recently we provide Commercial Papers – Meaning – Features and Senior citizens savings scheme. Now you can scroll down below ... Xem chi tiết

What Value investing : Meaning, How is it done?, Intrinsic value

What Value investing : Billionaire investor and his mentor Benjamin Graham both have made fortunes by practicing value investing for decades. Value understanding a simple investment philosophy does not require the investors to understand complex financial concepts. It’s very simple to understand but requires patience to practice. In this post, we discuss value investing and various issues associated with it. Value investing ... Xem chi tiết

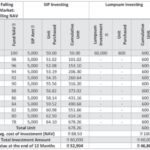

Systematic Investment Plan (SIP): Meaning, Advantages, Guide

Systematic Investment Plan (SIP. In this article you can find Meaning of Systematic Investment Plan, Benefits of SIP, How does SIP make difference over the rest, Benefit of compounding etc. Now you can scroll down below and check complete details regarding Systematic Investment Plan. If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” ... Xem chi tiết

Things to notice before buying Land or Plot in India 2023

Things to notice before buying Land or Plot in India, A wise man has quoted, ‘The best investment on earth is earth.’ Real estate is considered as an investment which would always appreciate. Moreover in India, real estate also carry emotional bonds, which means that the land or plot dealing have to be made with extra caution for avoiding any malicious activities which may impact on ownership and title of the property. This ... Xem chi tiết

Two Best Investments To Double Your Savings: Complete Guide

Two Best Investments To Double Your Savings, Once we start earning, we look forward towards making the best investments to get the best returns out of our surplus money. Your financial intelligence is tested here. The investments you make show not just your risk bearing capacity, but also how financially intelligent you are. Here, we will discuss the two quickest and simplest ways to double your savings. However, if the return ... Xem chi tiết

All you have to know about Gifting of Shares – Share Market

Gifting of Shares: In India presenting something which possess some value to friends, relatives and family members and the other group of persons is a very common thing to happen.Indian income tax act has provided some provisions in relation to the gifting property. In order to avoid the future problems which could occur due to non compliance it is advisable to go through the laid down norms to while gifting anything to ... Xem chi tiết

Tips to Invest while in Retirement Years, How to get Good Returns

Tips to Invest while in Retirement Years, How to Invest in Retirement Years, This article is basically about the investment which can be made by the old people by sitting at the home and relaxing and doing some proper investing to get the returns for the remaining life. People in the retirement years can not do some work which is harmful for their health, but can surely do some work which can keep their mind working in the ... Xem chi tiết

Key man insurance policy: Introduction, Advantages & Disadvantage

Key man insurance policy: Keyman insurance is defined as an insurance policy where the proposer as well as the premium payer is the employer, the life to be insured is that of the employee and the benefit, in case of a claim, goes to the employer. The `keyman’ or ‘key person’ would be any person employed by a company having a special skill set or substantial responsibilities and who contributes significantly to the profits of ... Xem chi tiết

Treasury Bill: Meaning, Types, Issuance, Auctions, Advantages

Treasury Bill: Meaning, Types, Issuance, Auctions, Advantages Categories: investment Source: bank.newstars.edu.vn ... Xem chi tiết

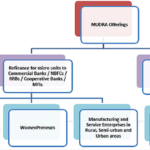

Pradhan Mantri Mudra Yojana 2023, PMMY Scheme ( In Detailed)

Pradhan Mantri Mudra Yojana: Pradhan Mantri Mudra Yojana (PMMY), also known as Mudra Loan Yojana, is a government-backed scheme that provides collateral-free loans to micro and small enterprises (MSEs). The scheme was launched in 2015 by the Prime Minister of India, Narendra Modi. PMMY has been a very successful scheme, with over 140 million loans disbursed as of March 2023 In the above backdrop, the Micro Units Development ... Xem chi tiết

Senior citizens savings scheme (SCSS): Benefits, Interest Rates

Senior citizens savings scheme (SCSS): The Senior Citizens Savings Scheme (SCSS) is a government-backed retirement benefits program. Senior citizens resident in India can invest a lump sum in the scheme, individually or jointly, and get access to regular income along with tax benefits. It is a Post Office savings scheme. Find out Benefits, Interest Rates, Other Features. Here we are providing full details for Senior citizens ... Xem chi tiết

7 Golden Rules for Investing Smartly, How to Invest in India 2023

7 Golden Rules for Investing Smartly, This article talks about the investment strategies which need to be adopted by an individual wishing to or currently investing in any of the investment portfolios and wants to know more about the ways to get a safe and a high return investment. Here I have provided the ways through which you can get the returns by taking care of the some points. The first and the foremost thing any ... Xem chi tiết

Jan Aushadhi Scheme: What is?, Features, Benefits – Detailed

Jan Aushadhi Scheme India being the 2nd largest country on the earth in terms of population is home for many drug producing companies. Over the years these companies achieved benchmarks in producing the lifesaving medicine at low cost. Even though these are priced at lower rates there are still millions of people in the country who cannot afford them to come out of their health problems. One reason for this scenario could be ... Xem chi tiết

Interest Rate of NSC, PPF, KYP, SSY, SCSS, Sukanya 2023

Interest Rate of NSC, PPF, KYP, SSY, SCSS For 2023 (Revised on 01-04-2023), Interest rates on Government Savings Scheme applicable from 1st April 2023. Small savings rates hiked: PPF and NSC to give 8%, senior citizens to get 8.7% from 1st April 2023. Find out updated nsc interest rate for 2023, Sukanya Samridhi Yojana Interest Rate 2023, PPF Interest Rate, Kisan Vikas Patra Interest Rate, Senior Citizen Saving Scheme (SCSS) ... Xem chi tiết

Varishtha Pension Bima Yojana (VPBY) – Eligibility, Benefits, Tax

Varishtha Pension Bima Yojana (VPBY). The NDA Government during its last term in office had introduced the Varishtha Pension Bima Yojana (VPBY) as a pension scheme for senior citizens. Government of India in the Union Budget for the financial year 2014-2015, announced the revival of ” Varishtha Pension Bima Yojana” (VPBY). Under the VPBY, subscribers pay a lump sum amount and receive a guaranteed pension for life. The pension ... Xem chi tiết

Why should you invest in SIP?, list of Various Reasons for Invest in SIP

Why should you invest in SIP?, list of Various Reasons for investing in SIP. check out Complete Benefits for Investment in SIP, you can invest a fixed amount in mutual funds step-by-step monthly or quarterly over a period of time, thereby averaging out your cost of investing and benefiting from the power of compounding. Here we are providing many reasons for investing in SIP – Habituate the discipline of Investment & ... Xem chi tiết

Key lessons from warren Buffet’s letters to the investors

Key lessons from warren Buffet’s letters to the investors: If you are familiar with the stock markets investment or list of world’s wealthiest persons then you might have heard the name of billionaire investor Mr Warren buffet. One of the things Billionaire investor Warren buffet is known for is his letters to the investors of his company Berkshire Hathaway. These letters which are closely followed by investors all over the ... Xem chi tiết

Financial Planning – At each and every Step of Life (Solutions)

DeliverablesRiskParticularsMethods UsedAdequate regular income The income of the family was such that the 75% of the income was spent in household expenses and only very less part of the income was being saved. The satisfaction of the living was not there, but still the man made some good investments out of the savings which made him a rich manFirstly there should be idea or goal in the mind that he has the responsibility of ... Xem chi tiết

Difference between Atal Pension Yojana & New Pension Scheme 2023

Difference between Atal Pension Yojana & New Pension Scheme 2023. Atal Pension Yojana (APY) Vs New Pension Scheme (NPY), Recently I have come across many queries asking the difference between New Pension Scheme (NPS) and Atal Pension Yojana (APY). In particular many people were asking about the major differences that make it (APY) quite better than NPS. In this article, you can find complete details regarding the ... Xem chi tiết

Best Debt Mutual Funds That you should never afford to miss

Best Debt Mutual Funds That you should never afford to miss. In this article, we will know about the Debt related mutual funds which are the best in the segment pertaining to the returns they offer which may be from short term to long term. Find complete details about Best Debt Mutual Funds. These mutual funds are those which receive the money from the investors and invest them in the debt market. The returns which they ... Xem chi tiết

Portfolio Management: Introduction, Objectives, Process

Portfolio Management: My this article is about how to manage the funds invested in the securities or the other market for the investment purpose. This is basically called the portfolio management, where the investments made by some intelligent person is managed by some other person and the returns are enjoyed by the person investing it. So this article is very beneficial for the persons wanting to invest in markets. Firstly ... Xem chi tiết

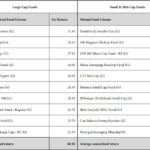

Best Mutual Funds to invest in 2020 – List of Top Mutual Funds

Best Mutual Funds to invest in 2020. Find list of top mutual funds to invest in 2020, Best Mutual Funds 2020 Based on the past market analysis, we have hereby compiled a list of mutual funds which have provided great returns. You can consider the same if you are planning to invest in them. However, we sincerely request you to read the offer document carefully before investing. In this article you can find complete details ... Xem chi tiết

Eligibility Criteria For Pradhan Mantri Mudra Yojana Refinance Loan

Eligibility Criteria For Pradhan Mantri Mudra Yojana Refinance Loan. Union Finance Minister Arun Jaitley said the MUDRA Bank was a step in the right direction for “funding the unfunded.” He had proposed the MUDRA Bank in his budget speech in February. Here we are providing complete details for Eligibility Criteria For Pradhan Mantri Mudra Yojana Scheme. Check Complete details from Below. Micro Units Development and Refinance ... Xem chi tiết

Mutual Fund – The best tool to achieve Financial Goals – Detailed

Mutual Fund – The best tool to achieve Financial Goals: In this article we have understood the importance of financial planning in our life and the process of financial planning. In this article, we will attempt to understand why a mutual fund is a useful tool in financial planning. Today, an investor has plenty of option to invest their money. They may go with a traditional investment product (like Bank FDs, Post office FDs, ... Xem chi tiết

Overview of Core Investment Company – Complete Analysis

Overview of Core Investment Company, This article is about the company which is specifically incorporated for some different purpose, i.e. for investment purpose. They are the companies which own non transferrable shares or debentures in its group companies for holding the shares in the company, which has been classified as non banking financial companies by the Reserve Bank of India. There is very simple process to register ... Xem chi tiết

Mutual Fund Riskometer – Risk Calculation in Mutual Fund

Mutual Fund Riskometer: Risk Calculation in Mutual Fund, Calculating Risk in Mutual Fund through meter – Mutual Fund Riskometer, this article is talking about the how the risk is calculated for the mutual funds that you have or are planning to buy. This type of riskometer is found when you go through the document provided when you purchase the mutual fund. This helps the investor to get the knowledge about what they are ... Xem chi tiết

Tips for Avoiding Personal Finance Mistakes: Finance Knowledge

Tips for Avoiding Personal Finance Mistakes, Financial Planning is the most important thing in any person’s life as it contains the element of money which affects every body’s life. There are some mistakes that most of us make while choosing some of the beneficial options but fail to identify the risks attach to it. I have mentioned some of the tips which would save you from the loss that occurs due to some silly mistakes. ... Xem chi tiết

How to Track Mutual Fund Portfolio, Steps to Track Mutual Fund

How to Track Mutual Fund Portfolio, Steps to Track Mutual Fund. Mutual funds give a sense to the investors whereby they feel like they are investing in big companies however with safety net with respect to principal invested. There are various types of mutual funds like growth fund, dividend fund, balanced fund etc.Hence depending on the financial objectives, the investor may choose to invest in different funds. At any given ... Xem chi tiết

Suryoday Bank Saving Account: up to 6.25% Interest Rates, Apply

Suryoday Bank Saving Account: up to 6.25% Interest Rates 2021. Why Choose Suryoday Bank Savings Account? Through its network of branches in India and overseas, Suryoday Bank provides a range of financial products including the Suryoday Bank Savings Account. The savings account has a variety of benefits and services. The most attractive features are that the savings account does not require a minimum balance and provides ... Xem chi tiết

Value investing in real estate investments: methods to be used

Value investing in real estate investments: Investing in real estate is no different from picking up the stocks on the security markets in terms of the analyzing by means of market fundamentals and other macro-economic conditions. Value investing in share market helps the real estate investors to make effective decisions. Billionaire investors like Warren buffet has been following value investing in making real estate ... Xem chi tiết

Mutual Funds Risk and Mutual Funds return – A Detailed Analysis

Mutual Funds Risk and return: Mutual funds, irrespective of their categories, cannot generate common returns on investments or have an equal degree of risk. Higher risks are usually involved in equity funds compared to debt or bond funds. At the same time, there’s no specific class or type of mutual fund, which is universally suited for all investors. A simplified risk-return profile can be prepared (table 2) on the basis of ... Xem chi tiết

HDFC Bank Saving Account – Benefits, Minimum Balance, Features

HDFC Bank Saving Account: Check Eligibility criteria for open HDFC Bank Regular Savings Account. Any savings account will be designed to meet your day to day banking needs while giving you 24X7 access to your bank. you may apply online for HDFC Saving account. check more details for HDFC Saving account from below… HDFC Bank have Wide network of branches and ATMs to meet all your banking needs, no matter where you are ... Xem chi tiết

Married women’s property act (MWP): Life insurance under MWP

Married women’s property act (MWP): Have you ever wondered why an individual takes the insurance policy on his life? After all, it’s your family members and dependents who suffer the most on your demise. If you are the only bread winner in the family, life of your family gets very difficult on your unfortunate demise. Then comes the policy amount of your life insurance to rescue your family members and dependents. But what ... Xem chi tiết

Bình luận mới nhất