RBL Credit Card Status, Check RBL Credit Card Application Status Online. How to Apply and Check RBL Bank Credit Card Application Status Online 2023. Steps to Check RBL Bank Credit Card Status. Hello Friends In this article we provide complete details for how to check RBL Bank Credit Card via Online mode and how we can approve RBL Credit Credit Card. Now check out detailed guide for how to check RBL Bank Credit Card Status via online or using Customer Caren helpline number…

RBL Provide many type of Credit Card like – RBL Bank Coral American Express Credit Card Status, Jet Airways RBL Insignia Preferred Banking World Card Status, RBL MoneyBack Credit Card, RBL Platinum Maxima Credit Card.

Types of RBL Credit Cards

- RBL Insignia Preferred Banking World Card,

- RBL Bank Icon Credit Card

- RBL Platinum Maxima Credit Card,

- RBL Blockbuster credit card

- RBL Movies and more card

- RBL Titanium delight card

- RBL Platinum delight card

- RBL Hypercity rewards plus credit card

- RBL Crossword black credit card

- RBL Bank Platinum edge supercard Credit Card

- RBL Bank platinum prime Super Credit Card

- RBL Bank Platinum max Super Credit Card

- And Many More……

Steps to Check RBL Credit Card Status online

- Step 1 – Visit on RBL Credit Card Official Website https://www.rblbank.com/

- Step 2 – After Visit on official RBL Credit Card Website, Please click on “Credit Card” Menu

- Step 3 – Now you may reach at official RBL Credit Card Page, please scroll down this page and you may see “Track Application” Link, Please click on above link…

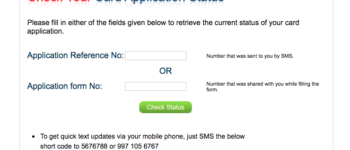

- Step 4 – Now you may reach at official tracking page, you may directly reach at this page by using following link “Click Here“

- Step 5 – Now Please Enter your Application Number, Mobile Number or Date of Birth and then click on “Track Status” Button

- Step 6 – Now you credit card status is appeared in your computer or mobile screen

Please Note – If you credit card is rejected or not approved then please don’t apply Again for RBL Credit Card till Next 6 Months

How to Approve RBL Credit Card Instantly

If you want to approve your RBL credit card instantly, then please submit following documents…

- Submit Last 2 Year ITR Copy More then Rs 2,50,000

- Provide Postpaid Mobile Bill or Landline Bill

- If you have any other bank credit card, then please provide last 3 statements of your credit card

- PAN Card Copy

- And Other ID Proof and Address Proof

Important Question’s Related to your RBL Credit Card

Q. I have applied for a RBL Credit Card – would like to know the status?

Click here to check the status of your RBL credit card application. You are required to input the Application reference number and Mobile number or Date of Birth (DDMMYYYY)

Q. I have not received my Credit Card?

Generally, your RBL Credit Card is delivered within 21 working days of submitting your application. If you have registered your mobile number with us, you will receive timely alerts informing you about the status and details of the dispatch of your RBL Credit Card.

If you have received the alert on Airway Bill number (courier reference) on your mobile number provided in Credit card application form.

You can track the status of the shipment using the Airway Bill number by visiting the courier websites.

Q. I had applied for an RBL Card 3 months back and now when I try to apply again, I am not able to do so.

In the normal course, you should be able to apply after 3 months of your previous application. There are some exceptional circumstances in which you may not be able to re-apply for longer.

Q. When is late payment charge levied?

Late Payment charges will be applicable if Minimum Amount Due is not paid by the payment due date, Clear funds need to be credited to RBL Bank Card account on or before the payment due date, to avoid Late Payment charges. Late payment charges are applicable as:

15% of Total amount due (Min Rs. 350, Max Rs. 750) (Till Oct 31st, 2015) 15% of Total amount due (Min Rs. 350, Max Rs. 1000) (W.e.f Nov 1st, 2015)

Over-limit charges*

Rs. 600

*Over-Limit Fee: Bank may approve certain transactions attempted by the Card Member which can breach the credit limit, as a service gesture. Please note that if the outstanding amount exceeds the credit limit, an over-limit fee of 2.5% of the over-limit amount (subject to a minimum of Rs 500) will be levied. Over-limit status may also happen because of fees or interest charges.

Goods and Services Tax (GST)

Effective 01 July 2017, the Goods and Services Tax (GST) will be applicable instead of Service Tax. GST may be applicable from time-to-time, presently the GST rate for banking and financial services is at 18% (applicable on all fees, interest, surcharge and other charges).

If you have any other query regarding “RBL Credit Card” then please tell us via below comment box…

Recommended Articles

Categories: Cards

Source: bank.newstars.edu.vn

Leave a Reply