Understanding The Process of Debt Securitization, Debt Securitization is a very important topic that is easy to understand but many students generally skip this topic by presuming that it is difficult. As per the oxford advanced learner dictionary, the meaning of the word debt is “a sum of money that somebody owes”, “a situation of owing money, especially when you cannot pay.” Now check more details about “Understanding The ... Xem chi tiết

Money

Various types of endorsement, There are seven kinds of endorsement

There are seven kinds of endorsement. types of endorsement: Endorsement is nothing but a part of negotiation. Negotiation is the transfer of an instrument by one party to another so as to constitute the transferee a holder of that instrument. A bearer instrument can be transferred by mere delivery but an order instrument can be transferred by endorsement. Endorsement in Blank : Where an endorsement on a bill of exchange ... Xem chi tiết

Cash Reserve Ratio (CRR): Everything you want to know about

Cash Reserve Ratio (CRR): Everything you want to know about Categories: Banking Source: bank.newstars.edu.vn ... Xem chi tiết

How to Get the Best Deal on a Personal Loan App?

At some point, almost everyone needs a loan according to their requirement, purpose, and immediacy. Most individuals with a critical financial condition find an online loan app the most dependable funding source. By downloading a simple app on your mobile phone, you can apply for a Personal Loan in minutes and get disbursal directly into your bank account. Whether you need funds for a medical emergency, wedding, education, ... Xem chi tiết

The Benefits of SIP for Long-Term Wealth Creation

Welcome, fellow investors! We all work hard, save diligently, and dream of a financially secure future. But here’s a secret: simply stashing away your savings in a traditional bank account might not be the best strategy. If you’re looking to grow your wealth over the long term, it’s time to explore the secret sauce called Systematic Investment Plan (SIP) that has been helping millions of Indians achieve their financial goals ... Xem chi tiết

Bank Stock Audit 2023: Sharing experiences & thoughts

Bank Stock Audit: Stock Audits are important from our profession point of view, as it gives us recognition in banking field & opens door for lot of opportunities in the Banking sector. As a Cost Accountants, we can bring our techno-commercial knowledge & experience in field restricting NPAs in the banking sector by early detection of problems in the industries. Bank Stock Audit As a stock Auditor what bank expects from ... Xem chi tiết

Real Estate Bill, 2015 – Amendments in Real Estate Bill, 2013

Real Estate Bill, 2015 – Amendments in Real Estate Bill, 2013, The real estate sector has always been in talks and in media because of its pricing going up and down day by day. The Real Estate Bill, 2013 had been brought in by the UPA government but due to some loopholes in the bill, it was a very liberal bill which allowed the builders to escape from the wrong happenings. So the NDA government amended the bill by taking the ... Xem chi tiết

Types of Hundi: Shah Jog Jokhmi Jawabee Nam jog Darshani

Types of Hundi, When we sit to study the Negotiable Instruments Act, we need to understand what is a hundi and the various types of hundi. In Layman’s language, the term “hundi” includes all negotiable instruments whether they are bills of exchange or promissory notes. An instrument in order to be a hundi must be capable of being sued by the holder in his own name, and it can be transferred like cash that is, by delivery. Now ... Xem chi tiết

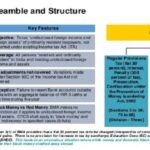

10 Main features of Black Money Act, 2015 (Key Highlights)

10 Main features of Black Money Act, 2015. Key Highlights of The Black Money Act 2015, Check Salient Features Of Black Money Bill, Highlights of the Black Money Bill, Features of the Black Money Bill 2015. 10 Main Features of Black Money and Imposition of Tax Act, 2015. This article is basically talking about the features and consequences for undisclosed incomes and the undisclosed foreign incomes and the assets which are ... Xem chi tiết

Canara Bank NEFT Form 2023, Timing, Charges, How to do NEFT

Canara Bank NEFT Form 2023: Inter Bank Transfer enables electronic transfer of funds from the account of the remitter in one Bank to the account of the beneficiary maintained with any other Bank branch. With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further ... Xem chi tiết

Shopping is no longer tension free, Income tax inspector came into life

Now your shopping is no longer tension free. The central government is tracking your life style from your big transactions. That is, the income tax inspector’s roll in your life has increased. Prime Minister Narendra Modi has made many such decisions on the policy front, including from the previous Diwali to the Diwali until the ban on currency, which has completely changed the way you spend your money. Now whenever you go to ... Xem chi tiết

SIM Swap Fraud, how to prevent sim swap fraud 2023 Detailed

All you have to know about SIM Swap Fraud, What is Mobile Phone SIM Swap fraud and how to protect your Bank Account?, Now a days Mobile has become an interface to communicate with the world. No matter where you are you can use it for almost all the needs of your daily routine. With the increasing opportunity to avail the services of banks on mobile every one started using the banking services in their phone. This scenario has ... Xem chi tiết

These are the India’s richest Jewellers, know how much wealth

These are the India’s richest Jewellers, know how much wealth. Most customers buy festive time in gold, silver and diamond. This is considered to be the best time for the Festive Time Jewellers business. But do you know who is the richest jeweler in the country? We are telling you about the country’s five richest Jewellers … Rank -1Net worth – about 8,407 crores Kalyan Jewellers Managing Director TS Kalyanmaran is the richest ... Xem chi tiết

Important Items of Bank Balance Sheet – A Detailed Analysis

Banks balance sheets contain certain unusual items when compared to others. We shall have an over view of the same. Know more about Important Items of Banks Balance Sheets from below. Liabilities Side of Bank Balance Sheet Share Capital: Consist of Authorised, Issued, Subscribed and Paid-up share capital are shown separately. Under the head, Paid-up Capital, calls in arrears are reduced and forfeited share amount is ... Xem chi tiết

Withdraw PF Online if you Have Aadhaar and UAN – Check All Steps

Withdraw PF Online if you Have Aadhaar and UAN. 4 Cr Active Members will benefit by using this new facility. Now you can withdraw money from your provident fund online. You do not need to take a round of your company for this. The Employees Provident Fund Organization (EPFO) has started the facility of filing online claims for extracting PF and getting advance. It will benefit about four crore active members of the EPFO. ... Xem chi tiết

Importance of Technology of Banking : (All you need to know)

Importance of Technology of Banking: Many of the IT initiatives of banks started in the late 1990s, or early 2000, with an emphasis on the adoption of core banking solutions (CBS), automation of branches and centralisation of operations in the CBS. Over the last decade, most of the banks completed the transformation to technology-driven organisations. Moving from a manual, scale-constrained environment to a global presence ... Xem chi tiết

Real Estate Regulation and Development Act 2016, RERA All Details

Real Estate Regulation and Development Act 2016, RERA Act. The Real Estate Regulation and Development Act 2016, herein after called as “RERA”, which got the assent of the president on 25th March 2016 and published in the Gazette of India on 26th March 2016, which is set to come into effect from May , 2017, this year, has a surfeit of advantages that shall help the home buyers in various ways. RERA has taken into consideration ... Xem chi tiết

Payment banks: Meaning, Moto, Features, Eligibility, Investment

Payment banks – Meaning, Main Moto, Features, Eligibility. Payment banks are the banks set up in accordance with the related regulations issued by the supreme monetary regulatory authority Reserve Bank of India. To say in simple lines payment banks will perform the activities they are allowed to do and they are different from the normal banks. read more on payment banks from below… They do the following : Acceptance of ... Xem chi tiết

Know how much per person income in 1947, how much income today

Know per capita income of India: 68 years have been completed of the country from Independence. In these years, India has become the world’s third largest economy. Rapid economic progress has also had a direct effect on people’s income. At the time of independence in 1947, where per capita income was only 249.6 rupees annually. There has been an increase in the record by 200 per cent. By 2015, this has increased to Rs 88,533 ... Xem chi tiết

Bad Bank: why is it being described as good for banks? (Detailed)

Bad Bank: The name of this bank is ‘Bad’, so why is it being described as good for banks?. The Indian Banks Association (IBA), an institution of banks, proposed to the Finance Ministry and the Reserve Bank of India on May 12 that a bad bank be set up in the country. Bad bank can become a relief for the banks of India, ie it can be a very good step for our economy and banking system. Indian Bank Association has demanded the ... Xem chi tiết

Payment Gateways: Benefits, Process, How payment gateways work?

Payment Gateways: Must Adopt Tool for Every Business. The Internet has massive potential and can provide endless opportunities, payment gateways is the poster child of such opportunities. Customers can now pay for services in matter of minutes. One-click and the payment is made. With large number of business going online and doing business payment gateways have become massive and are enormously providing payment solutions to ... Xem chi tiết

What is “Taboola” and how it emerged as market leader?

What is “Taboola” and how it emerged as market leader?, This article is on the internet industry leader Taboola, which is an online website which provides the traffic to the websites in exchange of some fees. The detailed explanation of the website is given here. Taboola is a platform where the content writers or the creator of the content which offers them the external links to the articles or the blogs written by them and ... Xem chi tiết

Effects of Endorsement: Meaning, Effect of a Forged Endorsement

Meaning of Endorsement : Section 50 of the Negotiable Instrument Act deals with effects of endorsement. The endorsement of a negotiable instrument followed by delivery transfers to the endorsee, the property therein with the right of further negotiation. The endorsement may be, by express words, restrict or exclude such right, or may merely constitute the endorsee, an agent to endorse the instrument, or to receive its contents ... Xem chi tiết

An introduction to Social Impact Bonds | How does it work |

Social Impact Bonds : The launch of the Sustainable Development Goals (SDGs) by the United Nations in 2016 has brought the world together in a mission to end poverty, fight inequality, and tackle climate change. Meanwhile, a bond market aimed at financing projects with social issues has emerged and deepened, supported by a growing number of investors who have begun to embed ESG (Environmental, Social, and Governance) standards ... Xem chi tiết

Indian Banking System: Brief over View of The Start of RBI

Indian Banking System: India has one of the largest and a Biggest Banking system in the world which forms the backbone of its economy, where the old and the new banks coexist in new service of the nation, having evolved over a period of more than two centuries. Banks is the back bone of a country financial system. Modern Banking system in India is more than two centuries old. The Indian banking system consists of various ... Xem chi tiết

Dividends – Meaning of Dividend and Various Types of Dividend

Dividends – The term dividend is used to indicate that a part of the profits of a company, which is to be distributed amongst its shareholders. It may, therefore, be defined as the return that shareholders will get from the company, out of its profits, on his shareholdings. If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely ... Xem chi tiết

Small Finance Banks: Establishment, List of Banks, Features

Small Finance Banks: These banks also have been established with an aim of financial inclusion “to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganised sector entities.” These banks were expected to provide an institutional mechanism for promoting rural and semi urban savings and extending credit for viable economic ... Xem chi tiết

Import Export Code (IEC) in India: How to Apply?, Documents

Import Export Code (IEC): Nowadays the trend for the import and export of goods have been very much encouraging sectors that youngsters are going to that sector as a career and earning huge incomes. The Import Export Code is a 10 digit code which is issued by the Director General of Foreign Trade which is under the Ministry of Commerce, Government of India. This article would clarify all the details about how to apply and how ... Xem chi tiết

Need of Technology of Banking (All you know about)

Need of Technology of Banking: Technology has brought about a complete paradigm shift in the functioning of banks and delivery of banking services. Gone are the days when every banking transaction required a visit to the bank branch. Today, most of the transactions can be done from the comforts of one’s home and customers need not visit the bank branch for anything. Technology is no longer an enabler, but a business ... Xem chi tiết

Flipkart Seller Registration – How to register as Seller on Flipkart?

Flipkart Seller Registration: Flipkart offers a marvellous internet-based business platform for all businesses to rapidly establish a pan-India reach. How to sell your products on Flipkart, With the rapidly increasing smartphone availability and internet technologies world has become a tiny village in the hands of individuals. E-Commerce has got a prominent place in today’s market. With a view to reaching millions of ... Xem chi tiết

Electronic Fund Transfer (EFT): Rules, Transactions, Procedures

Electronic funds transfer or EFT refers to the computer based systems used to perform financial transactions electronically. This term is used for a number of different concepts: Cardholder initiated transactions, where a cardholder makes use of a payment card. Electronic payments by business, including salary payments. Electronic check (for cheque) clearing. Electronic fund transfer provides for electronic payments and ... Xem chi tiết

Primary Functions of Money: Medium of Exchange, Measure of Value

Primary Functions of Money: The main functions performed by money are called primary or original function. Since the entire financial structure revolves around banks and financial institutions it becomes significant to deliberate upon the role and functions of central and commercial banks. The primary functions of money are as follows: The fundamental role of money in an economic system is to serve as a medium of exchange ... Xem chi tiết

Functions of Bank: Primary Functions, Secondary Functions of Bank

Functions of Bank: In bank jobs interviews normally questions are asked about various functions of banks. So today I am listing down all the important functions of a bank.The functions of a bank can be summarised as follows : Functions of Bank Banks operate by borrowing funds-usually by accepting deposits or by borrowing in the money markets. Banks borrow from individuals, businesses, financial institutions, and governments ... Xem chi tiết

Commercial Bank: Meaning and Functions of Commercial Banks

Commercial Bank: A commercial bank is a financial institution authorized to provide a variety of financial services, including consumer and business loans, savings accounts etc. Earlier commercial banks were limited to accepting deposits of money or valuables for safekeeping and verifying coinage or exchanging one jurisdiction’s coins for another’s. By the 17th century, most of the essentials of modern banking, including ... Xem chi tiết

Contingent Functions of Money, Various Functions of Money

Contingent Functions of Money: Money is an important and indispensable element of modern civilization. In ordinary usage, what we use to pay for things is called money. To a layman, thus, in India, the rupee is the money, in England the pound is the money while in America the dollar is the money. But to an economist, these represent merely different units of money. check out Contingent Functions of Money. Prof. Kinley has ... Xem chi tiết

What is Merchant Banking | types, classification | functions

Merchant Banking: The term ‘Merchant banker’ was used in relation to a wealthy merchant, who developed the banking side of one’s business, in England. In India, merchant banking definition is framed in SEBI rules 1992. It defines merchant banker as “ any person who is engaged in the business of issue management either by making arrangement regarding selling, buying or subscribing to securities as manager, consultant, advisor ... Xem chi tiết

Why can’t a country print more currency to become rich? 2023

Why can’t a country print more currency to become rich?, It’s an interesting question to answer “why can’t a country print the currency as much as needed to become rich ?”. Check details for Why can’t a country print money and get rich?. People having no idea about this scenario may often think that instead of worrying about the falling rupee value and market conditions why the reserve Bank of India don’t think of printing the ... Xem chi tiết

Free Full credit report | How to check free annual credit report

How to get your Free Credit Score & Annual Credit Report online? | CIBIL Score 2023. Imagine yourself as a bank or any lending institution and keep disbursing the loans to your customers belonging to different walks of life. As you keep giving the loans/credit to your customer base, you would at one point realize how necessary it is to assess the credibility/merit of a customer to discharge the loan before sanctioning the ... Xem chi tiết

Money Savings Tips – How to Save Money while Shopping Online

Money Savings Tips – Save Money while Shopping Online. Top money savings tips for online shopping, The Start-Up ecosystem in India has boomed beautifully in ten years. This has led to the emergence of many start-ups, mostly in the form of E-Commerce. The E-Commerce market in India is worth 30 Billion Dollar. According to industry reports more than hundred e-commerce companies operating in this segment. This has led to ... Xem chi tiết

Bình luận mới nhất