Basel III – The Basel Committee on Banking Supervision (BCBS) issued a comprehensive reform package entitled “Basel III: The Basel III guidelines on strengthening the global capital framework and new regulatory requirements on liquidity and leverage were proposed in December 2010. This new accord is a set of new banking rules developed by Basel Committee on Banking Supervision to make the banks stronger and efficient enough to ... Xem chi tiết

Money

Principles of Commercial Banks (All you need to know about)

Principles of Commercial Banks: A central bank is an apex institution of a country’s monetary and financial system. Since the monetary system (which includes commercial banks) is a dominant part of the financial system of a country; the central bank is the apex system to the country’s financial system also. As such it plays a leading role in organizing, running, supervising, regulating and developing the monetary financial ... Xem chi tiết

Beware!!! Online Frauds which may destroy you, Fraud Types 2023

Beware!!! Online Frauds which may destroy you, Type of Frauds. With increased penetration of the internet in India and the introduction of services like internet banking, phone banking, and digital wallet, banks have seen a surge in transactions done online. This has eased the process for many individuals as they can access their bank accounts with the click of a button. Customers can log in, transfer money and pay from ... Xem chi tiết

Stagflation: Definition, Cause, Reasons, Measures to control

Stagflation is an economic condition when the economy experiences stagnant economic growth, high unemployment and high inflation. Stagflation is often happened by a supply-side shock. Know more about the definition of Stagflation, the Reasons of Stagflation, and how to control Stagflation. If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” ... Xem chi tiết

If Investment Banking not right for you, when to quit?: Detailed

As one of the top career choices for new professionals, investment banking tends to tempt many. The allure of a six-figure salary in your early 20s and being immersed in Wall Street culture can be enticing when you’re fresh out of CMA,CA and Business School. Investment banking is an exciting and lucrative career, but it isn’t right for everyone. You may have a desire to earn over $100,000 a year as a first-year analyst in New ... Xem chi tiết

Secondary Functions of Money: standard of deferred payment 2023

Secondary Functions of Money: The relatively less important functions of money are called secondary function. Since, this function originates from primary functions. These functions are also called derived functions. The secondary functions of money are as follows: – Money is a unit in terms of which debts and future transactions can be settled. Thus loans are made and future contracts are settled in terms of money. Money ... Xem chi tiết

Various Types of Endorsements in Banking with detailed analysis

Types of Endorsements, When we are studying about negotiable instruments, we need to study about the various types of endorsements as per The Negotiable Instruments Act. So, let us have a look on the type of endorsements: An endorsement may be (a) Blank or General, (b) Special or Full, (c) Restrictive, (d) Partial and (e) Conditional or Qualified. Various Types of Endorsements Let us study each of these in a little more ... Xem chi tiết

Functions of Money: Primary, Secondary and Contingent Functions

Functions of Money: With the advent of banking sector and emerging financial markets in the economy, one requires a precise understanding concerning money; what exactly would term money imply; any object (not necessarily rupee) that circulates widely as a means of payment or does it involve something more to it. Besides this, what is the connection between money, banks, and credit system? The term ‘Money’ was derived from the ... Xem chi tiết

National Digital Locker (DigiLocker): How to Upload & Share Documents?

National Digital Locker (DigiLocker): It will minimize the use of physical documents. It will provide authenticity of the edocuments and thereby eliminating usage of fake documents. It will provide secure access to Govt. issued documents. It will reduce the administrative overhead of Govt. departments and agencies and make it easy for the residents to receive services. You can find complete details for Digital Locker. Now you ... Xem chi tiết

Devaluation of Currency: Meaning, Devaluation vs Depreciation

Devaluation of Currency details 2023: The reduction of a currency´s value in relation to other currencies or a decrease in the exchange value of a currency against gold or other currencies, brough. After Providing How the value of rupee is determined?, Here we are providing everything you can to know about Devaluation of Currency like – Meaning of Devaluation of Currency. Devaluation of currency : Devaluation of a currency ... Xem chi tiết

Earning Per Share: Definition Calculation Basic EPS Diluted

Earning Per Share – Earnings of a company mean nothing but the net profit after taxes and minority interest and EPS means Earnings per share available to the equity share holders of the company for each share held after all other external stakeholders have been paid/accounted for. The portion of a company’s profit allocated to each outstanding share of common stock. Earnings per share serve as an indicator of a company’s ... Xem chi tiết

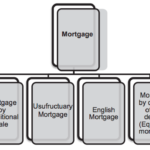

Mortgage: Introduction in detailed, Six Types of mortgages

Mortgage: It is defined in Transfer of Property Act as, transfer of interest in specific immovable property (land, benefits arising out of land, things attached and permanently fastened to earth) to secure an advanced loan, or an existing debt or a future debt or performance of an obligation. Once the amount due is paid to the lender, the interest in the property is restored back to the borrower. Lender gets right to recover ... Xem chi tiết

Core Banking Solution: Introduction Benefits of Core Banking

Core Banking solutions are banking applications on a platform enabling a phased, strategic approach that lets people improve operations, reduce costs, and prepare for growth. Implementing a modular, component-based enterprise solution ensures strong integration with your existing technologies. A leading provider of such a solution that many banks turn to as an ideal solution is BankPoint. An overall ... Xem chi tiết

Role of Letter of Credit in Business, Types of Letter of credit

Role of Letter of Credit in Business: In the modern era of trade, letter of credit is playing significant role in Business financing, earlier letter of credit was only used as international financing device in International trade, however now a days it is quite popular in domestic trade also. Theories said that Letter of credit is not a new term in this world. Some believes that origins of letters of credit go back to ancient ... Xem chi tiết

What are phishing, vishing and SMiShing and how can you protect?

Protect yourself against Phishing and Vishing: We have taken all efforts to protect our customers from fraudulent practices such as Phishing and Vishing, however our efforts can be much more effective if you join hands with us to protect yourself. What is Phishing? Phishing is a method by which the fraudster attempts to obtain personal and financial information through legitimate looking emails. Typically, the messages will ... Xem chi tiết

What is two factor authentication: how will your account be secure?

Two factor authentication or two-step verification is an important feature for additional security of your online accounts. You can enable it in Gmail, Facebook and other accounts. Many of you must have heard about two factor authentication. This is for the additional security of any online account. There are many types of two factor authentication. Tells you about two factor authentication and its benefits. Along with this, ... Xem chi tiết

Non banking financial companies (NBFC): Meaning, Types

Non banking financial companies (NBFC). All About NBFC. While discussing about banks and other financial institutions we used to hear about Non banking financial institutions. Here I’m going to discuss a few lines about NBFC’s. Non banking financial companies (NBFC) In this article you can find complete details for NBFC Companies like – Meaning of Non banking financial companies, Principle Business Activities, Different types ... Xem chi tiết

Debt stacking vs snowball: Debt Stacking Method Decision Making

Debt stacking vs snowball: How to come out of loans using Snowball or Stacking Methods?, Now a days it’s absolute that living without a loan is almost a rare thing. Each one of us whether salaried employee or self-employed person might have trapped in a variety of loans depends upon the activity of the individual. I found that many people have more than one kind of loan except in some cases. So, it is very essential know how ... Xem chi tiết

Things to check when you are on a Bank Audit with Check list

Things to check when you are on a Bank Audit. When you are on a Bank Audit, you need to be really careful about everything! Because even the slightest mistake can result into a heavy loss for the bank. Here’s a list of the things you must consider when on a bank audit. Now you can scroll down below and check more details for “Things to check when you are on a Bank Audit” If you like this article then please like us on Facebook ... Xem chi tiết

Bình luận mới nhất