Corporate Credit Worthiness And Credit Rating. Sitting with a mug of coffee & the topics list for the National Convention, my eyes fell on the topic ‘Corporate Credit Worthiness & Credit Rating’ & I remembered the time, when I was reading in the newspaper about how the stock markets have crashed due to the S&P rating of the Indian Economy as ‘Poor’. The thought that how can the rating by any agency could lead ... Xem chi tiết

Startup Companies in India, Ways to improve your Startup In India

Startup Companies in India – Ways to improve your Startup reputation in India, Overview of the Startup Companies in India, This article is about the recent trends seen in the markets of the India which is about the youngsters starting up their company and doing some innovative which others are not able to do. This period of India is considered to be the age of startups in which a huge amount of startups have been registered ... Xem chi tiết

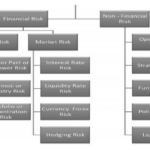

Types of Risks in Banking Sector – A Detailed Analysis

Types of Risks: Risks can be basically classified in to two types, viz. Financial and Non-Financial Risk. Financial risks would involve all those aspects which deal mainly with financial aspects of the bank. Credit Risk: A credit risk is the risk of default on a debt that may arise from inability of a borrower to make required payments as per commitments. In the first resort, the risk is that of the lender and includes lost ... Xem chi tiết

Pradhan Mantri Suraksha Bandhan Yojana 2022 – All Detailed

Pradhan Mantri Suraksha Bandhan Yojana: Keeping in view the ensuing Raksha Bandhan Festival in mind specially designed Schemes “Suraksha Bandhan” are launched. However, these products have relevance for other festivals, social occasions and family celebrations also. These schemes are as below: Jeevan Suraksha Gift Cheque- Rs.351/-Suraksha Deposit SchemeRs. 201/-Jeevan Suraksha Deposit Scheme Rs. 5001/-India being a nation of ... Xem chi tiết

Export Import Bank of India: Marketing Advisory, Export Advisory

Export Import Bank of India: Established in 1982 through an Act of Government of India viz. Export –Import Bank of India Act, 1981. It was established to make financial provisions for exporters and importers. Export-Import Bank of India is the premier export finance institution of the country. Also EXIM Bank was intended to serve as principal financial institution co-coordinating the functioning of those institutions engaged ... Xem chi tiết

Pradhan Mantri Jan Dhan Yojana 2022: Eligibility, Documents

Pradhan Mantri Jan Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance and Pension in an affordable manner. After being elected as the Prime Minister of the world’s one of the fastest growing countries Honourable Shri Narendra Modi has launched many schemes to improve the quality of living of the ... Xem chi tiết

what to do if money transferred into wrong bank account

what to do if money transferred into wrong bank account. Do not get upset about transferring money to banking / wrong bank account, bank will return money. Many times, due to hasty filling of wrong bank details, the money goes to the wrong bank account. Many people do not know what to do in such a situation and how to get this money back. Today we tell you what you should do if this happens to you. Know more about – What ... Xem chi tiết

How to get loan against PPF: Eligibility, Amount of loan, ROI

How to get loan against PPF – Public Provident fund is not just a good social security scheme but it also provides many other benefits in the form of deduction while computing the total taxable income and earns a good amount of interest at no risk. Apart from these benefits it also provides a facility to avail a loan against it. in this article, we provide complete details for How to get a loan against PPF like – Eligibility ... Xem chi tiết

Features of Bank 2023: Characteristics of a Bank (history)

Characteristics / Features of Bank : If you walk on the streets of any town or city, you could notice signboards on buildings with names – State Bank of India, Punjab National Bank, ICICI Bank, IDBI, City Union Bank, etc. What are these names? Have you tried ever to know about them? Have you entered those buildings? If you go inside these buildings, you can find an office layout wherein a lot of desks (counters) with names ... Xem chi tiết

Post Office Saving Account: Benefits & Rate of Interest 2022

Post Office Saving Account – Benefits and Rate of Interest. Check Rate of Interest of “Post Office Saving Account“. In this article we provide complete details for Post Office Saving Account Scheme like – Benefits of Post Office Saving Account, Rate of Interest in Post Office Saving Account Scheme. Account can be opened by cash onlyMinimum balance to be maintained in a non-Cheque facility account is INR 50/-Cheque facility ... Xem chi tiết

What should you choose for your startup – LLP or Pvt Ltd ?

What should you choose for your startup – LLP or Pvt Ltd Company ?. Nowadays the trend of registering a startup and making operational is very high. Youngsters and Teenagers are increasingly participating in the scheme of the Government of India, called “Startup India”, but it is very much crucial for the person to select which kind of institution it should select, should he select Company form or Proprietorship concern or ... Xem chi tiết

Statutory Liquidity Ratio (SLR): All you need to know about

Statutory Liquidity Ratio (SLR): In terms of section 24 (2A) of Banking Regulation Act, another tool for controlling credit in the country is available to RBI in the form of Statutory Liquidity Ratio under which, Liquid assets (in the form of prescribed securities by RBI) have to be maintained by all scheduled banks in India. Statutory Liquidity Ratio (SLR) is the Indian government term for the reserve requirement that the ... Xem chi tiết

What is FDI, Benefits & Importance of Foreign direct investment

What is FDI and its Benefits. In this article you can find everything you want to know about FDI like – Meaning if FDI, Fdi In India, Importance of FDI, Creates employment, Brings the expertise, Access to funds across the globe. Recently we provide complete details for FDI – Reporting under FDI Scheme on the e-Biz platform. Now you can scroll down below and check complete details for “What is FDI and its Benefits” If you like ... Xem chi tiết

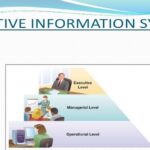

Executive Information System: Components, Advantages

Executive Information System: EIS is an information system based on computer which generally serves the information needs of the top level management of an organization. Check Complete details for EIS System like – What is Executive Information System?, Components of Executive Information System, Advantages of Executive Information System, Application of Executive Information System etc. Now scroll down below n check more ... Xem chi tiết

Formation of Foreign Institutional Investor by Foreign Entity

Foreign Institutional Investor, Incorporation of Foreign Institutional Investor in India. A Foreign Institutional Investor (FII) means an entity established outside India and which proposes to make investment in India in securities. Foreign entities, willing to invest in India as FIIs, should first register themselves with the Securities and Exchange Board of India (SEBI). A wide range of foreign entities are allowed to ... Xem chi tiết

ICICI Bank NEFT Form 2023, Timing, Charges, How to do NEFT?

ICICI Bank NEFT Form: With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. What is NEFT? National Electronic Funds Transfer (NEFT) is a nationwide payment system facilitating one-to-one funds transfer. Under this Scheme, individuals can ... Xem chi tiết

EPF Universal account number: What is UAN?, How to get UAN No

EPF Universal account number: What is UAN?, Advantages, How to get UAN Number?, All About on Universal Account Number (UAN) for Provident Fund Before Introduction of UAN every PF member used to spend a lot of time to comply the administrative procedures and rules to transfer his PF from old employer to new employer in the times of switching over to new jobs from existing one. But with introduction of UAN Government (In fact ... Xem chi tiết

How is Credit Rating Done?: Ways to Calculate Credit Score

How is Credit Rating Done?, To understand how is Credit Rating done, we first need to understand what exactly credit rating is! Credit Rating is a rating (a grade, marks, rank or in any other form) an indicator of how credit worthy a person or an enterprise is. You must have seen that all the Banks before sanctioning loans, usually get the credit capacity & credit history of the prospecting borrowers checked. For these ... Xem chi tiết

Startup India: Standup India 2022: All you need to Know About

Startup India – Standup India 2022: Complete Details, India being called as the worlds one of the fastest-growing economies is going through a perfect time for transforming the ideas of potential entrepreneurs into successful business ventures. Having an abundant market to reach India has the fastest emerging startup ecosystem in the world. To boost the idea of the setting new startups and creating immense employment ... Xem chi tiết

Educational loans – Eligibility, Required documents, Interest Rates

No deserving students should be stopped to pursue their dreams due to lack of money. One who has the desire to study should not be away from the studies just merely because of lack of financial support. In India day by day education is becoming costlier. There are number of students who depends on educational loan for their higher studies and study in abroad. The sole objective of educational loan is to give the financial ... Xem chi tiết

Stock audit of bank borrowers: Procedure, Documents Required

Stock audit of bank borrowers: Working capital finance in the form of cash credit/overdraft facility against the security of hypothecation of stock and debtors is one of the most common modes of finance frequently adopted by various bankers. The borrowers in such cases are expected to submit the details of stock and debtors every month on the basis of which Drawing Power after reducing the prescribed margin is calculated by ... Xem chi tiết

Employee Pension Scheme: Basic Details, Eligibility, Features

EPS Scheme: Employee Pension Scheme: After providing basic details for Employee Provident Fund, Here we are providing complete details for Employee Pension Scheme. In this article you can find everything you want to know about Employee Pension Scheme like – Details for Employee’s Pension Scheme 1995, Rules for Eligible employees, No contribution on above 15000 – for new members, Pensionable salary for pension calculation, Main ... Xem chi tiết

BOI loan against property: eligibility, types, interest rates, how to apply

BOI loan against property: Bank of India offers Loan Against Property starting at interest rate of 10.50% which is one of the best mortgage loan rates in India. Current 1 Year MCLR benchmark rate is 8.30%. BOI commits to nation-building is complete & comprehensive. Bank of India is actively involved since the year 1973 in non-profit activity called Community Services Banking. All the BOI branches and administrative offices ... Xem chi tiết

Mobile Banking: Advantages & Disadvantages of Mobile Banking

Mobile banking is a system that allows customers of a financial institution to conduct a number of financial transactions through a mobile device such as a mobile phone or personal digital assistant. Mobile banking differs from mobile payments, which involve the use of a mobile device to pay for goods or services either at the point of sale or remotely, analogously to the use of a debit or credit card to effect an EFTPOS ... Xem chi tiết

New Deduction 80C Sukanya Samriddhi Savings Account 2022

New Deduction 80C Sukanya Samriddhi Savings Account, Scheme is meant for long-term savings for Girl Children to meet out their Education and Marriage expenses. Sukanya Samriddhi Savings Account (Sukanya Samridhi Yojna) launched by Govt recently has received very good response as PM Mr. Narendra Modi gave personal attention to this scheme as a part of ‘Beti Bachao Beti Padhao’ campaign. Now you can scroll down below n check ... Xem chi tiết

Xpress credit personal loans by SBI – Loan amount, Term, Interest

Xpress credit personal loans by SBI: With the growing demand for personal loans, different banks have come up with various personal loan schemes to lure the customers. One such is State Bank of India’s Xpress credit personal loans. In this post we enumerate the complete features of SBI’s most popular personal loan. Under Xpress credit scheme, loans are provided by SBI to employees of below mentioned entities having salary ... Xem chi tiết

Brief History of Banking in India, History of Banks in India

Brief History of Banking in India, History of Banks in India. The Indian Banking Starts from Bank of Hindustan Established in 1770 and it was first bank at Calcutta under European management. It was liquidated in 1830-32. Here we are sharing Some most important points related to “History of Banking in India”. Evolution of banking in India started From Bank of Hindustan in 1770, and this evolution can be divided into three ... Xem chi tiết

Kisan Vikas Patras: Introduction, Benefits, Interest Rates, Types

Kisan Vikas Patras: Introduction, Benefits, Interest Rates, Various Types. Kisan Vikas Patra is a saving scheme that was announced by the Government of India. Under this scheme it doubles the money invested in eight years and seven months. There are many such post office schemes in which good returns are being received by the customers. KVP is also a popular post office office. It is giving 7.7 percent interest in the present. ... Xem chi tiết

EWS and LIG Scheme – PMAY Home Loan Subsidy Scheme 2020

EWS and LIG Scheme : Pradhan Mantri Awas Yojana – Urban (PMAY-U) home loan subsidy scheme 2019 for EWS and LIG under CLSS, know the subsidy amount, interest rates & how to apply for PMAY Yojana. EWS / LIG / MIG / HIG, Affordable Housing Scheme 2020 “Pradhan Mantri Awas Yojana (Urban) – Housing for All” Mission for urban area is being implemented during 2015-2022 and this Mission will provide central assistance to ... Xem chi tiết

Difference Between Commercial Bank and Central Bank 2023

A commercial bank is a financial intermediary. It accepts the deposits from the surplus units and lends these financial resources to the deficit units. Commercial Banks play a very prominent role in the financial system of an economy. Now Check out Commercial Bank Vs Central Bank. Functions of a Commercial Bank Modern commercial banks perform a variety of functions and provide a number of services to their customers. They are ... Xem chi tiết

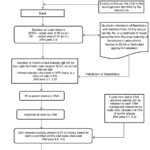

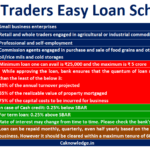

SBI Traders Easy Loan Scheme – Eligibility, Mortgage, loan Amount

SBI Traders Easy Loan Scheme: Getting a bank loan sanctioned for a business is very big deal. With the increasing bad debts, even the banks are left with no alternatives except tighten the credit sanction process. However, there are certain schemes especially designed to cater the financial needs of certain group of audience. State Bank of India (SBI)’s SBI Traders Easy Loan Scheme is one of such schemes. It was launched by ... Xem chi tiết

What is credit worthiness? & how to check the creditworthiness

What is credit worthiness? & how to check the creditworthiness, after providing detailed analysis for “Corporate Credit Worthiness And Credit Rating”. Now here we are providing complete details for credit worthiness like – Things to be considered to check the creditworthiness of an entity, How to improve credit worthiness, Repayment History, Credit Score, Capacity, Assets/Collateral security, Existing Credit relations, ... Xem chi tiết

Investment into India by Non Resident Indians on Non Repatriation Basis

Investment into India by Non Resident Indians on Non Repatriation Basis: Significant amendments have been legislated over the past couple of years under the exchange control regulations and FDI Policy for amending the definition of NRIs and for clarifying that investments made by NRIs on non-repatriation basis shall be treated at par with domestic investments. The purpose of this article is to summarise the amendments and ... Xem chi tiết

List of 5 best banks for personal loans in India with all details

Find out the 5 best banks for personal loans in India 2021: Personal loans are the most popular choices to meet a variety of financial needs varying from person to person. As the time goes, banks and financial institutions are coming with newer ways to lure the customers by offering attractive options ranging from low interest rates to waiver of processing charges etc. So, with the too much information available right there, ... Xem chi tiết

Letter of Credit: Importance, Types of LC, Parties: Detailed

A Letter of Credit is issued by a bank at the request of its customer (importer) in favour of the beneficiary (exporter). It is an undertaking / commitment by the bank, advising/informing the beneficiary that the documents under a LC would be honoured, if the beneficiary (exporter) submits all the required documents as per the terms and conditions of the LC. Importance of letter of credit in trade activities The trade can be ... Xem chi tiết

GDP of India 2022 with comparison of other countries, How to Calculate

GDP of India: India becomes the 6th largest economy in the world, climbing two places to overtake Britain and France. GDP, i.e., the Gross Domestic Product – means the total sum of goods and services in the country, which can be counted in money, which is a special period mainly for one year. This is an important micro economic scale which is a symbol of the economy and efficiency (effect). This is because GDP is associated ... Xem chi tiết

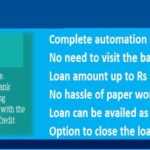

Federal bank digital personal loan (Fed-e-credit) – All Details

Federal bank’s digital personal loan (Fed-e-credit): Personal loans have become the most sought after by salaried employees to meet un-anticipated financial needs. No requirement for collateral and flexibility of usage has drawn the attention of many customers to the same. However, the paper work is viewed as a cumbersome step while availing the personal loan. Federal bank, a well-known private sector bank is offering a ... Xem chi tiết

Bank Reconciliation Statement (BRS) – when to prepare a BRS?

Bank Reconciliation Statement (BRS) –To reconcile means to reason or find out the difference between two and eliminating that difference. Whenever we deposit or withdraws money from banks, it is always recorded at two places:- Bank column of the cash book; and Bank statement (pass book) The cash book is maintained by the person having the bank account whereas the bank statement is prepared by the bank. Therefore, the balance ... Xem chi tiết

Axis Bank Sukanya Samriddhi Account 2023: How to Open Account

Axis Bank Sukanya Samriddhi Account 2023: Axis Bank is the third largest private sector bank in India. Sukanya Samriddhi Account is a Government of India backed saving scheme targeted at the parents of girl children. The scheme encourages parents to build a fund for the future education and marriage expenses for their female child. The bank offers financial services to customers from large and mid-sized corporates, MSME, ... Xem chi tiết

Bình luận mới nhất