SBI Secure OTP App Queries & Solutions, State Bank Secure OTP App – FAQ. “State Bank Secure OTP App” is an OTP generation App for Internet Banking transactions (INB) done through Onlinesbi and State Bank Anywhere App which can be downloaded from Google Playstore. URL is Click here SBI Secure OTP App Queries & Solutions 1. Who can use the application? Any internet banking user can use the application for generating OTP ... Xem chi tiết

Money

Aadhar Payment System, Aadhaar Enabled Payment System (AEPS)

Aadhar Payment System, Aadhaar Enabled Payment System (AEPS). The new payment service offered by the National Payments Corporation of India to banks, financial institutions using ‘Aadhaar’, the Unique Identification Authority of India (UIDAI) issued unique identification number shall be known as ‘Aadhaar Enabled Payment System’ and shall be referred to as “AEPS” hereinafter. Aadhar Payment System, Aadhaar Enabled Payment ... Xem chi tiết

Net Banking 2022: Introduction, Meaning & Advantages

Net Banking: The internet banking has changed the banking industry. It has major effects on banking relationships. According to the Internet researcher Morgan Stanley, the web is more important for retail financial services than for many other industries. Internet banking involves use of Internet for delivery of banking products and services. Must Read Meaning of Net Banking Net banking (or Internet banking or E-banking) ... Xem chi tiết

FASTag Recharge By BHIM App, By Any UPI App: Here is Process

FASTag recharge can also be done on the go, customers get this facility. The National Payments Corporation of India has provided customers the option to recharge NETC Fastag with Bhim UPI. What is FASTag FASTag is a device that employs Radio Frequency Identification (RFID) technology for making toll payments directly while the vehicle is in motion. FASTag (RFID Tag) is affixed on the windscreen of the vehicle and enables a ... Xem chi tiết

What are the methods of exporting?, Check Merits and De-merits

What are the methods of exporting? Merits and De-merits of direct exporting and indirect exporting. With the adaptation of globalization and the advancement of technology, world is shrinking day by day. World has become a global village unlike never before in the history. This has paved the way for the businesses to reach out to the world market by exporting their products across the globe. What China has achieved through its ... Xem chi tiết

ICICI Smart Vault Techno: Modern Banking, Smart Vault Features

ICICI Smart Vault Techno: ICICI bank under the “Make in India” initiative has launched a first of its kind, automated, state of the art digital locker to enrich customer experience. The bank call the locker “Smart Vault”. Smart Vault will offer digital locker facility to its customers even on weekends and after banking hours. However, ‘Smart Vault’ charges will be higher than manual lockers and would differ at places due to ... Xem chi tiết

SBI UPI App 2022, BHIM SBI Pay From Play Store: Direct Link

SBI UPI App 2022 – BHIM SBI Pay: UPI, Recharges, Bill Payments, Food. ‘BHIM SBI Pay’ (UPI App of SBI) is a most innovative payment app that allows any Banks’ customer to send or receive money to/from any other Banks customer using a single app & also allows to pay for services like recharge, food orders, bill payments & local deals. You need not worry which Bank you have your account with. Just download “BHIM SBI Pay” ... Xem chi tiết

What is CIBIL score, how banks decide whether you will get a loan or not?

Sometimes the bank refuses to give loans or credit cards even to those people who have a thick salary or good business. Then when the bank is asked the reason, the answer is that your Cibill Score is not good or is negative. Actually, in this world of digital transactions, facilities are now available online. All the transactions that you do with the bank are seen while taking the loan. Often, the bank offers the loan to the ... Xem chi tiết

Yes Bank NEFT Form 2023, Timing, Charges & How to do NEFT?

Yes Bank NEFT Form: National Electronic Funds Transfer. With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before… Now check more details for Yes Bank NEFT From below. What is NEFT? National Electronic Funds Transfer (NEFT) is a facility that allows you ... Xem chi tiết

Bank of Baroda NEFT Form 2023: Timing, Charges, Process

Bank of Baroda NEFT Form: Bank of Baroda brings to you “Online NEFT / RTGS” funds transfer, an initiative that extends convenience and comfort to your net banking experience. National Electronic Funds Transfer. With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach ... Xem chi tiết

Prospect and Challenges of Payment Bank in India – Detailed

Prospect and Challenges of Payment Bank in India, After Providing Detailed analysis for Payment Banks in India, Now here we discuss details for Prospect and Challenges of Payment Bank in India, The demographic pattern of India and its changing profile offer a host of opportunities for the PB aspirants. These are as follows: Prospect and Challenges of Payment Bank in India According to KPMG, about 40 – 50 percent of India’s 1.2 ... Xem chi tiết

Checklist for Statutory Audit of Banks – Complete list

Checklist for Statutory Audit of Banks, Complete Check List for Doing Audit of Banks. Download Checklist For Bank Audits. Use this check list for Doing Statutory Audit of Banks. Now scroll down below n check the complete list of “Checklist for Statutory Audit of Banks” Checklist for Statutory Audit of Banks Call for the following information / records / details / evidences for the purposes of Statutory audit of Bank : Closing ... Xem chi tiết

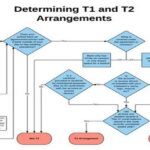

Difference Between Tier 1, Tier 2 Account in NPS – (Detailed)

Difference Between Tier 1, Tier 2 Account in NPS 2023. Check Classification within NPS with respects to accounts and Differences between Tier I and Tier II accounts in NPS. National Pension Scheme (NPS) refers to pension scheme approved by Government. This scheme is open for Indian citizens who are between age 18 years to 60 years. NPS is mandatory for central as well as state government employees. However, the scheme is ... Xem chi tiết

Bank of India NEFT Form 2023, Timing, Charges, BOI NEFT Form

Bank of India NEFT Form 2023: Bank of India taken another step in providing you the facility of Online Interbank Fund Transfer through our Star Connect Internet Banking Service, on a mouse click, using RTGS/ NEFT. National Electronic Funds Transfer (NEFT On line Funds Transfer to other banks). With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. What is ... Xem chi tiết

Difference Between NEFT, RTGS, IMPS, UPI, USSD, Mobile Banking

Difference Between NEFT, RTGS, IMPS, UPI, USSD, Mobile Banking. Complete Details for Electronic Fund Transfer, Demonetization in India, Various Types of EFT Like – NEFT, RTGS, IMPS, UPI, USSD, Mobile Banking, Missed call service Keeping all these in mind, in a country like India, where cash to GDP ratio is 12%, a surgical attack, as the Central Government called demonetization lead to severe crisis. 85% of total money in ... Xem chi tiết

What is the difference between UPI and Digital Wallet?

Unified Payment Interface (UPI) transaction takes place directly from bank to bank. In contrast, digital wallets act as an intermediary between bank accounts. There are many ways of online payment and money transfer. UPI and Digital Wallet are among them. However, many people do not understand the difference between these two. Unified Payment Interface i.e. UPI where there is a means of instant money transfer between two bank ... Xem chi tiết

Bank fixed deposits vs post office deposits: who is better?

Bank fixed deposits vs post office time deposits, who is better in both, where should one invest. Bank Fixed Deposit In addition to bank fixed deposits, post office time deposits are also a good investment option. Bank fixed deposits vs post office time deposits Every person who is earning wants to invest a part of the savings after his / her expenses so that his / her investment is safe and also get some income from the ... Xem chi tiết

What is Pre shipment credit, Types of pre-shipment credit

What is Pre shipment credit – Businesses that are engaged in exporting domestically produced goods to abroad often find it difficult to get the finances required unless there are confirmed and irrevocable orders from the overseas buyers. Pre-shipment credit is one of such means that enable the exporter enjoy the financial assistance before actual disposal of consignment. Pre shipment credit: As the name suggests ‘Pre-shipment ... Xem chi tiết

How to Link Pan Card With SBI Account – Update PAN at SBI Bank

How To Link Pan Card With SBI Account, How can we update a PAN card in State Bank of India (SBI) Online. PAN card is necessary for many financial transactions in India. Pan card is significantly important while opening a new bank account with banks. When opening a new bank account with SBI, an individual must enter the important PAN information to link it to their SBI account. However, sometimes individuals are not able to add ... Xem chi tiết

*99# for Mobile Banking 2023 Dial *99# for Bank Balance

*99# for Mobile Banking 2023 – Dial USSD *99# for Check Bank Balance, Mini Statement & Fund Transfer by IMPS. Unlike UPI, it does not require a smartphone and access to the internet but uses specified codes for transactions. This USSD interface (also called *99# service) was developed by NUUP (National Unified USSD Platform) to overcome the problem of poor internet connectivity in rural areas. It came up with the option of ... Xem chi tiết

8 Things You Can Do Today To Improve Your Credit Score 2023

Improve Your Credit Score: It is the statistical number that represents one’s creditworthiness. It is a measure of how well you have handled credit accounts in the past. After assessing one’s credit history by way of reviewing how he managed his past loans, credit card bills and other liabilities, credit rating agencies give a credit score that ranges from 300 to 900. A score above 750 is considered as decent enough for ... Xem chi tiết

Small Finance Bank (SFB) Vs Payment Banks (PB): Difference

Small Finance Bank (SFB): Basic objectives of setting up of small finance banks are : To promote financial inclusion through “(a) provision of savings vehicles, and (ii) supply of credit to small business units; small and marginal farmers; micro and small industries; and other unorganised sector entities, through high technology-low cost operations”. Small Finance Bank (SFB) SFBs can be promoted by resident ... Xem chi tiết

Digital Payment Products Offered by Banks – RTGS, IMPS, NEFT etc

The digital drive in banking transactions came to India soon after the liberalization in 1990s. Since then various technology enabled digital payment modes are being offered by the banks in India. Following are the most popular digital payment/transactions modes made available by the Indian banks. Digital Payment Products Offered by Banks Real Time Gross Settlement (RTGS): RTGS is an electronic payment system maintained by RBI ... Xem chi tiết

Treasury Management: What is? Objectives Scope Functions

Treasury Management – The fundamental differences between treasury management and financial management are presented in this article. Treasury management is the creation and governance of policies and procedures that ensure the company manages financial risk successfully. Objectives of Treasury Management, Scope & Functions Treasury Management. What’s Treasury Management? Treasury management means “To plan, organize and ... Xem chi tiết

Books To Be Maintained By Banking Companies: Detailed Discussion

Books To Be Maintained By Banking Companies: In order to maintain proper records of the various transactions undertaken by a banking company, various books have been prescribed under various laws which are to be maintained by the banks. Let us have a detailed look on the same. Books To Be Maintained By Banking Companies Every Banking companies for its proper functioning needs to maintain the following books: Primary ... Xem chi tiết

Powers of RBI (Reserve Bank of India Powers) – An Overview

Powers of RBI: Reserve Bank derives extensive powers under RBI Act as well as Banking Regulation Act, to regulate and supervise various banks in India. An over view of important powers of RBI are given as under: Powers of RBI Under Banking Regulation Act the RBI enjoys the following powers: Section 10 BB – Power of Reserve Bank to appoint Chairman of the Board of Directors appointed on a whole-time basis or a Managing Director ... Xem chi tiết

Banking: Meaning of Banking, Origin and Definitions 2023

Banking is an integral part of the modern economy. But the nature and functions of modern banks have evolved over a long period of time. The idea of banking evolved with the idea of money. The banking business is mainly linked to lending. Moneylender is to be found in every society-ancient or modern; advanced or backward. The ten commandments of Moses, Quoran, Manusmrity, Kautilya’s Arthashastra all have references to ... Xem chi tiết

Decision Support System (DSS) – Components, Application

Understanding The Decision Support System (DSS) With the progress made in the fields of computer sciences & information technology, the big organizations are not far away from their technical advancements. We had read about Expert Systems earlier at Expert Systems. Now, let us understand another very important Support System which are used by various MNC’s – The Decision Support System. What is Decision Support System ... Xem chi tiết

HDFC Bank NEFT Form 2023, Timing, Charges & How to do NEFT?

HDFC Bank NEFT Form 2023: With e-Monies National Electronic Funds Transfer you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. In this article we provide complete ... Xem chi tiết

Difference between Direct Exporting and indirect exporting

Direct exportingIndirect exportingMeaning:When the export activity is directly carried out by the manufacturer of the goods, it is called as direct exporting.In indirect exporting the manufacturer hires the services of an export intermediary agency to export his goods through the intermediaries.Control: Since all the activities such as packaging, promotion, shipment and distribution are carried on own, manufacturer enjoys the ... Xem chi tiết

Essentials of a valid Endorsement: a detailed list with explanation

The following are the essentials of valid endorsement. An endorsement on a negotiable instrument has the effect of transferring all the rights represented by the instrument to another individual. The ordinary manner in which an individual endorses a cheque is by placing his or her signature on the back of it but it is valid even if the signature is placed somewhere else, such as on a separate paper, known as an allonge which ... Xem chi tiết

National Housing Bank (NHB) 2023: The operations of NHB

National Housing Bank (NHB): In India there was no institutional arrangement for long term financing of individuals housing for a long time. This short coming was identified by the Sub-Group on Housing Finance for the Seventh Five Year Plan (1985- 90) as a stumbling block, hindering the progress of the housing sector and recommended setting up of a nodal, national level institution. National Housing Bank (NHB) The Government ... Xem chi tiết

Corporate Credit Worthiness And Credit Rating – All Details

Corporate Credit Worthiness And Credit Rating. Sitting with a mug of coffee & the topics list for the National Convention, my eyes fell on the topic ‘Corporate Credit Worthiness & Credit Rating’ & I remembered the time, when I was reading in the newspaper about how the stock markets have crashed due to the S&P rating of the Indian Economy as ‘Poor’. The thought that how can the rating by any agency could lead ... Xem chi tiết

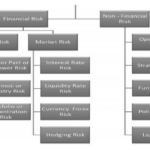

Types of Risks in Banking Sector – A Detailed Analysis

Types of Risks: Risks can be basically classified in to two types, viz. Financial and Non-Financial Risk. Financial risks would involve all those aspects which deal mainly with financial aspects of the bank. Credit Risk: A credit risk is the risk of default on a debt that may arise from inability of a borrower to make required payments as per commitments. In the first resort, the risk is that of the lender and includes lost ... Xem chi tiết

Export Import Bank of India: Marketing Advisory, Export Advisory

Export Import Bank of India: Established in 1982 through an Act of Government of India viz. Export –Import Bank of India Act, 1981. It was established to make financial provisions for exporters and importers. Export-Import Bank of India is the premier export finance institution of the country. Also EXIM Bank was intended to serve as principal financial institution co-coordinating the functioning of those institutions engaged ... Xem chi tiết

what to do if money transferred into wrong bank account

what to do if money transferred into wrong bank account. Do not get upset about transferring money to banking / wrong bank account, bank will return money. Many times, due to hasty filling of wrong bank details, the money goes to the wrong bank account. Many people do not know what to do in such a situation and how to get this money back. Today we tell you what you should do if this happens to you. Know more about – What ... Xem chi tiết

Features of Bank 2023: Characteristics of a Bank (history)

Characteristics / Features of Bank : If you walk on the streets of any town or city, you could notice signboards on buildings with names – State Bank of India, Punjab National Bank, ICICI Bank, IDBI, City Union Bank, etc. What are these names? Have you tried ever to know about them? Have you entered those buildings? If you go inside these buildings, you can find an office layout wherein a lot of desks (counters) with names ... Xem chi tiết

Statutory Liquidity Ratio (SLR): All you need to know about

Statutory Liquidity Ratio (SLR): In terms of section 24 (2A) of Banking Regulation Act, another tool for controlling credit in the country is available to RBI in the form of Statutory Liquidity Ratio under which, Liquid assets (in the form of prescribed securities by RBI) have to be maintained by all scheduled banks in India. Statutory Liquidity Ratio (SLR) is the Indian government term for the reserve requirement that the ... Xem chi tiết

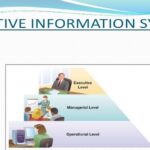

Executive Information System: Components, Advantages

Executive Information System: EIS is an information system based on computer which generally serves the information needs of the top level management of an organization. Check Complete details for EIS System like – What is Executive Information System?, Components of Executive Information System, Advantages of Executive Information System, Application of Executive Information System etc. Now scroll down below n check more ... Xem chi tiết

Bình luận mới nhất