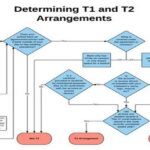

Difference Between Tier 1, Tier 2 Account in NPS 2023. Check Classification within NPS with respects to accounts and Differences between Tier I and Tier II accounts in NPS. National Pension Scheme (NPS) refers to pension scheme approved by Government. This scheme is open for Indian citizens who are between age 18 years to 60 years. NPS is mandatory for central as well as state government employees. However, the scheme is ... Xem chi tiết

Sankalp se siddhi & New India Movement: Activities, Time Bound

Sankalp se siddhi – New India Movement: Remember Mahatma Gandhi’s “Do or die” slogan? Demanding an end to British rule in India, Mahatma Gandhi on 8 August 1942 had launched a movement called “Quit India Movement”. On the occasion of remembrance and 75th Anniversary of Quit India movement, Prime Minister Narendra Modi has launched a initiative called “Sankalp Se Siddhi” calling for a New India movement from 2017 to 2022. The ... Xem chi tiết

Bank of India NEFT Form 2023, Timing, Charges, BOI NEFT Form

Bank of India NEFT Form 2023: Bank of India taken another step in providing you the facility of Online Interbank Fund Transfer through our Star Connect Internet Banking Service, on a mouse click, using RTGS/ NEFT. National Electronic Funds Transfer (NEFT On line Funds Transfer to other banks). With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. What is ... Xem chi tiết

Modified Special Incentive Package Scheme (M-SIPS) – All Details

Modified Special Incentive Package Scheme: The 3rd largest imports of our country are electronic goods. After becoming the world’s manufacturing factory, China has continued to flood the world market with its electronic goods. But the Indian electronic manufacturing sector has not taken the giant leap to meet the domestic demands. If the current state of demand & domestic supply for electronic goods continues for the next ... Xem chi tiết

Difference Between NEFT, RTGS, IMPS, UPI, USSD, Mobile Banking

Difference Between NEFT, RTGS, IMPS, UPI, USSD, Mobile Banking. Complete Details for Electronic Fund Transfer, Demonetization in India, Various Types of EFT Like – NEFT, RTGS, IMPS, UPI, USSD, Mobile Banking, Missed call service Keeping all these in mind, in a country like India, where cash to GDP ratio is 12%, a surgical attack, as the Central Government called demonetization lead to severe crisis. 85% of total money in ... Xem chi tiết

FDI Reporting under FDI Scheme on the e-Biz platform

FDI Reporting under FDI Scheme on the e-Biz platform. RBI Issued new Notification for Reporting under FDI Scheme on the e-Biz platform. Check Complete Notification from Below. If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “ Attention of Authorised Dealers Category-I (AD Category – I) banks is invited to the provisions of the ... Xem chi tiết

What is the difference between UPI and Digital Wallet?

Unified Payment Interface (UPI) transaction takes place directly from bank to bank. In contrast, digital wallets act as an intermediary between bank accounts. There are many ways of online payment and money transfer. UPI and Digital Wallet are among them. However, many people do not understand the difference between these two. Unified Payment Interface i.e. UPI where there is a means of instant money transfer between two bank ... Xem chi tiết

Padho pardesh yojana for minorities – Study abroad (Govt Yojana)

Padho pardesh yojana for minorities – Study abroad Yojana: In today’s day and age, education has become costlier. Not to blame anyone, one can attribute the causes for that to the increasingly improving facilities at the universities that involve huge costs. And the number of aspirants travelling abroad for education has been increasing year by year. Except in few European countries such as Germany, Italy and few scandanian ... Xem chi tiết

Bank fixed deposits vs post office deposits: who is better?

Bank fixed deposits vs post office time deposits, who is better in both, where should one invest. Bank Fixed Deposit In addition to bank fixed deposits, post office time deposits are also a good investment option. Bank fixed deposits vs post office time deposits Every person who is earning wants to invest a part of the savings after his / her expenses so that his / her investment is safe and also get some income from the ... Xem chi tiết

Buying or Selling Property by NRI – Relevant points with details

Buying or Selling Property by NRI, Legal aspects for NRIs selling or Buying property in India. There has been always confusion that whether Non resident Indian is eligible for buying or selling property in India by his own name. The answer to the query is definitely yes. But there are some conditions which needs to be fulfilled and exceptions are also to be taken care of. This article would cover the points regarding the ... Xem chi tiết

What is Pre shipment credit, Types of pre-shipment credit

What is Pre shipment credit – Businesses that are engaged in exporting domestically produced goods to abroad often find it difficult to get the finances required unless there are confirmed and irrevocable orders from the overseas buyers. Pre-shipment credit is one of such means that enable the exporter enjoy the financial assistance before actual disposal of consignment. Pre shipment credit: As the name suggests ‘Pre-shipment ... Xem chi tiết

Link your post office account with aadhaar – Here is Process

Link your post office account with aadhaar. Now you have to link post office accounts such as PPF, National Savings Certificates Scheme, Kisan Vikas Patra and Post Office Deposit Account till 30 September. The central government has made it necessary to provide the basis for the post office account on the lines of the bank account. If you do not do this then your post office account may be freeze. After the bank accounts, the ... Xem chi tiết

How to Link Pan Card With SBI Account – Update PAN at SBI Bank

How To Link Pan Card With SBI Account, How can we update a PAN card in State Bank of India (SBI) Online. PAN card is necessary for many financial transactions in India. Pan card is significantly important while opening a new bank account with banks. When opening a new bank account with SBI, an individual must enter the important PAN information to link it to their SBI account. However, sometimes individuals are not able to add ... Xem chi tiết

PPF Account: Benefits, Eligibility, Tax Benefits, Interest Rates

PPF Account 2021. PPF is the acronym of “Public Provident”. This was initially started by the Government to provide retirement benefits to self employed individuals and workers in the unorganized sector. As the income of people in this sector is very low and moderate ,they can’t invest some thing for their future…. So the government of India introduced this scheme so that compulsory savings obligation can be effective for ... Xem chi tiết

*99# for Mobile Banking 2023 Dial *99# for Bank Balance

*99# for Mobile Banking 2023 – Dial USSD *99# for Check Bank Balance, Mini Statement & Fund Transfer by IMPS. Unlike UPI, it does not require a smartphone and access to the internet but uses specified codes for transactions. This USSD interface (also called *99# service) was developed by NUUP (National Unified USSD Platform) to overcome the problem of poor internet connectivity in rural areas. It came up with the option of ... Xem chi tiết

8 Things You Can Do Today To Improve Your Credit Score 2023

Improve Your Credit Score: It is the statistical number that represents one’s creditworthiness. It is a measure of how well you have handled credit accounts in the past. After assessing one’s credit history by way of reviewing how he managed his past loans, credit card bills and other liabilities, credit rating agencies give a credit score that ranges from 300 to 900. A score above 750 is considered as decent enough for ... Xem chi tiết

Sovereign Gold Bond Scheme December 2021: Interest Rate

Sovereign Gold Bond 2021 – Government Announces Gold Bond Scheme: Resident entities like individuals, trusts, universities and charitable institutions are eligible to purchase gold bonds. The Government of India will be launching the Sovereign Gold Bonds Scheme soon. As investors will get returns that are linked to gold price, the scheme is expected to offer the same benefits as physical gold. They can be used as collateral ... Xem chi tiết

FAQ on Atal Pension Yojana, Queries on Atal Pension Yojana

FAQ on Atal Pension Yojana: Atal Pension Yojana is a government-backed pension scheme in India targeted at the unorganized sector. It was mentioned in the 2015 Budget speech by Finance Minister Arun Jaitley. Prime Minister Narendra Modi launched it on 9 May in Kolkata. Wikipedia. Now you can scroll down below n check more details for Queries Related to Atal Pension Yojana A Pension provides people with a monthly income when ... Xem chi tiết

Small Finance Bank (SFB) Vs Payment Banks (PB): Difference

Small Finance Bank (SFB): Basic objectives of setting up of small finance banks are : To promote financial inclusion through “(a) provision of savings vehicles, and (ii) supply of credit to small business units; small and marginal farmers; micro and small industries; and other unorganised sector entities, through high technology-low cost operations”. Small Finance Bank (SFB) SFBs can be promoted by resident ... Xem chi tiết

Incorporation of Non Corporate Entity by Foreign Entities

Incorporation of Non Corporate Entity by Foreign Entities, Formation of Non Corporate Entity, Incorporation of Non Corporate Entity includes Formation of Liaison Office/Representation Office, Incorporation of Branch Office Formation of Project Office. Foreign entity may not be keen to invest a huge amount of capital in India during its initial stage. It might simply be interested in evaluating business opportunities and ... Xem chi tiết

Digital Payment Products Offered by Banks – RTGS, IMPS, NEFT etc

The digital drive in banking transactions came to India soon after the liberalization in 1990s. Since then various technology enabled digital payment modes are being offered by the banks in India. Following are the most popular digital payment/transactions modes made available by the Indian banks. Digital Payment Products Offered by Banks Real Time Gross Settlement (RTGS): RTGS is an electronic payment system maintained by RBI ... Xem chi tiết

SHAKTI – the new Coal Linkage policy of Government of India

SHAKTI: Have you ever heard in any of PM Modi or any other politician’s speaking about the scams that were perpetrated during the UPA government? If so, you must be aware of the Coal gate scam involving the irregular allocation of coal blocks to the power companies. This scandal came into the limelight with massive coverage by main stream media after the Comptroller and Audit General of India brought it into the parliament in ... Xem chi tiết

Treasury Management: What is? Objectives Scope Functions

Treasury Management – The fundamental differences between treasury management and financial management are presented in this article. Treasury management is the creation and governance of policies and procedures that ensure the company manages financial risk successfully. Objectives of Treasury Management, Scope & Functions Treasury Management. What’s Treasury Management? Treasury management means “To plan, organize and ... Xem chi tiết

Open NPS Account, How to Open National Pension Scheme Account

Open NPS Account, How to Open National Pension Scheme Account Online, How to Open National Pension Scheme Account Online. Details for Opening NPS Account Online. As you all know that this era is also named as the “Era of Technology”, most of the procedures have been made online to assist the consumers with better availability and any time access to it. Now every person to retire in rich atmosphere, as they have been working ... Xem chi tiết

Books To Be Maintained By Banking Companies: Detailed Discussion

Books To Be Maintained By Banking Companies: In order to maintain proper records of the various transactions undertaken by a banking company, various books have been prescribed under various laws which are to be maintained by the banks. Let us have a detailed look on the same. Books To Be Maintained By Banking Companies Every Banking companies for its proper functioning needs to maintain the following books: Primary ... Xem chi tiết

Setting Up of Business in India by Foreign Companies – An Analysis

Setting Up of Business in India by Foreign Companies, Foreign investments are a very vital part of a country’s economy. Government of India has always shown keen interest in formulating the consolidated Foreign Direct Investment (FDI) Policy and other investment policies, with an intent and objective to promote foreign investment in the country, through a transparent and hassle free regulatory system. Last year, the government ... Xem chi tiết

Powers of RBI (Reserve Bank of India Powers) – An Overview

Powers of RBI: Reserve Bank derives extensive powers under RBI Act as well as Banking Regulation Act, to regulate and supervise various banks in India. An over view of important powers of RBI are given as under: Powers of RBI Under Banking Regulation Act the RBI enjoys the following powers: Section 10 BB – Power of Reserve Bank to appoint Chairman of the Board of Directors appointed on a whole-time basis or a Managing Director ... Xem chi tiết

Rashtriya Vayoshri Yojana – Objectives, Eligibility, Funding

Rashtriya Vayoshri Yojana: As we grow older and older, there will be a different set of needs that one requires and tend to be more dependent on others for support. Keeping in view of such circumstances, the governments has initiated many schemes over many years to make the lives of senior citizens better and happy. The government of the day headed by NDA has come up with a scheme called Rashtriya Vayoshri Yojana (RVY) for ... Xem chi tiết

Banking: Meaning of Banking, Origin and Definitions 2023

Banking is an integral part of the modern economy. But the nature and functions of modern banks have evolved over a long period of time. The idea of banking evolved with the idea of money. The banking business is mainly linked to lending. Moneylender is to be found in every society-ancient or modern; advanced or backward. The ten commandments of Moses, Quoran, Manusmrity, Kautilya’s Arthashastra all have references to ... Xem chi tiết

Time Deposits 2022: Types of time deposits Mode of working

Time deposits are money deposits that cannot be withdrawn for a certain term of period of time unless a penalty is paid. When the term is over it can be withdrawn or it can be held for another term. Generally, speaking, the longer the term the better the yield on the money. The rate of deposit is higher than for savings accounts because the requirement that the deposit be held for a prespecified term gives bank the ability to ... Xem chi tiết

Decision Support System (DSS) – Components, Application

Understanding The Decision Support System (DSS) With the progress made in the fields of computer sciences & information technology, the big organizations are not far away from their technical advancements. We had read about Expert Systems earlier at Expert Systems. Now, let us understand another very important Support System which are used by various MNC’s – The Decision Support System. What is Decision Support System ... Xem chi tiết

Pradhan Mantri Jan Dhan Yojana in Hindi – प्रधानमंत्री जन धन योजना

Pradhan Mantri Jan Dhan Yojana in Hindi is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner. Pradhan Mantri Account can be opened in any bank branch or Business Correspondent (Bank Mitr) outlet. Accounts opened under PMJDY are being opened with Zero balance. However, if the ... Xem chi tiết

HDFC Bank NEFT Form 2023, Timing, Charges & How to do NEFT?

HDFC Bank NEFT Form 2023: With e-Monies National Electronic Funds Transfer you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. In this article we provide complete ... Xem chi tiết

Formation of Limited Liability Partnership by Foreign Entity

Formation of Limited Liability Partnership by Foreign Entity, Incorporation of LLP By Foreign Companies in India, Limited Liability Partnership or LLP is a fairly new concept in India. An LLP is a corporate entity formed under the Limited Liability Partnership Act, 2008 and one of its important characteristics is that its partners have limited liability (unlike partnership firms registered under the Indian Partnership Act, ... Xem chi tiết

Difference between Direct Exporting and indirect exporting

Direct exportingIndirect exportingMeaning:When the export activity is directly carried out by the manufacturer of the goods, it is called as direct exporting.In indirect exporting the manufacturer hires the services of an export intermediary agency to export his goods through the intermediaries.Control: Since all the activities such as packaging, promotion, shipment and distribution are carried on own, manufacturer enjoys the ... Xem chi tiết

What is foreign institutional Investors, Who can be registered as FIIs??

My this article talks about the foreign institutional investors which are taking a large share of market in the current market scenario. Maximum number of readers do not know the meaning of the term Foreign Institutional Investor. The term means the entities or companies or any institution which are registered outside India and they want to make investments in India or make proposals for making investments in India. They make ... Xem chi tiết

Essentials of a valid Endorsement: a detailed list with explanation

The following are the essentials of valid endorsement. An endorsement on a negotiable instrument has the effect of transferring all the rights represented by the instrument to another individual. The ordinary manner in which an individual endorses a cheque is by placing his or her signature on the back of it but it is valid even if the signature is placed somewhere else, such as on a separate paper, known as an allonge which ... Xem chi tiết

Pradhan Mantri Suraksha Bima Yojana, PMSBY Yojana Details 2022

Pradhan Mantri Suraksha Bima Yojana, PMSBY Yojana Details 2022. The scheme will be a one-year cover, renewable from year to year, Accident Insurance Scheme offering accidental death and disability cover for death or disability on account of an accident. The scheme would be offered/administered through Public Sector General Insurance Companies (PSGICs) and other General Insurance companies willing to offer the product on ... Xem chi tiết

National Housing Bank (NHB) 2023: The operations of NHB

National Housing Bank (NHB): In India there was no institutional arrangement for long term financing of individuals housing for a long time. This short coming was identified by the Sub-Group on Housing Finance for the Seventh Five Year Plan (1985- 90) as a stumbling block, hindering the progress of the housing sector and recommended setting up of a nodal, national level institution. National Housing Bank (NHB) The Government ... Xem chi tiết

Bình luận mới nhất