Joint Home Loan: Every one in the world dreams of having their own house. To make it happen people often plan to take a home loan. But there are many types of loans one can apply in different banks and financial institutions. In home loans joint home loans are much popular than the other. What makes them so attractive is their ability to distribute the debt among all the applicants and the maximum sanction limit associated ... Xem chi tiết

Loans

How to get Personal Loan 2023: Eligibility, Interest, Apply

Personal loan is one of the most important thing in the life of any middle class family. They rely a lot on personal loans for the wellbeing of their families. There are plenty of loans available in the market. Loans are mostly categorized according to the specific needs of everyone. Like, for studies you take a students loan, for house you take a mortgage loan, for car you take an auto loan, and many more. But in case of ... Xem chi tiết

Educational loans – Eligibility, Required documents, Interest Rates

No deserving students should be stopped to pursue their dreams due to lack of money. One who has the desire to study should not be away from the studies just merely because of lack of financial support. In India day by day education is becoming costlier. There are number of students who depends on educational loan for their higher studies and study in abroad. The sole objective of educational loan is to give the financial ... Xem chi tiết

BOI loan against property: eligibility, types, interest rates, how to apply

BOI loan against property: Bank of India offers Loan Against Property starting at interest rate of 10.50% which is one of the best mortgage loan rates in India. Current 1 Year MCLR benchmark rate is 8.30%. BOI commits to nation-building is complete & comprehensive. Bank of India is actively involved since the year 1973 in non-profit activity called Community Services Banking. All the BOI branches and administrative offices ... Xem chi tiết

Xpress credit personal loans by SBI – Loan amount, Term, Interest

Xpress credit personal loans by SBI: With the growing demand for personal loans, different banks have come up with various personal loan schemes to lure the customers. One such is State Bank of India’s Xpress credit personal loans. In this post we enumerate the complete features of SBI’s most popular personal loan. Under Xpress credit scheme, loans are provided by SBI to employees of below mentioned entities having salary ... Xem chi tiết

EWS and LIG Scheme – PMAY Home Loan Subsidy Scheme 2020

EWS and LIG Scheme : Pradhan Mantri Awas Yojana – Urban (PMAY-U) home loan subsidy scheme 2019 for EWS and LIG under CLSS, know the subsidy amount, interest rates & how to apply for PMAY Yojana. EWS / LIG / MIG / HIG, Affordable Housing Scheme 2020 “Pradhan Mantri Awas Yojana (Urban) – Housing for All” Mission for urban area is being implemented during 2015-2022 and this Mission will provide central assistance to ... Xem chi tiết

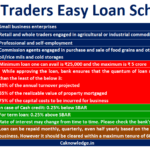

SBI Traders Easy Loan Scheme – Eligibility, Mortgage, loan Amount

SBI Traders Easy Loan Scheme: Getting a bank loan sanctioned for a business is very big deal. With the increasing bad debts, even the banks are left with no alternatives except tighten the credit sanction process. However, there are certain schemes especially designed to cater the financial needs of certain group of audience. State Bank of India (SBI)’s SBI Traders Easy Loan Scheme is one of such schemes. It was launched by ... Xem chi tiết

List of 5 best banks for personal loans in India with all details

Find out the 5 best banks for personal loans in India 2021: Personal loans are the most popular choices to meet a variety of financial needs varying from person to person. As the time goes, banks and financial institutions are coming with newer ways to lure the customers by offering attractive options ranging from low interest rates to waiver of processing charges etc. So, with the too much information available right there, ... Xem chi tiết

Federal bank digital personal loan (Fed-e-credit) – All Details

Federal bank’s digital personal loan (Fed-e-credit): Personal loans have become the most sought after by salaried employees to meet un-anticipated financial needs. No requirement for collateral and flexibility of usage has drawn the attention of many customers to the same. However, the paper work is viewed as a cumbersome step while availing the personal loan. Federal bank, a well-known private sector bank is offering a ... Xem chi tiết

CashParty loan app 2021: Features, Eligibility, Documents Required

CashParty loan app 2021: Features, Eligibility, Documents Required. There are a lot of features available in the CashParty app. You can enjoy various features and services from the CashParty app, making the entire experience very good. You can take an instant loan without having to worry about any paperwork and documentation. As the whole process is entirely online, you can start and end the process at your home without taking ... Xem chi tiết

SBI Business Loan: interest rates, features, advantages, charges

SBI Business Loan: To meet its financial requirements every business at some point of time has to look for external sources. To offer new product lines and services or enter new geographical areas which include managing daily operations, purchase assets like land, machinery or even technological investments, expand business these are some of the common reasons behind seeking external funding. There are primarily two ways of ... Xem chi tiết

MoneyEnjoy 2022: How to get a Personal loan from the app?

MoneyEnjoy Loan App 2022: MoneyEnjoy is an online application which is focused on providing easy loan to everyone without asking a lot of questions to them, about their income, salary, employment, etc. This is a newly launched application and it’s still now available on Google play store or any other official app store. Though you can download the MoneyEnjoy app online. In this article, we have given all the details related to ... Xem chi tiết

Kredivo loan app 2022: How to take Loan from this app?

Kredivo loan app 2022: Kredivo app is one of the very best applications which provides one of the personal loans of all. Its service is phenomenal and the application is also very reliable and secure. The app is authentic and it is also authorised by RBI. let’s know everything about the Kredivo app through this article. Also, check out PhonePe Loan. The Kredivo app provides loans from 1,000 to 10,000 without any paperwork, as ... Xem chi tiết

Buddy Loan 2022: How to get a Loan from Buddy loan?

Buddy Loan 2022: How to get a Buddy loan? Buddy is a very famous and successful online loan providing platform through which you can easily take a variety of loans and that too, without any paperwork and documentation. As the entire process is online, it makes it very easy and hassles free. You can take various loans like personal loans, business loans, home loans, education loans, and many more. You can take a maximum of 15 ... Xem chi tiết

FairMoney App 2022: How to get a loan from FairMoney app?

FairMoney App 2022: How to get a loan from the app? With the help of the FairMoney app, you can take a personal loan very quickly and without any hassle. Anyone who possesses all the required and essential documents and is eligible for it can easily take the loan within minutes. You can get a maximum of 50,000 loans at a time, whereas the minimum amount is 750 INR. The FairMoney App provides excellent flexibility to all the ... Xem chi tiết

Kreditzy loan App 2022: Features, Eligibility, Documents

Kreditzy loan app 2022: Kreditzy loan app is a very successful platform that provides straightforward and convenient personal loans to every individual in India eligible for it. You can take a loan amount ranging from 1,000 to 1,00,000 within minutes, and the entire process is entirely online. Also, the service of the application is phenomenal, and you can be completely rest assured. Kreditzy app provides a service 24*7 ... Xem chi tiết

FlexPay App 2022: How to get a loan from FlexPay App?

FlexPay App 2022: How to get a loan from Flex Pay? FlexPay app is one of the most successful payments and loan providing online platforms, which more than millions of Indians trust. The app is accessible from anywhere around the country, and you can take easy loans and credit from the app. You can also use the app for UPI payments. The credit which it gives every month to its customers can be used to pay for anything. In ... Xem chi tiết

Cashe app 2022: Features, Eligibility, Documents Required

Cashe app 2022: Features, Eligibility, Documents Required. With the help of the CASHe app, you can now have access to a variety of loans within minutes directly from the comfort of your home. As CASHe has introduced a variety of loans that can be accessed directly from the app, you can download the application either from the app store or from any other third party site. The interest rate for loans offered by CASHe is meagre, ... Xem chi tiết

Rufilo Loan app 2022: Features, Eligibility, Documents

Rufilo Loan app 2022: Features, Eligibility, Documents Required. Rufilo has been a sensation since its inception in the online lending platform. It provides one of the most accessible and convenient loans to every individual in India who is eligible for it. You can take a maximum of 25,000 instant loans within five minutes. There are also plenty of other features available like; you can get a list of gift cards and various ... Xem chi tiết

List of Restrictions on Loans Issued By all Bank (A Detailed list)

List of Restrictions on Loans Issued By all Bank, Check Various Restrictions On Loans Issued by RBI. Banking means accepting deposits from the public for the purpose of lending or investment and is repayable on demand. A Banking Organization is the one which is engaged in banking activities in India. Merely accepting deposits for the purpose of the business shall not be regarded as a banking activity. Every bank exists for the ... Xem chi tiết

MyMoney Mantra 2022: How to get a loan from the MyMoney app?

MyMoney Mantra 2022: How to get a loan from the MyMoney app? MyMoney Mantra loan app is a very famous and successful NBFC platform that provides hassle-free and convenient methods for loans, which you must have. If you ever need money in life, you can rely on the My Money app to fulfil all your dreams. With the MyMoney Mantra app, you can take various loans like personal loans, business loans, and many more. You can also take ... Xem chi tiết

SBI Two Wheeler Loan 2022: Interest Rates, Eligibility

SBI Two Wheeler Loan: In India, two-wheelers are more than just a commuting choice; they are in many cases a necessity. Especially due to poor and mostly overcrowded public transport in most major cities, owning a two-wheeler has become a necessity for Indians. State Bank of India’s 2 wheeler loan is designed to help individuals all over India purchase a new motorcycle or scooter of their choice with minimum hassle. Apart from ... Xem chi tiết

Monethics Personal Loan 2022: How to get a personal loan from the App?

Monethics personal loan 2022: How to get a personal loan from the App? Monethics is a very successful application famous for its innovative and flexible structure for a personal loan. This App is one of the most successful ones in its class. You can easily apply for a personal loan from the App. You can take a minimum of 2,500 to a maximum of 2,00,000 loan amount, and that too, within minutes. In this article, we will give you ... Xem chi tiết

SBI Education Loan 2022: Eligibility, Interest Rates, Documents

SBI Education Loan: Education loan for Courses at select leading Institutions in India like IITs, IIMs, NITs and other premier Institutions. Loan amount upto Rs. 40 lacs. With the increasing awareness of significance of education to succeed in the knowledge economy, the cost for it is also raising enormously the importance of higher education and a professional degree from reputed educational institutions is growing in ... Xem chi tiết

Bharat Pe App 2022: How to get loan from Bharat pe app?

Bharat Pe App 2022: How to get a loan from Bharat pe? Bharat Pe is one of the most successful and famous services in India these days. You will find a Bharat Pe QR scanner in every shop and merchant. Bharat Pe was made to be used by the merchants. It is a single place where you can send money through various UPI payment apps. This has made the life of all the merchants very easy. This article will give you all the details ... Xem chi tiết

Kreditbee Loan App 2022: Features, Eligibility, Documents

Kreditbee Loan App 2022: Features, Eligibility, Documents, Application: The Kreditbee app has gained the trust of millions of people in India. The app provides a loan to every citizen of India, if they have all the relevant documents and if they are eligible. KreditBee offers personal loans at a very low-interest rate and the processing fee is also quite low. KreditBee has a total download of more than 20 million, which makes ... Xem chi tiết

Navi Finserv App 2022: How to get a Navi loan? Full Process

Navi Finserv App 2022: Navi Finserv provides a variety of loans to every individual in India who is eligible for the loan. There are many options to choose from, and you can quickly get the loan directly from the comfort of your home. The application process is straightforward, and the eligibility criteria are also nothing special. You need to fill the form and submit the required documents and details about yourself. In this ... Xem chi tiết

Money Tap Credit line 2022: How to get Credit from the App?

Money Tap credit line 2022: How to get Credit from the App? Money Tap is one of the most famous and successful platforms for straightforward loans and credit without paperwork and documentation. It was never that easy to get a credit line before the arrival of the Money Tap app. You can take a credit line of 5 lakhs within minutes from the comfort of your home. In this article, we will give all the details related to the Money ... Xem chi tiết

Early Salary app 2022: Benefits, How to get a loan from the app?

Early Salary app 2022: Benefits, How to get a loan from the app? With the help of the Early Salary app, anyone can now have access to straightforward and flexible loans. The loan given by the Early Salary app is very safe and secure, as the app is approved by RBI. There isn’t any risk in taking money from the Early Salary app. You can get a minimum of 8,000 and a maximum of 5,00,000 loans at a time. Although you can also take ... Xem chi tiết

BOI Business Loan: interest rates, features, advantages, charges

BOI Business Loan: Bank Of India provides the business loan to the individuals, proprietors, partnership firms and limited companies to improve and expand their running business. The loan is sanctioned for the maximum tenure of 7 years and for the highest amount of ₹5 crores. To meet its financial requirements every business at some point of time has to look for external sources. To offer new product lines and services or ... Xem chi tiết

Money View App 2022: Apply for a Loan Online, how to apply?

Money View App 2022: Apply for a Loan Online; check here to know how to apply? With the help of the Money View app, more than millions of Indians have taken loans without any trouble. You can also take easy loans from the app, and you can easily apply for it within minutes. You can get a minimum of 5,000 rupees and a maximum of 5,00,000 INR. From this article, you can learn about the Online procedure to apply for a loan on the ... Xem chi tiết

Mudrakwik Loan 2022: Check here to know how to apply online?

Mudrakwik loan 2022: Check here to know how to apply online? Mudrakwik is an app that can help you take a loan within minutes without having to worry about any paperwork and documentation. The entire process runs entirely online and hassles free. You can take out a loan directly from the comfort of your home. In this article, we will give all the details related to mudrakwik loan. There are a lot of features available if you ... Xem chi tiết

Things to Keep in Mind While Using Personal Loan Calculator

When it comes to making smart borrowing decisions, a personal loan calculator is a handy tool. It helps you consider the impact of important loan factors such as the interest rate, tenor, and loan amount. These particulars of your personal loan will affect the cost of borrowing and the affordability of the loan. A personal loan calculator helps you consider these more meaningfully when optimizing your loan. Besides loan ... Xem chi tiết

MI credit 2023: How to take a loan from Mi credit easily?

MI credit 2023: How to take a loan from Mi credit? Mi credit is a famous finance application that provides easy credit with minimal documents and a straightforward and hassle-free process. Mi credit offers a variety of loans. This acts as a lot of flexibility, as you can easily choose the loan and loan amount from them. Also, check PhonePe Loan and Navi app. Mi credit provides loans at a meagre interest rate and processing ... Xem chi tiết

RapidPaisa Loan App 2023: How to get an Instant Loan from an App?

RapidPaisa Loan App 2023: How to get an Instant Loan from an App? Rapidpaisa is a very easy way of getting a loan without a lot of documentation and paperwork. The process is completely online and hassle-free. Anyone eligible can take the loan without any worries. The loan is transferred within minutes into your account and there isn’t any need for income as well. In this article, we have mentioned the features, eligibility ... Xem chi tiết

Dhani Loan 2023: How to Get a Loan from Dhani App Instantly?

Dhani Loan 2023: Dhani is pretty easy and convenient to take a loan from the app. The entire process is entirely online, so it’s pretty convenient and hassle-free as well. The loan amount also ranges from thousands to lakhs according to the needs of an individual. There are plenty of loans available, and you can take any according to the situation. In this article, we will give all the details related to the Dhani App loan. ... Xem chi tiết

SBI Gold Loan: Features, Eligibility, Interest Rates, Documents

SBI Gold Loan: SBI is India’s largest lender and ranked among the leading banks in the country. It offers various loans to its customers for meeting their different financial needs. SBI has total assets of above Rs.2529394.00 Crore. SBI is the only Indian bank which is ranked under 500 list of Forbes. SBI is the most searched bank in India. With a base of 17000+ branches SBI is accessible from most of the places in ... Xem chi tiết

Business Loan 2023: Features, Eligibility, Process, Document

Business loans are a very important and popular loan in our country. Anyone with a business running for more than three years and an annual turnover of more than 50 lakhs with an annual income of 2 lakhs can apply for the business loan. It is one of the easiest ways to make your business big, without any troubles. The interest rates are also very reasonable and the tenure for the repayment of loans is also flexible which ... Xem chi tiết

SBI Personal loan: eligibility, types, interest rates, EMI Calculator

About State Bank of India: SBI is the largest lender in the country and has its headquarters in Mumbai, Maharashtra. The majority is owned by the Government of India. Consolidated report says that SBI had a total income of Rs 2,57,289.51 crore as on March 31, 2015. SBI has total assets of over Rs 25,29,394 crore. check out more details for “SBI Personal loan” There are as many as 16,995 branches of SBI in India, including 190 ... Xem chi tiết

Bình luận mới nhất