CashParty loan app 2021: Features, Eligibility, Documents Required. There are a lot of features available in the CashParty app. You can enjoy various features and services from the CashParty app, making the entire experience very good. You can take an instant loan without having to worry about any paperwork and documentation. As the whole process is entirely online, you can start and end the process at your home without taking ... Xem chi tiết

Core Banking Systems with Analysis and Key modules of CBS

Core Banking Systems (CBS) refers to a standard IT solution wherein a central shared database supports the whole banking application. The characteristics of CBS are: There is a standard database during a central server located at a knowledge Center, which provides a consolidated view of the bank’s operations.. Branches function as delivery channels providing services to its customers. CBS is centralized Banking Application ... Xem chi tiết

Invest through direct shares or equity mutual funds? 2023

Invest through direct shares or equity mutual funds? Know what is the benefit deal for you. Usually, you can start investing in mutual funds from Rs 500. But there are also some companies that offer the facility to start investing from Rs 100. ‘Profit is the reward of risk’. This statement of Prof. Holley fits the business world to the investment market. Talking about investing in the stock market, if you are knowledgeable ... Xem chi tiết

SBI Business Loan: interest rates, features, advantages, charges

SBI Business Loan: To meet its financial requirements every business at some point of time has to look for external sources. To offer new product lines and services or enter new geographical areas which include managing daily operations, purchase assets like land, machinery or even technological investments, expand business these are some of the common reasons behind seeking external funding. There are primarily two ways of ... Xem chi tiết

Difference Between ADR and GDR (With Comparison Chart)

ADR and GDR Complete Guide. Guide for ADR (American Depository Receipts) and GDR Global Depository Receipts. Check ADR And GDR Complete Details From Below. In This article you can find difference between ADR and GDR. Recently we also provide Accounting Standard 3, Cash Flow Statement Full Guide And What’s the Difference Between FDI and FII?. Now you can scroll down below and check complete details regarding “ADR and GDR ... Xem chi tiết

Full service brokers Versus Discount brokers Which one to choose?

Full service brokers Versus Discount brokers: While making any buy or sell decisions in the stock market, one thing that we all worry about is brokerage costs. Any transaction in the stock market involves brokerage costs as brokers are the ones who act as the bridge between the retail investors and the stock market. Currently, there are 2 types of brokerage models in India that are distinctly different in terms of the services ... Xem chi tiết

What is pledge? – Bailment, Possession with Examples 2023

What is pledge? – a bailment of a chattel as security for a debt or other obligation without involving transfer of title. How to use pledge in a sentence. Find Everything you want to know about Pledge?, what is a bailment?, points to be considered to decide whether a bailment is pledge or not, Examples, Possession etc. we also discuss about hypothecation in our next Article and also discuss for “what is the difference between ... Xem chi tiết

HDFC Life Super Income Plan: Plan, Eligibility, Tax Benefits 2023

HDFC Life Super Income Plan is a participating plan that offers guaranteed income for a period of 8 to 15 years. It also offers an opportunity to participate in the profits of participating fund of the company by way of bonuses. The plan is ideal for individuals who need regular income at their disposal so that they don’t have to worry about future expenses and fulfil their financial goals uninterrupted. Min- Max Entry Age ... Xem chi tiết

MoneyEnjoy 2022: How to get a Personal loan from the app?

MoneyEnjoy Loan App 2022: MoneyEnjoy is an online application which is focused on providing easy loan to everyone without asking a lot of questions to them, about their income, salary, employment, etc. This is a newly launched application and it’s still now available on Google play store or any other official app store. Though you can download the MoneyEnjoy app online. In this article, we have given all the details related to ... Xem chi tiết

Banking Terminology with Explanation for Govt Exams (IBPS, SSC)

Banking Terminology: Before sharing this month article I hope that you and your family members are safe.There are number of opportunities in banking sector and many more need to happens yet. Basis on this theme, I am just sharing with you frequently used banking terminology to our readers, Because I believe that if we want to enter in this sector we must know the terms used in banking sector. Banking Terminology I hope that ... Xem chi tiết

What should be taken: Life Insurance or PPF ?? (with all details)

Life Insurance or PPF 2023: this article talks about the Similarities, Benefits, Differences in the Money to be given or invested for Life Insurance and PPF. This topic has been very much hit in the individuals that what should be taken and which would give high returns with additional benefits. So I had written this article for those who are confusion for what to do. After reading the full article, you would be crystal clear ... Xem chi tiết

Kredivo loan app 2022: How to take Loan from this app?

Kredivo loan app 2022: Kredivo app is one of the very best applications which provides one of the personal loans of all. Its service is phenomenal and the application is also very reliable and secure. The app is authentic and it is also authorised by RBI. let’s know everything about the Kredivo app through this article. Also, check out PhonePe Loan. The Kredivo app provides loans from 1,000 to 10,000 without any paperwork, as ... Xem chi tiết

NEFT (National Electronic Fund Transfer) : Coverage, Advantages

NEFT: With the availability of integrated technology consisting of computers and communication facilities, distances no longer remain a constraint in providing better customer service and expediting the funds transfer mechanism. EFT facilitates quick movement of funds through electronic media. EFT mechanism involving inter-bank funds settlement at the national level has come up only recently as an aftermath of the ... Xem chi tiết

Sagar mala programme of India: National Perspective Plan

Sagar mala programme: Lying in the middle of Indian Ocean, India is endowed with rich maritime advantages such as 7500 km coastline covering 13 states and union territories which is at a strategic location of many international trade routes such as Malacca strait etc. It is reported that maritime logistics has been a very important component of Indian economy accounting for 90% of Export & Import trade by volume & 72% ... Xem chi tiết

Buddy Loan 2022: How to get a Loan from Buddy loan?

Buddy Loan 2022: How to get a Buddy loan? Buddy is a very famous and successful online loan providing platform through which you can easily take a variety of loans and that too, without any paperwork and documentation. As the entire process is online, it makes it very easy and hassles free. You can take various loans like personal loans, business loans, home loans, education loans, and many more. You can take a maximum of 15 ... Xem chi tiết

National Pension Scheme: Eligibility Contribution Maturity

National Pension Scheme: Eligibility, Contribution, Tax Benefit, Maturity. Everything you want to know about National Pension Scheme. Here we are providing complete details for National Pension Scheme. Find full details for National Pension Scheme like About this Scheme, Eligibility Minimum contribution, etc. After Providing Complete details for Sukanya Samridhi Yojana now we provide National Pension Scheme The Government of ... Xem chi tiết

FairMoney App 2022: How to get a loan from FairMoney app?

FairMoney App 2022: How to get a loan from the app? With the help of the FairMoney app, you can take a personal loan very quickly and without any hassle. Anyone who possesses all the required and essential documents and is eligible for it can easily take the loan within minutes. You can get a maximum of 50,000 loans at a time, whereas the minimum amount is 750 INR. The FairMoney App provides excellent flexibility to all the ... Xem chi tiết

Important information regarding AnyDesk app frauds – Do’s & Don’ts

Beware Of The AnyDesk App: Important information regarding AnyDesk app frauds: Safeguard yourself against fraudulent access to your Mobile Phone. One of the recent techniques involves a fraudster taking unauthorized access of a victim’s mobile device to carry out fraudulent transactions via UPI using the AnyDesk App. This is how they do it with AnyDesk app: You may receive a phone call from a fraudster, who will claim to be a ... Xem chi tiết

Kreditzy loan App 2022: Features, Eligibility, Documents

Kreditzy loan app 2022: Kreditzy loan app is a very successful platform that provides straightforward and convenient personal loans to every individual in India eligible for it. You can take a loan amount ranging from 1,000 to 1,00,000 within minutes, and the entire process is entirely online. Also, the service of the application is phenomenal, and you can be completely rest assured. Kreditzy app provides a service 24*7 ... Xem chi tiết

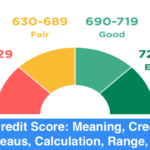

Credit Score: Meaning, Credit Bureaus, Calculation, Range

Credit Score: Lenders receive multiple loan applications daily. So it becomes necessary that credits are disbursed to individuals with good credit worthiness. The question arises how to evaluate credit worthiness? Credit worthiness is evaluated by Credit Bureaus by awarding credit score to an individual after considering various factors. The system has helped to improve the functionality and stability of the Indian financial ... Xem chi tiết

Pradhan Mantri Jeevan Jyoti Bima Yojana: Eligibility, Period

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a term insurance plan. If a person dies after investing in Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), then his family gets Rs 2 lakh. – PMJJBY is an Insurance Scheme offering life insurance cover for death due to any reason. It is a one year cover, renewable from year to year. Dena bank has tie-up with LIC for this scheme. The scheme will be a one year cover Term Life ... Xem chi tiết

FlexPay App 2022: How to get a loan from FlexPay App?

FlexPay App 2022: How to get a loan from Flex Pay? FlexPay app is one of the most successful payments and loan providing online platforms, which more than millions of Indians trust. The app is accessible from anywhere around the country, and you can take easy loans and credit from the app. You can also use the app for UPI payments. The credit which it gives every month to its customers can be used to pay for anything. In ... Xem chi tiết

HDFC Bank RTGS Form 2023 Timing, Charges & How to do RTGS?

HDFC Bank RTGS 2023: The RTGS system is primarily meant for large-value transactions. The minimum amount to be remitted through RTGS is Rs 2 lakh. The maximum limit is Rs 10 lakh per day. RTGS (Real Time Gross Settlement) is the fastest possible money transfer system through the banking channel. Because settlements are made in real-time, transactions are not subject to any waiting periods… Now check out more details for HDFC ... Xem chi tiết

Bharat Mala Project: Objectives, Coverage, Components, Funding

Bharat Mala Project: Government of India headed by Prime Minister Narendra Modi has launched many initiatives to boost the infrastructure development in the country which is an inevitable sector on which the industrial growth of any economy is premised. China is what it is today because of its multi faceted leap taken to modernize the infrastructure in the industrial cities such as Shenzhen etc. “American roads are not good ... Xem chi tiết

Cashe app 2022: Features, Eligibility, Documents Required

Cashe app 2022: Features, Eligibility, Documents Required. With the help of the CASHe app, you can now have access to a variety of loans within minutes directly from the comfort of your home. As CASHe has introduced a variety of loans that can be accessed directly from the app, you can download the application either from the app store or from any other third party site. The interest rate for loans offered by CASHe is meagre, ... Xem chi tiết

Endorsements 2023: Meaning and Parties of Endorsement

The word ‘endorsement’ in its literal sense means, a writing on the back of an instrument. But under the negotiable instruments act it means, the writing of one’s name on the back of the instrument or any paper attached to it with the intention of transferring the rights therein. Thus endorsement is signing a negotiable instrument for the purpose of negotiation. The person who effects an endorsements is called an ‘endorser’ ... Xem chi tiết

Pradhan Mantri Ujjwala Yojana: Eligibility, Application Form

Pradhan Mantri Ujjwala Yojana – Procedure for Applying Pradhan Mantri Ujjwala Yojana . In rural India still there is a larger section of the household using conventional sources of fuel for cooking. Some of them are dried cow dung and firewood. Due to the smoke generated during the cooking the health of the people in these areas is damaged very rapidly. There has been a survey saying “more than 5 lakhs people die each year” as ... Xem chi tiết

Rufilo Loan app 2022: Features, Eligibility, Documents

Rufilo Loan app 2022: Features, Eligibility, Documents Required. Rufilo has been a sensation since its inception in the online lending platform. It provides one of the most accessible and convenient loans to every individual in India who is eligible for it. You can take a maximum of 25,000 instant loans within five minutes. There are also plenty of other features available like; you can get a list of gift cards and various ... Xem chi tiết

Canara Bank RTGS Form 2023: About, Rules, Timing, Charges

Canara Bank RTGS: The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is Rs 2 lakh. Canara Bank RTGS Form, Rules, Timing, Charges & How to do RTGS?: With Real Time Gross Settlement (RTGS) you can transfer funds to any bank across India in real time. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. Canara ... Xem chi tiết

Best Investments Plans In India: PPF, LIC, Mutual Funds 2023

Best Investment Plans 2023, Best Investments Plans In India – PPF, LIC, Mutual Funds, Term Deposit with Banks 2023, Check Top Investment Plans in India For 2023. We all wish to go for investments which give us safe returns, are less risky, have our desired maturity periods & it will be a cherry on the cake if these investments also get us deductions from tax liability. Here we discuss many Investment Plans available in ... Xem chi tiết

List of Restrictions on Loans Issued By all Bank (A Detailed list)

List of Restrictions on Loans Issued By all Bank, Check Various Restrictions On Loans Issued by RBI. Banking means accepting deposits from the public for the purpose of lending or investment and is repayable on demand. A Banking Organization is the one which is engaged in banking activities in India. Merely accepting deposits for the purpose of the business shall not be regarded as a banking activity. Every bank exists for the ... Xem chi tiết

ICICI Bank RTGS Form 2023, Timing, Charges & How to do RTGS?

ICICI Bank RTGS 2023: The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is Rs 2 lakh. The maximum limit is Rs 10 lakh per day. ICICI Bank RTGS Form, Rules, Timing, Charges & How to do RTGS?: ICAI RTGS form rules timing charges. With Real Time Gross Settlement (RTGS) you can transfer funds to any bank across India in real time. With this service your transactions ... Xem chi tiết

Seed Funding Assistance, SEED Capital, Importance – Detailed

Seed Funding Assistance: Now a days there are many people coming with innovative business ideas that are having the viability of turning them into a successful business. But the only thing that stands as an obstacle to them is scarcity of funds. Seed funding is a boon to these people who are extremely desirous to establish their own startup. Here I’m going to discuss a few lines about seed capital assistance. If you like this ... Xem chi tiết

MyMoney Mantra 2022: How to get a loan from the MyMoney app?

MyMoney Mantra 2022: How to get a loan from the MyMoney app? MyMoney Mantra loan app is a very famous and successful NBFC platform that provides hassle-free and convenient methods for loans, which you must have. If you ever need money in life, you can rely on the My Money app to fulfil all your dreams. With the MyMoney Mantra app, you can take various loans like personal loans, business loans, and many more. You can also take ... Xem chi tiết

What is capital account convertibility – Advantages & Drawbacks

Capital account convertibility (CAC) means freedom to convert currency, both in terms of outflows and inflows, for capital transactions. Find out complete details regarding capital account convertibility, Full capital account convertibility. After Providing What is current account convertibility and its Advantages, If you like this article then please like us on Facebook so that you can get our updates in future ……….and ... Xem chi tiết

Moats and Floats: Investment lessons from Warren Buffet’s letters

Moats and Floats – Investment lessons from Warren Buffet’s letters. Moats: For those who are familiar with the letters that Billionaire investor writes to his company’s shareholders, the concept of moat is known as the competitive advantage enjoyed by a business entity over its rivals in the same industry. For example, if CoCo Cola has certain competitive advantages over its rival PepsiCo then these advantages can be termed as ... Xem chi tiết

SBI Two Wheeler Loan 2022: Interest Rates, Eligibility

SBI Two Wheeler Loan: In India, two-wheelers are more than just a commuting choice; they are in many cases a necessity. Especially due to poor and mostly overcrowded public transport in most major cities, owning a two-wheeler has become a necessity for Indians. State Bank of India’s 2 wheeler loan is designed to help individuals all over India purchase a new motorcycle or scooter of their choice with minimum hassle. Apart from ... Xem chi tiết

Tips to Make your banking transactions safe, secure credentials

Tips to Make your banking transactions safe, Tips for safe online and mobile banking transactions. Internet banking has really been a genie for the people due to its fast and convenient approach for any transaction. Now you have every bank transaction on your fingertips with luxury of sitting at any corner of the world and getting the work done in real-time.But as we know every coin has two sides, internet banking has its ... Xem chi tiết

Reverse Mortgage: Features, Meaning, Eligibility, Taxation

Reverse Mortgage : Soon after retirement one may have to think about the available resources to lead his rest of the life. Those having good amount of retirement benefits and a financial supporter don’t need to worry too much at this point of their time. There are many plans offered by various banking institutions to fund the needs of this kind. One of those plans is reverse mortgage. Living in a house owned by you rather in a ... Xem chi tiết

Bình luận mới nhất