Standard Chartered Bank Credit Card Status, Check Standard Chartered Credit Card Application Status Online. In this article we provide complete details for how to check Standard Chartered Bank Credit Card via Online mode and how we can approve Standard Chartered Bank Credit Credit Card. Now check out a detailed guide for how to check Standard Chartered Bank Credit Card Application Status Online or using Customer Caren helpline number…How to Apply and Check Standard Chartered Bank Credit Card Application Status Online 2021. Steps to Check Standard Chartered Bank Credit Card Status.

- Standard Chartered Bank Ultimate Credit Card,

- Standard Chartered Bank Landmark Rewards Platinum Credit Card

- Standard Chartered Bank Super Value Titanium Credit Card,

- Standard Chartered Bank Manhattan Platinum Credit Card

- Standard Chartered Bank Platinum Rewards Credit Card,

- Standard Chartered Bank Standard Chartered Yatra Platinum Credit Card,

- Standard Chartered Bank Priority Banking Visa Infinite Credit Card

- Standard Chartered Bank Emirates World Credit Card

- And Many More……

- Step 1 # Visit on Standard Chartered Credit Card Official Website https://www.sc.com/in/credit-cards/

- Step 2 # After Visit on official Standard Chartered Credit Card Website, Please click on “Credit Card” Menu

- Step 3 # Now you may reach at official Standard Chartered Credit Card Page, please scroll down this page and you may see “Track Application” Link, Please click on above link…

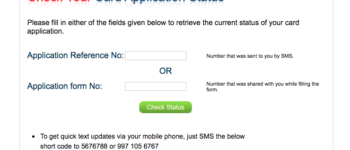

- Step 4 # Now you may reach at official tracking page

- Step 5 # Now Please Enter your Application Number, Mobile Number or Date of Birth and then click on “Track Status” Button

- Step 6 # Now you credit card status is appeared in your computer or mobile screen

Please Note – If you credit card is rejected or not approved then please don’t apply Again for Standard Chartered Credit Card till Next 6 Months

Check if your card is active?

You can find out the status of your card by calling us on 91-22-67987700 or by visiting your nearest Standard Chartered Bank Branch. Please provide your 16-digit card number and expiry date of your card for this information.

If you want to approve your Standard Chartered Bank credit card instantly, then please submit following documents…

- Submit Last 2 Year ITR Copy More then Rs 2,50,000

- Provide Postpaid Mobile Bill or Landline Bill

- If you have any other bank credit card, then please provide last 3 statements of your credit card

- PAN Card Copy

- And Other ID Proof and Address Proof

Q. I have applied for a Standard Chartered Bank Credit Card – would like to know the status?

Click here to check the status of your Standard Chartered Bank credit card application. You are required to input the Application reference number and Mobile number or Date of Birth (DDMMYYYY)

Q. I have not received my Credit Card?

Generally, your Standard Chartered Bank Credit Card is delivered within 21 working days of submitting your application. If you have registered your mobile number with us, you will receive timely alerts informing you about the status and details of the dispatch of your Standard Chartered Bank Credit Card.

If you have received the alert on Airway Bill number (courier reference) on your mobile number provided in Credit card application form.

You can track the status of the shipment using the Airway Bill number by visiting the courier websites.

Q. I had applied for an Standard Chartered Bank Card 3 months back and now when I try to apply again, I am not able to do so.

In the normal course, you should be able to apply after 3 months of your previous application. There are some exceptional circumstances in which you may not be able to re-apply for longer.

Q. When is late payment charge levied?

Late Payment charges will be applicable if Minimum Amount Due is not paid by the payment due date, Clear funds need to be credited to Standard Chartered Bank Card account on or before the payment due date, to avoid Late Payment charges. Late payment charges are applicable as:

Rs 100 for statement outstanding balance less than or equal to Rs 500. Rs 350 for statement outstanding balance between Rs 501 and Rs 2,000. Rs 500 for statement outstanding balance between Rs 2,001 and Rs 4,000. Rs 700 for statement outstanding balance between Rs 4,001 and Rs 20,000. Rs 800 for statement outstanding balance greater than Rs 20,000.

Rs 500 per instance or 2.5% of the Overlimit amount. (Minimum Rs 500)

The Payment Due Date on your Card can be between 18 and 25 days after the Statement Date (Please check your statement for your exact Payment Due Date). Therefore, the interestfree credit period can range from 18-48 days to 25-55 days depending on your Payment Due Date. The interest-free period does not apply for cash advances and revolving balances. For these, interest is charged fromthe date of the transaction.We reserve the right to change this interest-free period by giving you notice.

Assume that your Statement Date is 2 Nov (covering transactions billed between 3 Oct and 2 Nov) and your Payment Due Date is 24 Nov. You have paid the total amount due by 24 Nov (making you eligible for interest-free period). In this case, the Payment Due Date is 22 days after the Statement Date and the interest-free period will range from 22-52 days.

- For a transaction billed on 3 Oct, the interest-free period is 52 days (from3 Oct to 24 Nov)

- For a transaction billed on 2 Nov, the interest-free period is 22 days (from2 Nov to 24 Nov)

Illustrative Example for Interest Free Period Calculation:

For a statement for the period 11 April to 10 May the payment due date is 28 May. Assuming you have paid Your previous month’s dues in full, the grace period would be:

For the purchase dated 12 April, interest free grace period is from 12 April to 28 May=48 days and for the purchase dated 2 May, interest free grace period is from 2 May to 28 May=27days However, if you have not paid the previous month’s balance in full before due date, then there will be no interest free period.

Effective 01 July 2017, the Goods and Services Tax (GST) will be applicable instead of Service Tax. GST may be applicable from time-to-time, presently the GST rate for banking and financial services is at 18% (applicable on all fees, interest, surcharge and other charges).

If you have any other query regarding “Standard Chartered Bank Credit Card Status” then please tell us via below comment box…

Categories: Credit Card

Source: bank.newstars.edu.vn

Leave a Reply