Understanding The Process of Debt Securitization, Debt Securitization is a very important topic that is easy to understand but many students generally skip this topic by presuming that it is difficult. As per the oxford advanced learner dictionary, the meaning of the word debt is “a sum of money that somebody owes”, “a situation of owing money, especially when you cannot pay.” Now check more details about “Understanding The ... Xem chi tiết

Finance

Various types of endorsement, There are seven kinds of endorsement

There are seven kinds of endorsement. types of endorsement: Endorsement is nothing but a part of negotiation. Negotiation is the transfer of an instrument by one party to another so as to constitute the transferee a holder of that instrument. A bearer instrument can be transferred by mere delivery but an order instrument can be transferred by endorsement. Endorsement in Blank : Where an endorsement on a bill of exchange ... Xem chi tiết

Cash Reserve Ratio (CRR): Everything you want to know about

Cash Reserve Ratio (CRR): Everything you want to know about Categories: Banking Source: bank.newstars.edu.vn ... Xem chi tiết

How to Get the Best Deal on a Personal Loan App?

At some point, almost everyone needs a loan according to their requirement, purpose, and immediacy. Most individuals with a critical financial condition find an online loan app the most dependable funding source. By downloading a simple app on your mobile phone, you can apply for a Personal Loan in minutes and get disbursal directly into your bank account. Whether you need funds for a medical emergency, wedding, education, ... Xem chi tiết

The Benefits of SIP for Long-Term Wealth Creation

Welcome, fellow investors! We all work hard, save diligently, and dream of a financially secure future. But here’s a secret: simply stashing away your savings in a traditional bank account might not be the best strategy. If you’re looking to grow your wealth over the long term, it’s time to explore the secret sauce called Systematic Investment Plan (SIP) that has been helping millions of Indians achieve their financial goals ... Xem chi tiết

Bank Stock Audit 2023: Sharing experiences & thoughts

Bank Stock Audit: Stock Audits are important from our profession point of view, as it gives us recognition in banking field & opens door for lot of opportunities in the Banking sector. As a Cost Accountants, we can bring our techno-commercial knowledge & experience in field restricting NPAs in the banking sector by early detection of problems in the industries. Bank Stock Audit As a stock Auditor what bank expects from ... Xem chi tiết

Types of Hundi: Shah Jog Jokhmi Jawabee Nam jog Darshani

Types of Hundi, When we sit to study the Negotiable Instruments Act, we need to understand what is a hundi and the various types of hundi. In Layman’s language, the term “hundi” includes all negotiable instruments whether they are bills of exchange or promissory notes. An instrument in order to be a hundi must be capable of being sued by the holder in his own name, and it can be transferred like cash that is, by delivery. Now ... Xem chi tiết

Canara Bank NEFT Form 2023, Timing, Charges, How to do NEFT

Canara Bank NEFT Form 2023: Inter Bank Transfer enables electronic transfer of funds from the account of the remitter in one Bank to the account of the beneficiary maintained with any other Bank branch. With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further ... Xem chi tiết

SIM Swap Fraud, how to prevent sim swap fraud 2023 Detailed

All you have to know about SIM Swap Fraud, What is Mobile Phone SIM Swap fraud and how to protect your Bank Account?, Now a days Mobile has become an interface to communicate with the world. No matter where you are you can use it for almost all the needs of your daily routine. With the increasing opportunity to avail the services of banks on mobile every one started using the banking services in their phone. This scenario has ... Xem chi tiết

Important Items of Bank Balance Sheet – A Detailed Analysis

Banks balance sheets contain certain unusual items when compared to others. We shall have an over view of the same. Know more about Important Items of Banks Balance Sheets from below. Liabilities Side of Bank Balance Sheet Share Capital: Consist of Authorised, Issued, Subscribed and Paid-up share capital are shown separately. Under the head, Paid-up Capital, calls in arrears are reduced and forfeited share amount is ... Xem chi tiết

Importance of Technology of Banking : (All you need to know)

Importance of Technology of Banking: Many of the IT initiatives of banks started in the late 1990s, or early 2000, with an emphasis on the adoption of core banking solutions (CBS), automation of branches and centralisation of operations in the CBS. Over the last decade, most of the banks completed the transformation to technology-driven organisations. Moving from a manual, scale-constrained environment to a global presence ... Xem chi tiết

Payment banks: Meaning, Moto, Features, Eligibility, Investment

Payment banks – Meaning, Main Moto, Features, Eligibility. Payment banks are the banks set up in accordance with the related regulations issued by the supreme monetary regulatory authority Reserve Bank of India. To say in simple lines payment banks will perform the activities they are allowed to do and they are different from the normal banks. read more on payment banks from below… They do the following : Acceptance of ... Xem chi tiết

Bad Bank: why is it being described as good for banks? (Detailed)

Bad Bank: The name of this bank is ‘Bad’, so why is it being described as good for banks?. The Indian Banks Association (IBA), an institution of banks, proposed to the Finance Ministry and the Reserve Bank of India on May 12 that a bad bank be set up in the country. Bad bank can become a relief for the banks of India, ie it can be a very good step for our economy and banking system. Indian Bank Association has demanded the ... Xem chi tiết

Payment Gateways: Benefits, Process, How payment gateways work?

Payment Gateways: Must Adopt Tool for Every Business. The Internet has massive potential and can provide endless opportunities, payment gateways is the poster child of such opportunities. Customers can now pay for services in matter of minutes. One-click and the payment is made. With large number of business going online and doing business payment gateways have become massive and are enormously providing payment solutions to ... Xem chi tiết

Effects of Endorsement: Meaning, Effect of a Forged Endorsement

Meaning of Endorsement : Section 50 of the Negotiable Instrument Act deals with effects of endorsement. The endorsement of a negotiable instrument followed by delivery transfers to the endorsee, the property therein with the right of further negotiation. The endorsement may be, by express words, restrict or exclude such right, or may merely constitute the endorsee, an agent to endorse the instrument, or to receive its contents ... Xem chi tiết

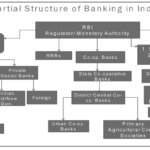

Indian Banking System: Brief over View of The Start of RBI

Indian Banking System: India has one of the largest and a Biggest Banking system in the world which forms the backbone of its economy, where the old and the new banks coexist in new service of the nation, having evolved over a period of more than two centuries. Banks is the back bone of a country financial system. Modern Banking system in India is more than two centuries old. The Indian banking system consists of various ... Xem chi tiết

Small Finance Banks: Establishment, List of Banks, Features

Small Finance Banks: These banks also have been established with an aim of financial inclusion “to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganised sector entities.” These banks were expected to provide an institutional mechanism for promoting rural and semi urban savings and extending credit for viable economic ... Xem chi tiết

Need of Technology of Banking (All you know about)

Need of Technology of Banking: Technology has brought about a complete paradigm shift in the functioning of banks and delivery of banking services. Gone are the days when every banking transaction required a visit to the bank branch. Today, most of the transactions can be done from the comforts of one’s home and customers need not visit the bank branch for anything. Technology is no longer an enabler, but a business ... Xem chi tiết

Electronic Fund Transfer (EFT): Rules, Transactions, Procedures

Electronic funds transfer or EFT refers to the computer based systems used to perform financial transactions electronically. This term is used for a number of different concepts: Cardholder initiated transactions, where a cardholder makes use of a payment card. Electronic payments by business, including salary payments. Electronic check (for cheque) clearing. Electronic fund transfer provides for electronic payments and ... Xem chi tiết

Functions of Bank: Primary Functions, Secondary Functions of Bank

Functions of Bank: In bank jobs interviews normally questions are asked about various functions of banks. So today I am listing down all the important functions of a bank.The functions of a bank can be summarised as follows : Functions of Bank Banks operate by borrowing funds-usually by accepting deposits or by borrowing in the money markets. Banks borrow from individuals, businesses, financial institutions, and governments ... Xem chi tiết

What is Merchant Banking | types, classification | functions

Merchant Banking: The term ‘Merchant banker’ was used in relation to a wealthy merchant, who developed the banking side of one’s business, in England. In India, merchant banking definition is framed in SEBI rules 1992. It defines merchant banker as “ any person who is engaged in the business of issue management either by making arrangement regarding selling, buying or subscribing to securities as manager, consultant, advisor ... Xem chi tiết

Free Full credit report | How to check free annual credit report

How to get your Free Credit Score & Annual Credit Report online? | CIBIL Score 2023. Imagine yourself as a bank or any lending institution and keep disbursing the loans to your customers belonging to different walks of life. As you keep giving the loans/credit to your customer base, you would at one point realize how necessary it is to assess the credibility/merit of a customer to discharge the loan before sanctioning the ... Xem chi tiết

Basel III – Meaning, BASEL III Accord, Major Features of Basel III

Basel III – The Basel Committee on Banking Supervision (BCBS) issued a comprehensive reform package entitled “Basel III: The Basel III guidelines on strengthening the global capital framework and new regulatory requirements on liquidity and leverage were proposed in December 2010. This new accord is a set of new banking rules developed by Basel Committee on Banking Supervision to make the banks stronger and efficient enough to ... Xem chi tiết

Beware!!! Online Frauds which may destroy you, Fraud Types 2023

Beware!!! Online Frauds which may destroy you, Type of Frauds. With increased penetration of the internet in India and the introduction of services like internet banking, phone banking, and digital wallet, banks have seen a surge in transactions done online. This has eased the process for many individuals as they can access their bank accounts with the click of a button. Customers can log in, transfer money and pay from ... Xem chi tiết

If Investment Banking not right for you, when to quit?: Detailed

As one of the top career choices for new professionals, investment banking tends to tempt many. The allure of a six-figure salary in your early 20s and being immersed in Wall Street culture can be enticing when you’re fresh out of CMA,CA and Business School. Investment banking is an exciting and lucrative career, but it isn’t right for everyone. You may have a desire to earn over $100,000 a year as a first-year analyst in New ... Xem chi tiết

Various Types of Endorsements in Banking with detailed analysis

Types of Endorsements, When we are studying about negotiable instruments, we need to study about the various types of endorsements as per The Negotiable Instruments Act. So, let us have a look on the type of endorsements: An endorsement may be (a) Blank or General, (b) Special or Full, (c) Restrictive, (d) Partial and (e) Conditional or Qualified. Various Types of Endorsements Let us study each of these in a little more ... Xem chi tiết

National Digital Locker (DigiLocker): How to Upload & Share Documents?

National Digital Locker (DigiLocker): It will minimize the use of physical documents. It will provide authenticity of the edocuments and thereby eliminating usage of fake documents. It will provide secure access to Govt. issued documents. It will reduce the administrative overhead of Govt. departments and agencies and make it easy for the residents to receive services. You can find complete details for Digital Locker. Now you ... Xem chi tiết

Devaluation of Currency: Meaning, Devaluation vs Depreciation

Devaluation of Currency details 2023: The reduction of a currency´s value in relation to other currencies or a decrease in the exchange value of a currency against gold or other currencies, brough. After Providing How the value of rupee is determined?, Here we are providing everything you can to know about Devaluation of Currency like – Meaning of Devaluation of Currency. Devaluation of currency : Devaluation of a currency ... Xem chi tiết

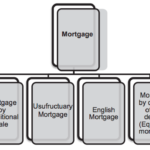

Mortgage: Introduction in detailed, Six Types of mortgages

Mortgage: It is defined in Transfer of Property Act as, transfer of interest in specific immovable property (land, benefits arising out of land, things attached and permanently fastened to earth) to secure an advanced loan, or an existing debt or a future debt or performance of an obligation. Once the amount due is paid to the lender, the interest in the property is restored back to the borrower. Lender gets right to recover ... Xem chi tiết

Core Banking Solution: Introduction Benefits of Core Banking

Core Banking solutions are banking applications on a platform enabling a phased, strategic approach that lets people improve operations, reduce costs, and prepare for growth. Implementing a modular, component-based enterprise solution ensures strong integration with your existing technologies. A leading provider of such a solution that many banks turn to as an ideal solution is BankPoint. An overall ... Xem chi tiết

Role of Letter of Credit in Business, Types of Letter of credit

Role of Letter of Credit in Business: In the modern era of trade, letter of credit is playing significant role in Business financing, earlier letter of credit was only used as international financing device in International trade, however now a days it is quite popular in domestic trade also. Theories said that Letter of credit is not a new term in this world. Some believes that origins of letters of credit go back to ancient ... Xem chi tiết

What are phishing, vishing and SMiShing and how can you protect?

Protect yourself against Phishing and Vishing: We have taken all efforts to protect our customers from fraudulent practices such as Phishing and Vishing, however our efforts can be much more effective if you join hands with us to protect yourself. What is Phishing? Phishing is a method by which the fraudster attempts to obtain personal and financial information through legitimate looking emails. Typically, the messages will ... Xem chi tiết

What is two factor authentication: how will your account be secure?

Two factor authentication or two-step verification is an important feature for additional security of your online accounts. You can enable it in Gmail, Facebook and other accounts. Many of you must have heard about two factor authentication. This is for the additional security of any online account. There are many types of two factor authentication. Tells you about two factor authentication and its benefits. Along with this, ... Xem chi tiết

Non banking financial companies (NBFC): Meaning, Types

Non banking financial companies (NBFC). All About NBFC. While discussing about banks and other financial institutions we used to hear about Non banking financial institutions. Here I’m going to discuss a few lines about NBFC’s. Non banking financial companies (NBFC) In this article you can find complete details for NBFC Companies like – Meaning of Non banking financial companies, Principle Business Activities, Different types ... Xem chi tiết

Debt stacking vs snowball: Debt Stacking Method Decision Making

Debt stacking vs snowball: How to come out of loans using Snowball or Stacking Methods?, Now a days it’s absolute that living without a loan is almost a rare thing. Each one of us whether salaried employee or self-employed person might have trapped in a variety of loans depends upon the activity of the individual. I found that many people have more than one kind of loan except in some cases. So, it is very essential know how ... Xem chi tiết

Things to check when you are on a Bank Audit with Check list

Things to check when you are on a Bank Audit. When you are on a Bank Audit, you need to be really careful about everything! Because even the slightest mistake can result into a heavy loss for the bank. Here’s a list of the things you must consider when on a bank audit. Now you can scroll down below and check more details for “Things to check when you are on a Bank Audit” If you like this article then please like us on Facebook ... Xem chi tiết

Bình luận mới nhất