ICICI Bank NEFT Form: With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. What is NEFT? National Electronic Funds Transfer (NEFT) is a nationwide payment system facilitating one-to-one funds transfer. Under this Scheme, individuals can ... Xem chi tiết

Banking

How is Credit Rating Done?: Ways to Calculate Credit Score

How is Credit Rating Done?, To understand how is Credit Rating done, we first need to understand what exactly credit rating is! Credit Rating is a rating (a grade, marks, rank or in any other form) an indicator of how credit worthy a person or an enterprise is. You must have seen that all the Banks before sanctioning loans, usually get the credit capacity & credit history of the prospecting borrowers checked. For these ... Xem chi tiết

Stock audit of bank borrowers: Procedure, Documents Required

Stock audit of bank borrowers: Working capital finance in the form of cash credit/overdraft facility against the security of hypothecation of stock and debtors is one of the most common modes of finance frequently adopted by various bankers. The borrowers in such cases are expected to submit the details of stock and debtors every month on the basis of which Drawing Power after reducing the prescribed margin is calculated by ... Xem chi tiết

Mobile Banking: Advantages & Disadvantages of Mobile Banking

Mobile banking is a system that allows customers of a financial institution to conduct a number of financial transactions through a mobile device such as a mobile phone or personal digital assistant. Mobile banking differs from mobile payments, which involve the use of a mobile device to pay for goods or services either at the point of sale or remotely, analogously to the use of a debit or credit card to effect an EFTPOS ... Xem chi tiết

Brief History of Banking in India, History of Banks in India

Brief History of Banking in India, History of Banks in India. The Indian Banking Starts from Bank of Hindustan Established in 1770 and it was first bank at Calcutta under European management. It was liquidated in 1830-32. Here we are sharing Some most important points related to “History of Banking in India”. Evolution of banking in India started From Bank of Hindustan in 1770, and this evolution can be divided into three ... Xem chi tiết

Difference Between Commercial Bank and Central Bank 2023

A commercial bank is a financial intermediary. It accepts the deposits from the surplus units and lends these financial resources to the deficit units. Commercial Banks play a very prominent role in the financial system of an economy. Now Check out Commercial Bank Vs Central Bank. Functions of a Commercial Bank Modern commercial banks perform a variety of functions and provide a number of services to their customers. They are ... Xem chi tiết

What is credit worthiness? & how to check the creditworthiness

What is credit worthiness? & how to check the creditworthiness, after providing detailed analysis for “Corporate Credit Worthiness And Credit Rating”. Now here we are providing complete details for credit worthiness like – Things to be considered to check the creditworthiness of an entity, How to improve credit worthiness, Repayment History, Credit Score, Capacity, Assets/Collateral security, Existing Credit relations, ... Xem chi tiết

Letter of Credit: Importance, Types of LC, Parties: Detailed

A Letter of Credit is issued by a bank at the request of its customer (importer) in favour of the beneficiary (exporter). It is an undertaking / commitment by the bank, advising/informing the beneficiary that the documents under a LC would be honoured, if the beneficiary (exporter) submits all the required documents as per the terms and conditions of the LC. Importance of letter of credit in trade activities The trade can be ... Xem chi tiết

Bank Reconciliation Statement (BRS) – when to prepare a BRS?

Bank Reconciliation Statement (BRS) –To reconcile means to reason or find out the difference between two and eliminating that difference. Whenever we deposit or withdraws money from banks, it is always recorded at two places:- Bank column of the cash book; and Bank statement (pass book) The cash book is maintained by the person having the bank account whereas the bank statement is prepared by the bank. Therefore, the balance ... Xem chi tiết

Core Banking Systems with Analysis and Key modules of CBS

Core Banking Systems (CBS) refers to a standard IT solution wherein a central shared database supports the whole banking application. The characteristics of CBS are: There is a standard database during a central server located at a knowledge Center, which provides a consolidated view of the bank’s operations.. Branches function as delivery channels providing services to its customers. CBS is centralized Banking Application ... Xem chi tiết

Difference Between ADR and GDR (With Comparison Chart)

ADR and GDR Complete Guide. Guide for ADR (American Depository Receipts) and GDR Global Depository Receipts. Check ADR And GDR Complete Details From Below. In This article you can find difference between ADR and GDR. Recently we also provide Accounting Standard 3, Cash Flow Statement Full Guide And What’s the Difference Between FDI and FII?. Now you can scroll down below and check complete details regarding “ADR and GDR ... Xem chi tiết

What is pledge? – Bailment, Possession with Examples 2023

What is pledge? – a bailment of a chattel as security for a debt or other obligation without involving transfer of title. How to use pledge in a sentence. Find Everything you want to know about Pledge?, what is a bailment?, points to be considered to decide whether a bailment is pledge or not, Examples, Possession etc. we also discuss about hypothecation in our next Article and also discuss for “what is the difference between ... Xem chi tiết

Banking Terminology with Explanation for Govt Exams (IBPS, SSC)

Banking Terminology: Before sharing this month article I hope that you and your family members are safe.There are number of opportunities in banking sector and many more need to happens yet. Basis on this theme, I am just sharing with you frequently used banking terminology to our readers, Because I believe that if we want to enter in this sector we must know the terms used in banking sector. Banking Terminology I hope that ... Xem chi tiết

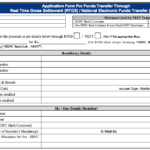

NEFT (National Electronic Fund Transfer) : Coverage, Advantages

NEFT: With the availability of integrated technology consisting of computers and communication facilities, distances no longer remain a constraint in providing better customer service and expediting the funds transfer mechanism. EFT facilitates quick movement of funds through electronic media. EFT mechanism involving inter-bank funds settlement at the national level has come up only recently as an aftermath of the ... Xem chi tiết

Important information regarding AnyDesk app frauds – Do’s & Don’ts

Beware Of The AnyDesk App: Important information regarding AnyDesk app frauds: Safeguard yourself against fraudulent access to your Mobile Phone. One of the recent techniques involves a fraudster taking unauthorized access of a victim’s mobile device to carry out fraudulent transactions via UPI using the AnyDesk App. This is how they do it with AnyDesk app: You may receive a phone call from a fraudster, who will claim to be a ... Xem chi tiết

Credit Score: Meaning, Credit Bureaus, Calculation, Range

Credit Score: Lenders receive multiple loan applications daily. So it becomes necessary that credits are disbursed to individuals with good credit worthiness. The question arises how to evaluate credit worthiness? Credit worthiness is evaluated by Credit Bureaus by awarding credit score to an individual after considering various factors. The system has helped to improve the functionality and stability of the Indian financial ... Xem chi tiết

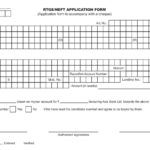

HDFC Bank RTGS Form 2023 Timing, Charges & How to do RTGS?

HDFC Bank RTGS 2023: The RTGS system is primarily meant for large-value transactions. The minimum amount to be remitted through RTGS is Rs 2 lakh. The maximum limit is Rs 10 lakh per day. RTGS (Real Time Gross Settlement) is the fastest possible money transfer system through the banking channel. Because settlements are made in real-time, transactions are not subject to any waiting periods… Now check out more details for HDFC ... Xem chi tiết

Endorsements 2023: Meaning and Parties of Endorsement

The word ‘endorsement’ in its literal sense means, a writing on the back of an instrument. But under the negotiable instruments act it means, the writing of one’s name on the back of the instrument or any paper attached to it with the intention of transferring the rights therein. Thus endorsement is signing a negotiable instrument for the purpose of negotiation. The person who effects an endorsements is called an ‘endorser’ ... Xem chi tiết

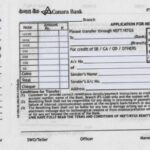

Canara Bank RTGS Form 2023: About, Rules, Timing, Charges

Canara Bank RTGS: The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is Rs 2 lakh. Canara Bank RTGS Form, Rules, Timing, Charges & How to do RTGS?: With Real Time Gross Settlement (RTGS) you can transfer funds to any bank across India in real time. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. Canara ... Xem chi tiết

ICICI Bank RTGS Form 2023, Timing, Charges & How to do RTGS?

ICICI Bank RTGS 2023: The RTGS system is primarily meant for large value transactions. The minimum amount to be remitted through RTGS is Rs 2 lakh. The maximum limit is Rs 10 lakh per day. ICICI Bank RTGS Form, Rules, Timing, Charges & How to do RTGS?: ICAI RTGS form rules timing charges. With Real Time Gross Settlement (RTGS) you can transfer funds to any bank across India in real time. With this service your transactions ... Xem chi tiết

What is capital account convertibility – Advantages & Drawbacks

Capital account convertibility (CAC) means freedom to convert currency, both in terms of outflows and inflows, for capital transactions. Find out complete details regarding capital account convertibility, Full capital account convertibility. After Providing What is current account convertibility and its Advantages, If you like this article then please like us on Facebook so that you can get our updates in future ……….and ... Xem chi tiết

Tips to Make your banking transactions safe, secure credentials

Tips to Make your banking transactions safe, Tips for safe online and mobile banking transactions. Internet banking has really been a genie for the people due to its fast and convenient approach for any transaction. Now you have every bank transaction on your fingertips with luxury of sitting at any corner of the world and getting the work done in real-time.But as we know every coin has two sides, internet banking has its ... Xem chi tiết

An Ordinance on the victims of Bounce Cheque: Detailed Guide

An Ordinance on the victims of Bounce Cheque. An Ordinance (14th in just over a year) that brings smile on the victims of Bounce Cheque, Victims of cheque bounce rule now may have a reason to cheer. The Modi government today came up with another ordinance which enables the harassed victims in cheque bounce cases to file a suit against culpable individuals and entities in the place where cheque was presented for encashment. Now ... Xem chi tiết

Non Performing Assets – What are NPA?, Provision for Standard Asset

Non Performing Assets: Any amount which is withdrawn from any financial institution in any form such as loan or credit it has to be paid in limited time period as stipulated in the contract. If the payment is not made in such stipulated period than it will result in non performing asset. The details of when it will result in non performing asset and other relevant details have been easily explained in this article. Now you can ... Xem chi tiết

Secondary Functions of Bank: Agency and General Functions

Secondary Functions of Bank: The primary function of banks is to act as intermediary between savers and producers. They collect savings from people and lend them for productive purposes. Apart from these primary functions of collecting deposits and giving loans, they also perform some secondary functions which add to the utility of their customers and to the society. Secondary Functions of Bank We can not think modern commerce ... Xem chi tiết

What is Cyber Crime? Over view of Various Types of cyber crimes

What is Cyber Crime?: As the use of internet is increasing, a new face of crime is spreading rapidly from in-person crime to nameless and faceless crimes involving computers. Cyber crime includes all unauthorized access of information and break of security like privacy, password, etc. with the use of internet. Cyber crimes also includes criminal activities performed by the use of computers like virus attacks, financial ... Xem chi tiết

NABARD – National Bank for Agriculture and Rural Development

NABARD: Till late 1970s there was no institutional credit arrangement for Agriculture and Rural credit in India. The needs were looked after by Reserve Bank of India and Agricultural Refinance and Development Corporation (‘ARDC’). However, the importance of institutional credit in boosting rural economy has been clear to the Government of India right from its early stages of planning. Therefore, the Reserve Bank of India ... Xem chi tiết

Tele Banking: Meaning of Tele Banking, Services in Tele banking

Tele Banking: Without visiting the bank one can receive the services of banks. The device used for this purpose is called tele banking. This is a fast and convenient way of obtaining services from the banks by using a telephone. One can receive the services such as information about account, conduct of selected transactions, report of loss of ATM card, debit card, credit card or cheque book, etc. To avail this facility any ... Xem chi tiết

Security Review Program, types of Information security systems

Security Review Program: In today’s economy information is the gold. Information can help a company get an edge over others. For the protection of information security systems are in place. The main work of such systems is protection of assets from harm. This lead to minimum loss. If the systems can protect assets and minimize losses then it is considered good system. Although, it is important to understand that sometimes it ... Xem chi tiết

Axis Bank NEFT Form 2023: Timing, Charges & How to do NEFT

Axis Bank NEFT Form 2023: National Electronic Funds Transfer (NEFT Online Funds Transfer to other banks). With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before. What is NEFT? NEFT has paved the way for big fund transfers online. Earlier people ... Xem chi tiết

Types of Different Bank Deposits in India, Various Bank Deposits

Types of Different Bank Deposits in India, Various Bank Deposits. Types of Bank Deposits like Current Deposit, Fixed Deposit, Recurring Deposit, Term Deposits etc. After Providing Various Terms of Banking – Know Their Actual Meaning and Banking in India – A comprehensive list of all Banks today we are providing Types of different bank Deposits in India. Types of Different Bank Deposits in India Deposit Rate :- In deposit ... Xem chi tiết

Right to issue bank notes, Form and Denominations of Bank Notes

Right to issue bank notes is one of the key central banking functions of the RBI. Section 22 of RBI Act confers RBI with sole right to issue bank notes in India. The issue function of bank notes is performed by the Issue Department, which is separated and kept wholly distinct from Banking Department. The RBI Act enables the RBI to recommend to Central Government the denomination of bank notes, i.e. two rupees, five rupees, ten ... Xem chi tiết

Banker’s Duty and Rights for Cheque Returns (A Detailed Analysis)

Banker’s Duty and Rights for Cheque Returns, The Negotiable Instruments Act provides the various cases in which the the cheque should be returned. In this article you can find complete details for Banker’s Duty and Rights for Cheque Returns like – When Banker must refuse Payment, When Banker may Refuse Payment, Protection of Paying Banker etc. Now you can scroll down below n check more details regarding “Banker’s Duty and ... Xem chi tiết

Various Terms of Banking: Repo Rate, Credit Card, ATM, Bed Debts

Various Terms of Banking 2023 – Know Their Actual Meaning. Definition of Various Terms Used In Banking. these Terms or Words are very useful in Daily Banking Transaction. In this article you can find Definition of various banking terms like Definition of Account Holder, What is Repo Rate, What is Bank Statement, What is Credit Card Etc. Recently we provide a special article on Banking in India – A comprehensive list of all ... Xem chi tiết

Transaction Processing System (TPS): Components Attributes

Transaction Processing System (TPS) – All the organizations in the world need to maintain records of the transactions entered into by it. An organization while running business has to undergo certain activities such as purchases, sales, receipts, payments, etc. All these activities are termed as transactions. Managing such transactions is termed as Transaction processing and the system used for processing of such transaction ... Xem chi tiết

Reverse Mortgages: Features, Taxation, Benefits, Risks, Term

Understanding Reverse Mortgages: You own a house, have retired & wish fervently that there was some additional cash flow coming in, to face the twin demons of inflation & health-care costs. Your children offer to help, but you & your spouse have decided to remain self-reliant & independent. There is hope; the Reverse Mortgage Loan. What follows is a brief introduction to the RML & its features. Caveat: As ... Xem chi tiết

Documents handled under Letters of Credit – In Detailed

Documents play a crucial role in trade transactions. Documents are integral part of LCs. The banks involved in LC transactions deal only with documents and on the evidence of the correct and proper documents only the paying banks (opening bank/ confirming bank) need to make payment. In view of these factors, banks have to be careful while handling documents/ LCs. Now check out Documents handled under Letters of Credit from ... Xem chi tiết

How the value of rupee is determined? – Know Various Factors

How the value of rupee is determined?. It’s a very common doubt that comes into mind if you think about the daily news in the print and electronic media about the value of rupee in terms of dollars and vice versa. Well , it may be a mysterious question to some one who doesn’t have a basic awareness about a country’s ecosystem. I heard someone questing his friends “why do we need to worry if the value of rupee increases from 55 ... Xem chi tiết

Canceling a Cheque: Various Reasons and How to Cancel Check

Canceling a Cheque in 2023: Various Reasons and How to Cancel Check: This article is specially written to make you aware of the uses of the cancelled cheque and when it is required and to whom it should be given, as it forms an important part as a proof. The cancelled cheque should be given to only specified persons only. Full details of the same is mentioned here and to make sure that you do not give to some unknown ... Xem chi tiết

Bình luận mới nhất