UCO Bank NEFT Form 2020, Rules, Timing, Charges & How to do NEFT?: National Electronic Funds Transfer. With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. In this article we provide complete details for UCO Bank NEFT like – How to send ... Xem chi tiết

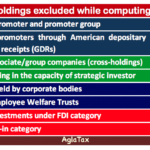

What is Investible Weight Factors (IWF)? with Example & signifies?

Investible Weight Factors (IWFs): Investible weight factor is the unit that shows how much portion of a company’s total shares is available to the investors for trading freely on the stock exchange. It is mainly used in computing the market capitalization of a company under free float methodology. While computing IWF, stocks held by the entities having strategic interest in a company are eliminated from the total number of ... Xem chi tiết

Union Bank of India NEFT Form, Timing, Charges & How to do NEFT?

Union Bank of India NEFT Form: With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. What is NEFT? National Electronic Funds Transfer (NEFT) NEFT is electronic funds transfer system, which facilitates transfer of funds to other bank accounts in ... Xem chi tiết

Pradhan Mantri Krishi Sinchai Yojana, all you need to know about PMKSY

Pradhan Mantri Krishi Sinchai Yojana (PMKSY): Have ever pondered yourself on a question “which sector in India is generating most employment?” Few may wonder to know that it is the agriculture sector that generates more employment opportunities by contributing to the country’s workforce by more than 50%. Agriculture is considered to be the backbone of Indian economy. People’s president APJ Abdul Kalam in his vision 2020 has ... Xem chi tiết

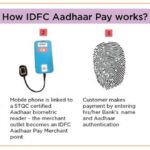

Aadhar Payment App 2020, BHIM Aadhaar Payment App, android APK

BHIM Aadhaar Payment App Platform: PM Narendra Modi’s Launched BHIM Aadhaar platform App on 14th April, Check how Aadhar Payment app works: Prime Minister Narendra Modi launched BHIM Aadhaar Pay app on today, Aadhar Payment apk is a biometric based payment system that will make paying with the help of thumb impression a reality, in Nagpur today. The BHIM Aadhaar pay app is developed only for merchants and makes use of two ... Xem chi tiết

NIFTY Sectoral indices & How are they calculates?, Selection criteria

What is NIFTY Sectoral index?: Index that is constructed by the stocks that are selected and grouped together on the basis of the industry the companies belong to is a Sectoral index. NIFTY sectoral index is calculated by grouping the stocks listed on National Stock Exchange (NSE). These are computed based on free-float market capitalization method in which the market value of the share is multiplied by the number of shares ... Xem chi tiết

Andhra Bank NEFT Form 2020: Timing, Charges & How to do NEFT?

Andhra Bank NEFT Form 2020: National Electronic Funds Transfer (NEFT Online Funds Transfer to other banks) Called AB Xpress. With National Electronic Funds Transfer you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. What is NEFT? National Electronic Funds Transfer (NEFT) is a funds transfer ... Xem chi tiết

National Apprenticeship Promotion Scheme: Objectives, Eligibility

National Apprenticeship Promotion Scheme: One of the biggest problems our country has been facing is the growing unemployment along with the growing graduates every year. Unfortunately, mere college education is not giving them the skills required to enter the job market. And there have been many programmes that the government of the day initiated to train the youth to make them ready for the industry. “National Apprenticeship ... Xem chi tiết

United Bank of India NEFT 2020: Timing, Charges, How to do NEFT

United Bank of India NEFT Form 2020: National Electronic Funds Transfer. With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. What is NEFT? National Electronic Funds Transfer (NEFT) is a nation-wide system that facilitates individuals, firms and ... Xem chi tiết

State Bank of India Fleet Finance Scheme, SBI Fleet Finance Scheme

State Bank of India Fleet Finance Scheme: State bank of India has been providing various loan services specially designed for Small and Medium Enterprises (SME). One of such products offered by India’s largest bank is SBI Fleet Finance Scheme, which is aimed at providing loan for transport operators owing fleet of commercial vehicles like trucks, trailers, tankers and buses. check more details for SBI Fleet Finance Scheme from ... Xem chi tiết

SBBJ Balance Enquiry Number 2020, SBBJ Balance Check Number 2020

SBBJ Balance Enquiry Number 2020, SBBJ Balance Check Number 2020, SBBJ Toll Free Number – check out latest guide for how to check SBBJ Balance online. SBBJ Bank Account Balance Enquiry Number, SBBJ Balance Enquiry Toll Free Number. Check SBBJ account Balance by Miss Call. SBBJ Official Missed call balance enquiry number. SBBJ Miss Call Number for balance Check, Check SBBJ Bank Balance. State bank of Bikaner and Jaipur Balance ... Xem chi tiết

Nai Udaan scheme – Free coaching to minorities 2020 (All Details)

Nai Udaan scheme – Free coaching to minorities 2020: There have been many schemes implemented by the government of India for the improving the lives of the minority communities. One of such schemes is a ‘free coaching scheme for minority students’ which essentially focuses on providing free coaching services to the students belonging to the recognized minority communities. This scheme is run by ministry of minority affairs, ... Xem chi tiết

RTGS Charges 2020, RTGS Timing, What is RTGS, RTGS Full Form

RTGS Charges 2020: Real-time gross settlement systems. Every banking company is adapting itself to E- Commerce needs of online banking. It’s easier, convenient and time saving also. RTGS is one of such online banking transfer methods. Let’s understand what it is and also discuss relevant details. Now check more details for “RTGS Charges, RTGS Timing, What is RTGS, RTGS Full Form” from below….. RTGS Charges, RTGS Timing, What ... Xem chi tiết

Reasons for Fluctuations in Gross Profit Ratio, Fluctuations GP Ratio

Reasons for Fluctuations in Gross Profit Ratio, Fluctuations GP Ratio: In the preparation and finalization of Financial Statements, GP analysis plays a very important role. Here, we will analyze the reasons for fluctuations and how to observe them. Before we proceed further, let us understand the basic meaning of the term. now check more details for “Reasons for Fluctuations in Gross Profit Ratio” from below… Gross profit ... Xem chi tiết

Verification of Advances with Special Reference to IRAC Norms

Verification of Advances with Special Reference to IRAC Norms (Income Recognition and Asset Classification). Following is the Addendum to the article published about verification of advances with special reference to Income Recognition and Asset Classification (IRAC) Norms in February 2018 issue of The Chartered Accountant journal. The RBI has issued a circular dated February 07, 2018 granting relief for MSME Borrowers ... Xem chi tiết

KVP, PPF, NSC Which is best? Comparison Chart with interest rates

KVP, PPF, NSC Which is best? Comparison Chart. Check Comparison Chart – KVP, NSC and PPF. Check Compression between KYP, NSC and PPF. There are so many options available for investment. Don’t get confused though. This article will spill out the options, their benefits and drawbacks. So read more on KVP, PPF, NSC Which is best? from below… The Below mentioned points have been explained in detail below: KVP (kisan Vikas ... Xem chi tiết

Banking in India – A Complete list of all Banks – Govt & Private

All Banks List 2020, Banking in India: Banking in India in the modern sense originated in the last decades of the 18th century. The first banks were Bank of Hindustan (1770-1829) and The General Bank of India, established 1786 and since defunct. Now you can scroll down below and check complete details regarding “Banking in India – A comprehensive list of all Banks” Banking in India – A comprehensive list of all Banks The ... Xem chi tiết

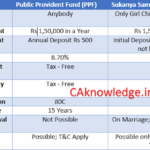

Sukanya Samridhi Yojana vs PPF – Eligibility, Maturity, Interest

Sukanya Samridhi Yojana vs PPF. Here we provide Difference Between Sukanya Samridhi Yojana vs PPF. find our complete information regarding Sukanya Samridhi Yojana vs PPF. Find full details of Sukanya Samridhi Yojana and PPF (Public Provident Fund) Account like Eligibility, Location of opening the account etc. now you can scroll down below and check difference between Sukanya Samridhi Yojana vs PPF. Sukanya Samriddhi yojana ... Xem chi tiết

Vidyanjali – A School Volunteer Programme: What is?, Eligibility

Vidyanjali: Being the 2nd most populated country, India is also the home for more number of school going children. And the school dropouts due to lack of financial resources has been increasing at an alarming rate. And the government schools are continuously failing to retain the students either because the students switch over to private & corporate schools or the children are forced to work to support their family. ... Xem chi tiết

Digital empowerment in India challenges and opportunities

Digital empowerment in India challenges and opportunities, The digital wave in India is poised to create great strides in the functioning of the government and delivery of its services to citizens, helping transform the life experiences of 1.2 billion Indians and drive the India growth story. The road to digital empowerment in India has thrown up some great challenges and opportunities. Digital empowerment in India challenges ... Xem chi tiết

Stages in the Evolution of Banking in India, Banking Evolution

Stages in the Evolution of Banking in India: Modern banking as evolved in England was introduced by the British during their rule in India. Naturally, today’s Indian banking is similar to British banking. However, it does not mean that banking was unknown to India. The essence of banking is lending for productive purposes. In fact, India was a major partner in international trading and was a big producer of steel, cloth, ... Xem chi tiết

Major initiatives of Ease of doing businesses in India – Detailed

Major initiatives of Ease of doing businesses in India. Find Complete details for Ease of doing business in India. My this article is about the automation which has been acquired by the new government and the new initiative for the better India. This initiative has been highly been encouraged as our PM is also fond of all the processes to be automated and the process from obtaining the license to the liquidation of the same ... Xem chi tiết

Vijaya Bank NEFT Form 2021: Timing, Charges & How to do NEFT?

Vijaya Bank NEFT Form 2021, Rules, Timing, Charges & How to do NEFT?: National Electronic Funds Transfer (NEFT On line Funds Transfer to other banks). With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. In this article we provide complete ... Xem chi tiết

Masala Bonds – Meaning and Background (All you need to know)

Masala Bonds : Meaning of Masala Bonds and Background of Masala Bonds.Masala bond was the first Indian bond to get listed in London Stock Exchange. IFC named it Masala bonds to give a local flavour by calling to mind Indian culture. In this article you can find complete details about Masala Bonds like – Meaning of Masala Bonds, Background of Masala Bonds etc. Recently we also provide details about “Masala Bonds – Quick Facts, ... Xem chi tiết

Features of E-banking: Benefits and Disadvantages of eBanking

Features of E-banking: E–banking is a product designed for the purposes of online banking that enables you to have easy and safe access to your bank account. E-banking or Online banking is a generic term for the delivery of banking services and products through the electronic channels such as the telephone, the internet, the cell phone etc. Features of E-banking 1) Transactional : a) Electronic Bill Presentment and Payment ... Xem chi tiết

Sukanya Samriddhi Yojana in Hindi: सुकन्या समृद्धि योजना इन हिंदी

Sukanya Samriddhi Yojana in Hindi: हम जानते है की हमारे देश में बेटियों के क्या हालात है| बेटियों के हालात में सुधार लाने के लिए Sukanya Samriddhi Yojana को प्रस्तुत किया था| Sukanya Samriddhi Scheme Details में जानकारी आपको इस आर्टिकल में प्राप्त होगी| Sukanya Samriddhi Account के बारे में और अधिक जानकारी प्राप्त करे और Sukanya Samriddhi Yojana Calculator से बेटियों को कितनी अमाउंट प्राप्त होगी उस बारे में जाने| इस अकाउंट में ... Xem chi tiết

NEFT Charges 2021, NEFT Timing, What is NEFT, NEFT Full Form

NEFT Charges: NEFT refers to National Electronic Fund Transfer. The account holders can transfer funds from one bank branch to another or to another bank account. With a click of your fingertips, now you can access your bank statement or pay your mobile bill, and can even recharge your DTH (Direct To Home) connection. This is possible due to online banking facility offered by the core banking system. Online banking includes ... Xem chi tiết

Masala Bonds – Quick Facts, Positive Side & Apprehensions

Masala Bonds: find complete details about Masala Bonds like – Difference between ECB and Masala Bonds, Quick Facts about Masala Bonds, Positive side of Masala Bonds, Apprehensions about Masala Bonds etc. Now check more details about “Masala Bonds – Quick Facts, Positive Side & Apprehensions” from below….. ECBs refer to commercial loans in the form of bank loans, securitized instruments, buyers’ credit, suppliers’ credit ... Xem chi tiết

All About Black Money Bill 2015 and Imposition of Tax Rules, 2015

All About Black Money Bill 2015: Black Money and Imposition of Tax Rules, 2015 notified.. Recently Lok Sabha is Passed Black Money Bill 2015. Here we are providing Complete details for Black Money Bill 2015 in Very Simple Manner. In this article you can find complete details about Black Money Bill 2015 like Applicability date of black money bill 2015, Tax Rate etc. Now you can scroll down below and check complete details ... Xem chi tiết

23 most common Investments and how they are taxed? – Detailed

23 most common Investments and how they are taxed?:Most forms of tax saving investments options work under the parameters of section 80C of the Income Tax Act. Here are the best investment options and plans in India for 2020 with safe investments & higher returns with Tax information. Interest earned in saving bank account up to Rs 10,000 is exempted from tax u/s 80TTA. Any interest more than Rs 10,000 is added to your ... Xem chi tiết

NEFT FAQ’s, NEFT Frequently Asked Questions, All Details for NEFT

NEFT FAQ’s, NEFT Frequently Asked Questions: National Electronic Funds Transfer is a nation-wide payment system facilitating one-to-one funds transfer. Under this Scheme, individuals, firms and corporates can electronically transfer funds from any bank branch to any individual, firm or corporate having an account with any other bank branch in the country participating in the Scheme. Q.2. Are all bank branches in the country ... Xem chi tiết

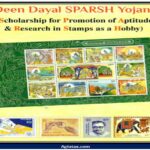

Deen Dayal SPARSH: What is SPARSH?, Objective, Eligibility

Deen Dayal SPARSH (Scholarship for Promotion of Aptitude & Research in Stamps as a Hobby): Do you know what philately is? Not many have heard the term philately which means collection, appreciation and research activities on postal stamps. Are you one among those few in school who show extreme interest in collection and study of postal stamps? Then you must know about a new scheme called Deen Dayal SPARSH (Scholarship for ... Xem chi tiết

Banks will be closed for 13 days in March 2021, Holiday Lis

The month of March is about to begin. Banks will remain closed in most parts of the country, on the fifth day of this month i.e. March 5th. Actually, due to Bakrid on this day, there will be no work in banks. The Reserve Bank of India (RBI) has released a calendar, according to which banking operations will be closed for a few days in March. These include 5 days off. Speaking of the entire month, banks will remain closed for a ... Xem chi tiết

Tax Free Bonds – Purpose, Benefits, Interest, Eligibility, Risk

Tax free bonds are highly popular investment option among investors due to the taxation benefit that they offer. Know more about Tax Free Bonds in India. 1.How to Invest in Tax Free Bonds? 2. Who can Invest? 3. Comparison with Tax Saving Bonds. These bonds, generally issued by Government backed entities, are exempt from taxation on the interest income received from such instruments under the Income Tax Act, 1961. The income by ... Xem chi tiết

SBI Merger Queries & Answers for SBH, SBP, SBM, SBT, SBBJ Customers

SBI Merger Queries & Answers: State bank of India merged 5 associate banks on 1st April 2017. and now all users of these associate banks are merged with SBI, all the customers who have net banking in associates banks can login net banking at SBI net banking site and manage there accounts easily. SBI Merger Queries & Answers for SBH, SBP, SBM, SBT, SBBJ Customers. Merger of Associate Banks with SBI Probable ... Xem chi tiết

How & Where to get loans under Pradhan Mantri MUDRA Yojana (PMMY)

How & Where to get loans under Pradhan Mantri MUDRA Yojana (PMMY): Mudra loan under PMMY is available at all bank branches across the country. Mudra loan is also issued by NBFCs / MFIs who are engaged in Financing for micro enterprises in small business activities. MUDRA loans are extended by banks, NBFCs, MFIs and other eligible Financial intermediaries as no ed by MUDRA Ltd. The Pradhan Mantri MUDRA Yojana (PMMY) ... Xem chi tiết

Best Credit card for Online Shopping with Cash back Benefits

Best Credit card for Online Shopping with Cash back Benefits, The availability of cheap credit and internet has led to an increase in demand of credit cards. With the increase in number of shopping portals. Credit Card companies and banks have also increased the number of services they are willing to offer to attract customers. Also the ease to do online transaction has become better. Credit card were traditionally providing ... Xem chi tiết

Govt Issues Sovereign Gold Bond Scheme May 2021: Detailed

Govt Issues Sovereign Gold Bond Scheme May 2021: Govt of India, in consultation with the Reserve Bank of India, has decided to issue Sovereign Gold Bonds. This series of sovereign gold bonds are opening from 24th May 2021 and you will be able to invest in it till 28th May 2021. This is the last series of the current financial year. The most important thing is that this time the price of Sovereign Gold Bond is the lowest in 10 ... Xem chi tiết

RTGS: Charges, Timing, Transfer Limit, Benefits | RTGS System |

RTGS: The real time gross settlement solution is a milestone in the history of Indian payment system. It is the key critical element. It provides the missing link in the process of the setting up of the Integrated payment and settlement system in the country. Now a days, it is the preferred mode of the settlement of large value interbank payments in the world over. As a settlement process, RTGS minimises settlement risks by ... Xem chi tiết

Bình luận mới nhất